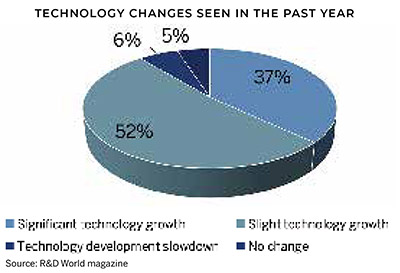

Technology growth in the R&D environment appears to be continuous and without much letup or increase in the rate of change. According to the respondents to R&D World magazine’s 2020 Global R&D Funding Forecast reader survey, performed in September 2019, most researchers have seen significant technology changes over the past year (September 2018 to September 2019). 89% of the survey respondents experienced technology growth in their industry, while only 6% saw a slowdown in their industry’s technology growth. The rate of technology change is likely accelerating, but the acceleration rate is remaining close to the same each year we collect data for our R&D Funding Forecasts.

Technology growth in the R&D environment appears to be continuous and without much letup or increase in the rate of change. According to the respondents to R&D World magazine’s 2020 Global R&D Funding Forecast reader survey, performed in September 2019, most researchers have seen significant technology changes over the past year (September 2018 to September 2019). 89% of the survey respondents experienced technology growth in their industry, while only 6% saw a slowdown in their industry’s technology growth. The rate of technology change is likely accelerating, but the acceleration rate is remaining close to the same each year we collect data for our R&D Funding Forecasts.

To collect data on the trends in R&D performance for this report, the editors of R&D World magazine create and deploy annual electronic reader surveys. Responses for last year’s 2019 R&D Funding Forecast resembled survey results collected for this report — within 1% of each other. To create these reports, three surveys are deployed annually, generally with about two to three weeks separating them. Each survey has about twenty distinctive questions. For the 2020 Funding Forecast, the editors received more than 2,100 responses, which is definitely statistically significant, and the results are considered reliable.

A review of the responses from R&D World magazine’s reader surveys reveals respondents’ over-riding concerns with costs. Operating costs, capital costs, materials costs, production costs, staffing costs — but always costs. It is clear that reliable cost prediction and reduction are both important. If an R&D project is late, costs will be larger as well.

A review of the responses from R&D World magazine’s reader surveys reveals respondents’ over-riding concerns with costs. Operating costs, capital costs, materials costs, production costs, staffing costs — but always costs. It is clear that reliable cost prediction and reduction are both important. If an R&D project is late, costs will be larger as well.

A classic, but extreme, example concerns one of the largest R&D projects ever created — the James Webb Space Telescope (JWST) being developed by NASA, the European Space Agency (ESA) and the Canadian Space Agency (CSA). Originally designed as the Next Generation Space Telescope in 1996 and as a replacement for the NASA/ESA developed Hubble Space Telescope, the JWST was originally scheduled to launch in 2007. JWST is billed as one of the most technically complex satellites ever and will be situated at the Earth’s Lagrangian point (L2) 1.5 million miles from its surface. Following 14 years of multiple technical delays, the telescope now is scheduled to launch in March 2021 following a 2018 official project review. It’s estimated final cost is now close to $10 billion, 25 times more than its original estimate.

Other R&D challenges brought out by R&D World magazine’s surveys include: funding sources, the rapid pace of technological change, new technologies and sociological issues, technical staffing shortages, aging infrastructures, inflation and its effects on increasing costs, global competition, economic disruptions and corporate pressures to improve performance.

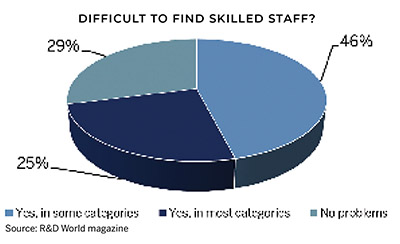

R&D managers say it is more difficult to find skilled R&D staff than it was even 12 months ago. In 2019, about 65% of survey respondents found it difficult to find skilled R&D staff. In 2020, that figure has risen to 71%. Part of the issue is that the overall U.S. unemployment rate in August 2018 was 3.9%. In August 2019, when the latest Funding Forecast survey deployed, the unemployment rate had dropped to 3.5%, where it still remains and is forecast to continue for the foreseeable future.

R&D managers say it is more difficult to find skilled R&D staff than it was even 12 months ago. In 2019, about 65% of survey respondents found it difficult to find skilled R&D staff. In 2020, that figure has risen to 71%. Part of the issue is that the overall U.S. unemployment rate in August 2018 was 3.9%. In August 2019, when the latest Funding Forecast survey deployed, the unemployment rate had dropped to 3.5%, where it still remains and is forecast to continue for the foreseeable future.

Part of the staffing shortage relief in the past for R&D managers was the ability to hire skilled immigrants. MS and PhD-qualified personnel could be hired on as interns in many high-technology positions, especially in U.S. government labs. That option has been diminished on several fronts, as immigration laws have become more restrictive, especially for selective countries in the Middle East and South East Asia.

And while the rules are increasingly restrictive on who can enter the U.S., the actual process for those immigrants has become more complex and time-consuming. The overall approval process has lengthened from several months to now often more than a year. The complexity of it all discourages potential immigrants, some of whom decide not to pursue a position in the U.S. and either apply to enter another country or just stay where they are.

In particular, many Asian students studying in U.S. universities have historically found positions within the U.S. This scenario has also changed. Many now retrun to their homeland following graduation where they are well received. Additionally, foreign students increasingly find that their own country’s academic institutions have improved substantially over the past five to ten years to a point where they are now competitive with U.S. academic institutions. And there are jobs for them at home when they finish.

Chinese academia is also actively recruiting professor-level teachers and researchers from U.S. academic institutions along with substantial incentives to move. In China, these U.S. professionals can teach, perform research (with much less work to get funded than in the U.S.) and become more and faster recognized for their scientific accomplishments.

Net, U.S. R&D managers have an increasingly smaller skilled R&D worker pool to draw from than they have in the past. The forecast also is not dramatically positive for the foreseeable future.

These statistical trends also show up in the expectations that U.S. research managers see in their immediate R&D plans. The overall U.S. economy has been surprisingly strong for more than 10 years and is expected to continue expanding into 2020. This expansion contrasts with the rest of the world where economic growth is slowing and even stalling. China’s automotive sector, for example, has shrunk over the past six months with some Chinese companies, including automotive dealerships, now threatened with closure because of reduced demand. Foreign automotive companies in China, such as General Motors and Ford Motor Co., are not immune to these events and their sales as well have declined.

These statistical trends also show up in the expectations that U.S. research managers see in their immediate R&D plans. The overall U.S. economy has been surprisingly strong for more than 10 years and is expected to continue expanding into 2020. This expansion contrasts with the rest of the world where economic growth is slowing and even stalling. China’s automotive sector, for example, has shrunk over the past six months with some Chinese companies, including automotive dealerships, now threatened with closure because of reduced demand. Foreign automotive companies in China, such as General Motors and Ford Motor Co., are not immune to these events and their sales as well have declined.

The continuing U.S.-China trade disputes throughout 2019 has only exacerbated this situation with little “light seen at the end of the tunnel.” And a smaller or shrinking economy also has the effect of smaller or shrinking R&D budgets as well.

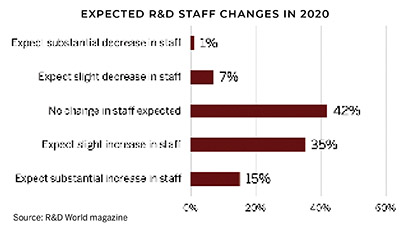

Nevertheless, with a growing U.S. economy and despite the specter of a shrinking U.S. job force, R&D managers continue to be optimistic. They expect to grow their R&D staffs in 2020. In 2019, about 45% of the survey respondents expected to add personnel while 10% expected to make cuts. But 50% of R&D managers now expect to increase their R&D staffs in 2020 while less than 8% expect to cut them.

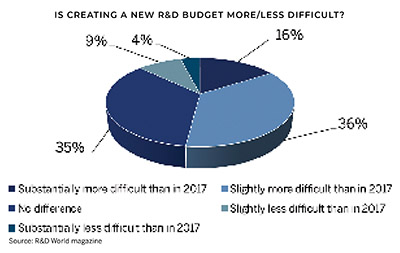

One of the 2020 Global R&D Funding Forecast survey questions queried researchers about the difficulty of creating a 2020 R&D budget. Some 52% of the respondents said budgeting was more difficult in 2020 than in 2017. Only 13% of respondents felt budgeting was easier now than three years ago. We found the same sentiment in responses submitted in last year’s (2019) R&D Funding Forecast.

The factors making R&D budgets more difficult to create than in the past include accounting for expected R&D staffing shortages which, as noted earlier, is likely to be slightly more severe in 2020 than it was in 2019. Continuing high technology advances also complicate the creation of budgets. Artificial intelligence technologies continue to be more complex, as do autonomous implementations. This is especially true in the automotive industry and in other transportation modes, include aircraft. Autonomous aircraft, however, are even further down the road than driverless automotive and trucking systems. Interestingly, there has been no discussion of AI-assisted R&D budget creation in the literature but likely could be a future topic.

Further complicating the creation of R&D budgets for 2020 is the continuing slowdown of the overall global economy. The International Monetary Fund’s (IMF’s) October global economic forecast pegs the U.S. economy to grow by about 2.2%, slower than 2018’s 2.5% growth. This deacceleration creates more caution in committing to numerous R&D investments.

This article is part of R&D World’s annual Global Funding Forecast (Executive Edition). This report has be published annually for more than six decades. To purchase the full, comprehensive report, which is 58 pages in length, please visit the 2020 Global Funding Forecast homepage.

Tell Us What You Think!