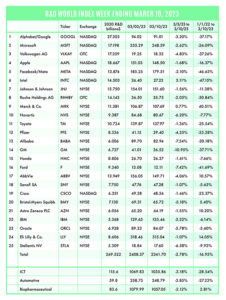

The R&D World Index (RDWI) for the week ending March 10, 2023, closed at 2,341.70 for the 25 companies in the RDWI. The Index was down -2.78% (or -66.87 basis points). Two of the 25 RDWI members gained value last week from 0.77% (Merck & Co.) to 3.11% (Intel). Twenty-three of the 25 RDWI members lost value last week from -1.07% (Sanofi SA) to -10.95% (General Motors).

The R&D World Index (RDWI) for the week ending March 10, 2023, closed at 2,341.70 for the 25 companies in the RDWI. The Index was down -2.78% (or -66.87 basis points). Two of the 25 RDWI members gained value last week from 0.77% (Merck & Co.) to 3.11% (Intel). Twenty-three of the 25 RDWI members lost value last week from -1.07% (Sanofi SA) to -10.95% (General Motors).

RDW Index member Microsoft, Redmond, Washington, Salesforce Inc., San Francisco, and several other large enterprise companies are adding OpenAI’s Chat GPT-like artificial intelligence (AI) software tools to their business software systems. ChatGPT has become enormously popular and successful over the past six months, which has led to its incorporation and duplication in other technology products. Its acceptance has been despite hesitation by numerous corporate technology chiefs to employ it. Last week Salesforce launched a $250 million investment fund targeting generative AI startups, for example. And Microsoft last week unveiled new AI-powered features which were integrated into several of its core business applications. The AI-enabled apps are designed to automate repetitive tasks in consumer-based areas.

RDW Index member Facebook parent Meta Platforms Inc., Menlo Park, California, announced last week that it is planning additional layoffs in the coming months. These layoffs will likely be similar in size to the 13% workforce cuts (or approximately 11,000 jobs) the company made last year. Among projects which will be cut due to the layoffs are wearable devices that were being developed at Meta’s hardware and metaverse division, Reality Labs. The cumulative result of the 2022 and 2023 cuts was not immediately available.

A plan was submitted to China’s parliament last week to create a national data bureau that will be responsible for coordinating the sharing and development of the country’s massive data resources. The bureau will be administered by the state planning agency, the National Development and Reform Commission. The plan is expected to be discussed and approved this week at the National People’s Congress during its annual session. If approved, the bureau will regulate the data generated in China by multinational companies. The bureau would also investigate issues in the digital domain and identify data-security vulnerabilities that could be prone to cyberattacks. China’s overall digital environment would be consolidated to eliminate inefficiencies.

The collapse of the Silicon Valley Bank (SVB), Santa Clara, California, last week resulted in several unique reactions by the U.S. Treasury Department. Traditionally, U.S. bank deposits are insured by the Federal Deposit Insurance Corporation (FDIC), but only to a maximum of $250,000. But the vast majority of SVB deposits were in business accounts with balances significantly above the $250,000 limit. Treasury Secretary Janet Yellen initially stated that the U.S. government would stand by that limit and not bail out the bank’s investors. Non-stop meetings between state, federal, and banking executives over the March 10-12 weekend changed that initial posture and it was announced on Sunday that all investors could get all their investments (regardless of size) back on Monday (March 13) morning. All SVB’s assets were therefore being guaranteed by the federal government. SVB is the 16th largest bank in the U.S. and largely serves technology startup companies. The Treasury Department was not about to create a banking environment that investors did not trust. At the time of this writing, the SVB actions and actions by other banks are still volatile and could change.

The Biden Administration last week released a budget outline for FY2024 that totaled $1.7 trillion (including RDT&E – R&D, Test and Evaluation) with about 50% or $842 billion dedicated to the Defense Department. The DOD budget is about 3.2% more than that allocated for FY2023. Republican lawmakers stated that the DOD budget should be about 5% more than the 2023 inflation rate to insure the U.S.’s national security. The budget will undergo a series of detailed congressional reviews and following approval by both the Senate and House of Representatives will only then be submitted to the President for finalization (theoretically by October 1, 2023, but previous budgets over the past 20 years have failed to meet that deadline).

Comments made by Federal Reserve chair Jerome Powell last week revealed that the next interest rate increase will depend on economic data collected by the Fed’s next meeting (March 21-22). Data collected since the last rate increase has not been what the fed desired. Inflation was still 4.7% in January (up from 4.6% in December) and 517,000 new jobs were also added to the economy in January. These data point to another 0.5% rate increase this month, rather than the 0.25% rate increase imposed in January.

RDW Index member General Motors, Detroit, released electric vehicle (EV) production data last week and the results revealed the company is losing ground to competitors in its ability to meet demand. The company has a waitlist of 80,000 customers for its Hummer EV and it’s only producing 12 EVs per day. The company has also only sold 1,000 of its Cadillac Lyriq EVs in the past year, while Tesla has sold an estimated 252,000 Model Ys (the competitor to the Cadillac model) in the same period. GM has suffered with quality issues and tighter than expected battery supplies is the explanation provided by GM.

The U.S. Navy last week announced that it will speed up Australia’s acquisition of nuclear-powered submarines by building the first few submarines in the U.S. The plan is to provide Australia with five U.S. Virginia-class submarines by the mid-2030s. Future production would then shift to the U.K. and Australia which would incorporate U.S. technology in a new Australian design. The discussions last week also considered having Australia contribute to the expansion of U.S. nuclear submarine capacities.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies), and ICT (9 companies) which invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spending in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online

Tell Us What You Think!