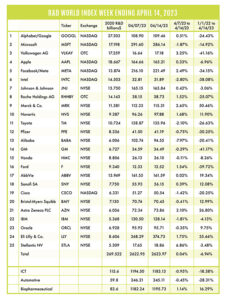

The R&D World Index (RDWI) for the week ending April 14, 2023, closed at 2,623.97 for the 25 companies in the RDWI. The Index was up 0.04% (or 1.02 basis points). Fourteen of the 25 RDWI members gained value last week from 0.02% (AbbVie) to 6.86% (Stellantis NV). Eleven of the 25 RDWI members lost value last week from -0.11% (Honda) to -7.97% (Alibaba).

The R&D World Index (RDWI) for the week ending April 14, 2023, closed at 2,623.97 for the 25 companies in the RDWI. The Index was up 0.04% (or 1.02 basis points). Fourteen of the 25 RDWI members gained value last week from 0.02% (AbbVie) to 6.86% (Stellantis NV). Eleven of the 25 RDWI members lost value last week from -0.11% (Honda) to -7.97% (Alibaba).

Italian energy firm Enel SpA, Rome, Italy, announced last week that it will nearly double the number of fast electric vehicle (EV) battery chargers (or add 10,000 chargers) in the U.S. by 2030. Enel says it plans to apply for U.S. government subsidies to build the infrastructure. Timing of that build is critical, not fast enough and you don’t meet user expectations, too fast and you may have too many chargers that go unused. The U.S. currently has about 12,000 fast-charging ports, while Tesla has a network of about 18,700 ports. Enel’s current charging business is based on at-home and private commercial equipment in North America with a large public charging network in Europe.

The cloud computing division of Amazon.com Inc., Seattle, last week announced artificial intelligence (AI) offerings to compete against the already publicly available AI products from RDW Index members Alphabet/Google (chatbot Bard) and Microsoft (ChatGPT). In addition to these AI tools, Amazon is also expanding access to custom-made semiconductor chips which could allow it to run AI software more efficiently and cheaply than competitors. Amazon, Microsoft, and Google are the three largest cloud companies and all have put generative AI at the center of their sales pitches to capitalize on the new technology.

Elon Musk last week created a new AI company called X.AI, which is now incorporated in Nevada. Musk also recently opted to change the name of his recently purchased Twitter social media company to X Corp. Musk supposedly is developing a competitive product to the viral chatbot ChatGPT developed by OpenAI, San Francisco, and supported financially by Microsoft.

The U.S. Environmental Protection Agency (EPA), Washington, D.C., was reported by several sources looking to propose extensive new limits on vehicle tailpipe emissions (to be announced in April) to move automakers toward more EV sales. The new standards for light-duty vehicles would cover vehicle model years 2027 to 2032. The big three U.S. automakers, GM, Ford, and Stellantis, have all voluntarily agreed to target half of their annual vehicle production to be electric by 2030.

The U.S. Department of Commerce (DOC) last week put out a formal request for comments on accountability measures for AI software. These include queries on whether potentially risky new AI software and models should go through a certification process before they are released commercially. Open AI’s ChatGPT reached 100 million users faster than any previous consumer application and regulators globally are now considering putting curbs on the fast-evolving technology. Also, last week China’s top internet regulator (The Cyberspace Administration of China) proposed strict controls that would obligate Chinese AI companies to ensure that their services don’t generate context which would disrupt social order or subvert state power. New AI products created in China would need to go through a government security review before being released.

EV automaker Tesla Inc., Austin, Texas, announced last week that it is building a factory in Shanghai, China, to produce its Megapack battery. Groundbreaking is scheduled for 3Q 2023 with a production start scheduled for 2Q 2024. Tesla plans to produce 10,000 Megapacks annually or 40 GW-hours of energy storage. One Megapack can store enough energy to power an average of 3,600 homes for one hour. The Megapack can be used for utility-scale power storage such as for solar energy for later use. The Shanghai plant will supplement the output of a Megapack plant in California.

RDW Index member IBM Corp., Armonk, New York, is exploring the sale of its weather forecasting operation, according to several analysts last week. A proposed auction of the business is still in its early stages. IBM purchased the Weather Co.’s business-to-business operation in 2015 for approximately $2 billion. A sale of the weather unit would be part of a continuing push by IBM to streamline its operations.

In 2022, the three major South Korean electric battery development companies — Samsung SDI, LG Energy Solutions, and SK On — exceeded a combined R&D investment of two trillion won ($1.2 billion). The three Korean battery makers have recently increased their R&D investments based on the judgment that they had to increase their competitiveness by developing super-gap technologies to secure a technological edge in the increasingly competitive global EV battery market.

The population of India will exceed that of China for the first time in 2023, possibly even this month, according to statisticians at the United Nations. This trend will only increase in the future with an increasing fertility rate and a GDP growth rate almost twice that of China. India’s rising population is likely to keep its economy growing and play a larger role in global affairs.

Qunnect Inc., New York City, announced last week the expansion of its R&D facility and Network Research Hub in the Brooklyn (New York) Navy Yard. The company is an industry leader in quantum-secure networking technologies which are designed for scalable deployment on existing telecom fiber infrastructures.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies), and ICT (9 companies) which invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spending in the world by government, industries, and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index

Tell Us What You Think!