As we end an economically disastrous 2020, the outlook for 2021 appears to be that of a “rousing recovery,” according to U.S. investment strategists. Economists anticipate that continued accommodative monetary and fiscal policies will support markets and that market-destabilizing political developments will not come to pass. A small economic recovery began in the summer of 2020, following the pandemic-induced economic ‘mini-crash’ in the spring. A resurgence in COVID cases and uncertainty about the November elections slowed this recovery in the fall, according to a Federal Reserve report.

The positive outlook for 2021 is largely in response to the COVID-19 vaccine successes. The vaccine timeline allowed drug development, a full series of trials, regulatory approval, production, and the beginning of distribution across the planet to take place in less than a year. This feat was nothing short of extraordinary and faster than any drug development program in the past. Vaccinations in the first half of 2021 are expected to set the stage for vigorous growth recovery in the latter part of the year. Economists expect a return to a modified normalcy by mid-year or late-summer with numerous industries registering an increased demand for labor. The pre-COVID unemployment rate of 3.5% will not return in the short term, but the current rate of 6.7% will certainly drop.

These events came at a steep price with an explosion in debt at the federal, state and personal levels. And these debt levels will linger for years. The expected strong economic growth, and near-zero interest rates through at least 2023, will work to minimize the long-term effects of this debt load. U.S. fiscal support measures are expected to continue into 2021 with a ($900 billion) second stimulus bill approved in late-Dec. 2020 for small businesses, unemployed Americans, and health care workers, along with support for vaccine distribution. These support mechanisms are likely to happen in other countries as well. The European Central Bank, for example, is expected to boost asset purchases in the near future.

As part of its measures to control the economic effects caused by the COVID-19 pandemic, in August 2020, the U.S. Federal Reserve announced a new “average Inflation targeting” approach. This approach backs away from the Fed’s pre-emptive measures to control inflation by raising interest rates and allows inflation to be above target (currently 2.0%) for ‘some time.’ This policy will play into R&D asset manager plans as the Fed will be unlikely to raise interest rates anytime soon to stave off inflation, even at the risk of rising inflation rates.

Emerging markets are likely to benefit from the 2021 economic recovery with rates of growth superior to those of developed markets. Upward pressure on commodity prices will be consistent with a recovery in manufacturing and will impact emerging markets to a higher degree.

Manufacturers have indicated in Fed surveys that they intend to resume capital expenditures in the coming months — the pandemic delayed spending plans in 2020. A real resurgence in capital spending will not arise, however, until manufacturers see the pandemic-induced risks to the economy firmly behind them.

Analysts still expect a limited number of virus flare-ups over the next year or so. But, with a steadily rising inoculation rate (estimated to approach 50% of the U.S. population by June), these flare-ups shouldn’t slow the economy much. However, an R&D World reader survey deployed in the Fall of 2020 revealed that more than half of researcher respondents expect the COVID-19 pandemic to still have negative R&D budgeting and performance effects beyond 2021.

As of late December 2020, the pandemic in the U.S. still rages especially when compared to several other parts of the world. The U.K. also struggles with large numbers of new COVID-19 cases and deaths and has recently seen a virus variant that spreads much more rapidly. Effects from the vaccines being distributed in the U.S. (Moderna and Pfizer) are not expected to diminish the overall pandemic statistics (daily new caseloads and fatalities) until a large number of people are inoculated, possibly by the spring of 2021.

R versus D

Applied research is original investigation undertaken to acquire new knowledge that is directed primarily toward a specific, practical aim or objective. Basic research is experimental or theoretical work undertaken primarily to acquire new knowledge of the underlying foundations of phenomena and observable facts without any particular application or use in view. Total R&D expenditures are the sum of spending on experimental development, applied research and basic research.

Experimental development is systematic work that draws on knowledge gained from research and practical experience and is directed toward producing new or improving existing products or processes. The U.S. continues to be the country making the biggest investments in both applied research and basic research, outspending second-place China by a ratio of about 2:1, or more than $50 billion in each research category.

U.S. R&D investments divide approximately into 20% applied research, 16.5% basic research, and the remaining 63.5% in experimental development. Until 2021, the U.S. outspent all other countries in total R&D investments. But in 2021, China is forecast to outspend the U.S. in total R&D by about 3.8% or $22.8 billion ($621.5 vs $598.7 billion USD – purchasing power parity).

Since 2013, China has outspent the U.S. in experimental development. This trend continues, and China was estimated to outspend the U.S. in experimental development by nearly $70 billion in 2017, according to a recent report by the National Science Foundation (NSF-20-304).

In R&D intensity, the U.S. now ranks 10th in the world, dropping out of the top five after the mid-1990s, according to a recent report by the NSF. R&D intensity is the amount of R&D dollars as a share of gross domestic product (GDP). Over the past 20 years, South Korea, Taiwan, Germany and others have surpassed U.S. R&D intensity. R&D expressed by itself refers to the combined public (government) and private spending.

Limited to only public R&D, the U.S. has similarly fallen in leadership. As of 2017, the U.S. ranks 14th, again a significant drop from its position within the top five in the mid-1990s. Public R&D intensity values in France, Germany, South Korea and Austria now exceed that of the U.S., a trend which appears to be a product of the federal R&D spending slowdown following the 2009 financial crisis.

For the R&D World global R&D funding reports, GDP and R&D intensities are listed in purchasing power parity (PPP) values. PPP is an economic theory that allows the comparison of the purchasing power of various world currencies to one another. It is a theoretical exchange rate that theoretically allows buying the same amount of goods and services in every country. Government agencies use PPP to compare the output of countries that use different exchange rates.

The PPP calculation provides the value of goods if all countries used the U.S. dollar. PPP is tedious to compute — a U.S. dollar value must be assigned to everything. The World Bank calculates specific PPP values for every country. For our reports, PPP values of each country’s GDP are obtained from multiple sources, with a heavy emphasis on the U.S. CIA’s (Central Intelligence Agency’s) World Factbook because of its broad coverage of most global countries.

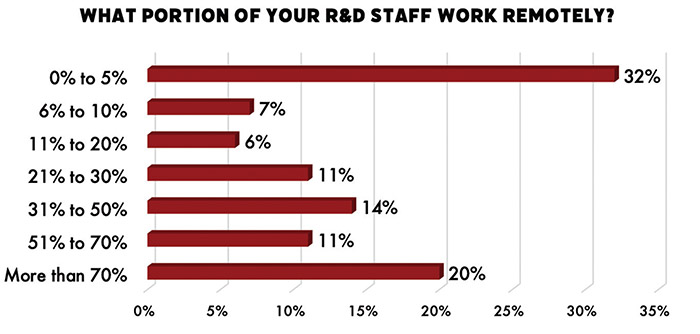

According to a recent R&D World reader survey, about a third of U.S. researchers currently work remotely, mostly due to COVID-19 quarantine restrictions. Those working remotely generally needn’t perform their R&D tasks in a research laboratory setting. Some researchers are still working in labs, according to a Dept. of Energy national laboratory representative. A significant number of researchers, however, have not visited their former workplace or lab since March 2020.

As with many other kinds of businesses, interpersonal relationships and meetings among researchers now take place virtually in an increasingly ‘normal’ manner. This pandemic effect could possibly become a normal operational mode for research personnel, once the pandemic is over. According to the R&D World reader survey, a similar number of researchers (35%) are expected to work remotely in part or mostly throughout 2021. Only 20% of the survey respondents indicated they would work consistently in their research labs throughout 2021.

Of those Americans working remotely throughout 2020 (researchers and non-researchers), a University of Chicago study in November 2020 found the largest beneficiary of the time saved from not having to commute to and from work was more time spent on traditional jobs (35%). Other activities seeing commuting-based time gains included indoor leisure (19%), home improvements (16%), and childcare (11%). Nevertheless, those working remotely on average still spent less time working than before the pandemic. Remote workers put 32 hours/week during the pandemic into their jobs and 36.4 hours/week into their jobs before the pandemic (not working remotely).

Long-term, the pandemic is likely to have lasting effects for researchers beyond the virtual communications arrangements they created. According to our survey, R&D budgeting is likely to be reduced beyond 2021. More than a third of the survey respondents think this is likely to happen, while only 11% think R&D budgeting will rise beyond 2021.

Along with reduced budgeting, actual R&D performance is also likely to drop beyond 2021 due primarily to the pandemic effects. About a quarter of the survey respondents fear their performance will suffer beyond 2021 while about 7% are optimistic their performance will rise during the same time period. A third of the survey respondents indicated that both R&D budgeting and performance would continue unchanged due to the pandemic beyond 2021.

R&D staffing Issues

R&D managers always seem to have problems finding and retaining skilled R&D staff. The situation hasn’t changed during the COVID-19 pandemic. A year ago, in 2019, slightly more than half of R&D managers queried in the 2020 Global R&D Funding Forecast-based reader survey found it difficult to get skilled staff. This result echoed that of reader surveys conducted over the past several years. But 75% of managers complained of staffing problems in our most recent researcher reader survey. At least a portion of this dramatic rise can be attributed to federal regulations that continue to restrict immigration. Another reason can be found in the dramatically reduced ability to commute because of pandemic and stay-at-home confinements.

A year ago, a strong economy revealed a strong desire and need to boost R&D staff. As revealed in last year’s reader survey, about half of researchers responding to the survey expected to augment their R&D staffs in 2020. Following the pandemic, this ratio has now dropped below 50% — with a third of respondents revealing they would expect to reduce their R&D staffs in 2021, while only 8% thought would reduce staffs in 2020.

This article is part of R&D World’s annual Global Funding Forecast (Executive Edition). This report has been published annually for more than six decades. The Executive Edition will be published in the April 2021 print issue of R&D World. To purchase the full, comprehensive report, which is 54 pages in length, please visit the 2021 Global Funding Forecast homepage.

Tell Us What You Think!