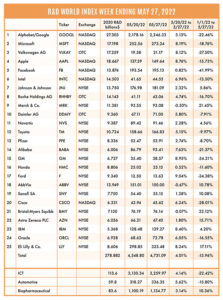

The R&D World Index (RDWI) for the week ending May 27, 2022, closed at 4,731.09 for the 25 companies in the RDWI. The Index was up 4.01% (or 182.29 basis points) from the week ending May 20, 2022. Twenty-two of the 25 RDWI members gained value from 0.52% (Honda Motors) to 8.95% (General Motors). Three of the 25 RDWI members lost value from -0.07% (Bristol-Myers Squibb) to -0.67% (AbbVie).

The R&D World Index (RDWI) for the week ending May 27, 2022, closed at 4,731.09 for the 25 companies in the RDWI. The Index was up 4.01% (or 182.29 basis points) from the week ending May 20, 2022. Twenty-two of the 25 RDWI members gained value from 0.52% (Honda Motors) to 8.95% (General Motors). Three of the 25 RDWI members lost value from -0.07% (Bristol-Myers Squibb) to -0.67% (AbbVie).

Semiconductor and software solutions manufacturer Broadcom Inc., San Jose, California, announced last week that it was in talks to purchase VMware Inc., Palo Alto, California, for about $61 billion in cash and stock. The deal faces significant regulatory hurdles, along with issues from VMware stockholders which includes Dell Computer founder Michael Dell and private equity firm Silver Lake who have a more than 50% stake in VMware. Broadcom invested more than $5.6 billion in R&D in 2020, while VMware invested $2.3 billion in R&D in the same year.

RDW Index member Toyota Motors, Toyota City, Japan, last week announced that its first 100% electric vehicle (EV), the bZ4X is now arriving in global showrooms. The bZ4X is a compact sport utility vehicle built on a rolling bed or “skateboard” of batteries. It was developed with input from all-wheel drive specialist Subaru, Tokyo, which will launch a rival model this summer called the Solterra. Initial reviews of the bZ4X are mostly weak with nothing innovative or clever other than it fits into Toyota’s brandmark for safety, affordability and reliability.

RDW Index member Apple, Cupertino, California, last week told some of its contract manufacturers and suppliers that it is looking to increase production of its products outside of China, citing issues with China’s strict anti-Covid-19 policy among other reasons. Apple is looking to increase its production in India and Vietnam, which already have shares of its production. More than 90% of Apple products are currently manufactured in China by outside contractors. Apple has already curtailed sending manufacturing support personnel to China over the past two years due to the recent increase in Covid-19 cases there. Analysts expect the largest share of production movement will be toward India due to its large population and low costs.

China’s tech giant Baidu Inc., Beijing, reported last week that its R&D investment in 2021 increased 10% on a yearly basis to just under $1 billion. Baidu has an autonomous ride-hailing service in ten Chinese cities and provided 196,000 rides in Q1 2022, including Beijing and Shanghai. In April, the company was granted permits to provide driverless robotaxis in a Beijing suburb, along with driverless testing in other cities.

RDW Index member Pfizer, New York City, last week announced that it will sell 23 patented drugs and vaccines to poorer countries at reduced prices. These countries include Ghana, Malawi, Rwanda, Senegal and Uganda where sales will begin in late-2022. Pfizer said it will work with the governments’ health-system infrastructure to resolve regulatory and procurement obstacles. The drugs involved include those for cancer, heart conditions and autoimmune diseases. Pfizer sales to developing countries in Africa and other emerging markets totaled about $8.4 billion in 2020, about a fifth of its total sales during the year.

The U.S. corporate tax credit rules are expected to change in 2022 according to laws passed by President Trump in 2017. Companies are now expected to spread their R&D tax expenses over five years instead of expensing them in one year as before. The U.S. Senate last week voted in support of a nonbinding resolution to restore the one-year tax break, as part of the still-developing China competition bill, which lawmakers expect to pass this year. If this tax credit rule is not passed, corporations state that it will significantly reduce their current operating cash flows.

Minutes from the May 3-4 Federal Reserve meeting were released last week with Fed officials noted as discussing the need to raise short-term interest rates by 0.5% at each of their next two meetings (June 14-15 and July 26-27) to combat the effects of high inflation. “A restrictive stance of policy may well become appropriate,” according to the minutes. “We need to see inflation coming down in a convincing way,” said Fed chairman Jerome Powell.

As Covid-19 cases have declined, the amount and reliability of data documenting their status also declined according to the Centers for Disease Control and Prevention (CDC) and the Institute for Health Metrics and Evaluation (IHME) at the University of Washington, Seattle. Analysts now state that the current published infection rates are being underestimated due to the lower toxicity of the current variant, undocumented home testing statistics and longer intervals between testing protocols. The lack of good data has resulted in an unexpectedly large number of Covid Omicron cases surging into hospitals over the past month.

The U.S. Department of Commerce last week reported that orders for nondefense capital goods, excluding aircraft, rose just 0.3% in April from March after growing 1.1% in the previous month. While analysts expect that semiconductor device shortages could be partially responsible for this decline, they also note that some caution may be creeping into the corporate capital spending plans. Significantly more companies still plan on increasing capital spending over the next six months (27% versus 17%) but a New York manufacturing survey in April has shown a drop in capital spending expectations. Another survey reveals that investment professional would rather see companies spend money on shareholder payouts rather than capital spending.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!