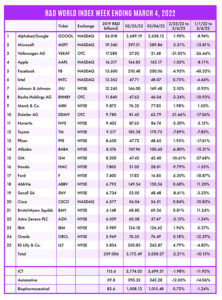

The R&D World Index (RDWI) for the week ending March 4, 2022, closed at 5,058.27 for the 25 companies in the RDWI. The Index was down 2.21% (or 114.22 basis points) from the week ending February 25, 2022. The stock of 10 RDWI members gained value from 0.18% (Oracle) to 4.79% (Eli Lilly & Co.). The stock of 15 RDWI members lost value from -1.02% (Apple) to -21.66% (Daimler AG).

RDW Index member Honda Motor Co., Minato City, Japan, and Sony Group Corp., also with headquarters in Minato City, announced last week that they will form a joint venture that will manufacture electric vehicles (EVs) starting in 2025. Honda’s current EV is a very small portion of its global sales, which it doesn’t offer in the U.S. Honda has already teamed with General Motors to build EVs. The Sony-Honda joint venture will build its EVs at existing Honda factories but will be their own brand. Sony said it will bring its expertise in electronics and online services to the partnership. Honda also said last week that it plans to phase out its gas-powered vehicles by 2040.

RDW Index member Ford Motor Co., Dearborn, Michigan, announced last week that it was splitting its company into a division for gas-powered vehicles and another division for Evs — Ford Blue and Ford Model e (similar to its old Model T heritage). Ford said that they needed both a division focused on future technologies, such as batteries and software, along with the engineering and manufacturing expertise of its legacy business. Each division will have its own president.

The Jeep division of Stellantis NV, Amsterdam, the Netherlands, announced last week that it plans to offer a full line of fully electric SUVs in the coming years, with its first EV in 2023 and a comprehensive line by 2025. Stellantis was formed in 2021 through the merger of PSA Group and Fiat Chrysler Automobiles NV. Jeep will continue to manufacture gas-powered vehicles so it can offer its customers a choice. While Stellantis recognizes that the costs for developing and building EVs are much higher than conventional gas-powered vehicles, it still wants to have half of its sales in the U.S. and all its sales in the EU to be fully electric models. Stellantis has said that it plans to spend more than $35 billion on EVs through 2025, a figure that’s comparable with its competitors’ EV investments.

Taiwan Semiconductor Manufacturing Co. (TSMC), Hsinchu, Taiwan, has announced that it will invest $44 billion in 2022 on capacity expansions, up from the $30 billion it invested in 2021. These expansions will take time to design, manufacture, install, and qualify, so their real impact on production output expansions made this year won’t be realized until 2024. Analysts expect the global semiconductor chip shortage to continue into 2023, and possibly even 2024.

Chevron Corp., San Ramon, California, announced last week that it was purchasing Renewable Energy Group, Ames, Iowa, for $3.15 billion. The Iowa-based company makes diesel and other fuels from sources such as corn or cooking oil. The company has 11 refineries that source mainly from waste products such as tallow or used cooking oil. Chevron plans on continuing to make acquisitions in this area and will upgrade existing refineries so they can process low carbon fuel sources. Chevron is expected to move its renewable energy business headquarters to Ames. Chevron has said that it will invest $10 billion through 2028 on biofuels, hydrogen production, carbon capture and other technologies, which is an increase from $3 billion that it previously committed to invest. The company plans to produce 100,000 barrels of renewable diesel by 2030.

Following the award of $30 million in financing, Ion Storage Systems, Beltsville, Maryland, has announced that it plans to start producing a new kind of faster charging, longer lasting battery by the end of 2022. The batteries also are not combustible. The company has a contract with the U.S. Army and Lockheed Martin to develop the batteries. The company is also in discussions with five automakers regarding these batteries. They also are considering an IPO within the next year. Ford Motor Co., Volkswagen, Mercedes-Benz Group, Stellantis and Toyota are also working on competitive solid-state batteries.

The U.S. Patent and Trade Office (USPTO) last week ruled that the Broad Institute — a partnership including Harvard University and the Massachusetts Institute of Technology — deserves the credit for inventing a way to use Crispr in plants and animals. Crispr, clustered regularly interspaced short palindromic repeats — was the subject of the 2020 Nobel Prize in Chemistry awarded to researchers at the University of Vienna. The USPTO ruling concerns a dispute between the Broad Institute and researchers at the University of Vienna and the University of California, Berkeley, as to who made the first practical use of Crispr-Cas9.

The U.S. Food and Drug Administration (FDA) last week approved a new customized, cell-based treatment for blood cancer from RDW Index member Johnson & Johnson, New Brunswick, New Jersey. Carvykti is the first therapy in the U.S. to be developed initially in China. The drug is used to treat multiple myeloma in adult patients whose disease has worsened despite prior treatments with other drugs. In J&J’s U.S. studies, 98% of the 97 multiple myeloma patients treated with Carvykti had a significant reduction in the proteins that signal the presence of myeloma. Multiple myeloma is a cancer affecting plasma cells and is estimated to cause more than 12,400 deaths annually in the U.S., according to the American Cancer Society.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2019 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of. Multri all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!