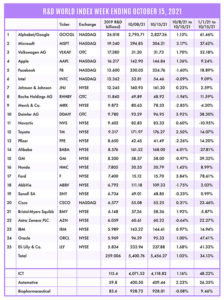

The R&D World Index (RDWI) for the week ending October 15, 2021, closed at 5,456.27 for the 25 companies in the R&D World Index. The Index was up 1.03% (or 55.51 basis points) from the week ending October 8, 2021. The stock of 16 R&D World Index members gained value from 0.23% (Johnson & Johnson) to 4.01% (Alibaba). The stock of nine R&D World Index members lost value from -0.09% (Intel) to -2.85% (Merck & Co.).

Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest contract chip maker, announced last week that it will build a new chip manufacturing plant in Japan with a completion date scheduled for late-2024. The company is also building a $12 billion plant in Arizona and expanding production at its plants in China. The Japanese plant will focus on less-advanced chips commonly used in automobiles and will be in addition to its previously stated pledge to spend $100 billion on advanced facilities over the next three years.

Emerson Electric Co., a large industrial conglomerate based in St. Louis, announced last week that it plans to merge two of its software businesses (OSI and Geological Simulation Software) with Aspen Technology, Bedford, Mass., in an $11 billion deal. Emerson spends about $200 million annually on R&D, while Aspen invests roughly $90 million. The two companies have had a commercial partnership since 2018. Emerson’s close rival Schneider Electric SE also merged its industrial software business with Aveva Group in a roughly $4 billion deal in 2018.

The Washington, D.C.-headquartered International Monetary Fund (IMF) released its annual World Economic Outlook (WEO) last week with a lower 2021 global growth forecast than it released in previous projections (5.9% growth for 2021, down 0.1% compared to its July 2021 WEO update of 6.0% overall growth). Economists cited the spread of the COVID-19 Delta variant and lower than expected global vaccinations as reasons for the lower forecast. The IMF group also stated that consumer price inflation will reach 2.8% in advanced global economies in 2021 and 2.3% in 2022, up from 2.4% and 2.1% respectively in its July report. RDW editors utilize the October IMF forecast data and other data in our 2022 Global R&D Funding Forecast, which will be published in early 2022.

The U.S. Space Force (USSF) last week announced that its SpaceWERX (the agency’s arm for pursuing and integrating innovative technologies) has entered into a partnership with the eleven-month-old venture capital firm Embedded Ventures, Los Angeles. The partnership is aimed at building out R&D opportunities which can grow the domestic space economy and be used to defend U.S. interests. Similar to the CRADA (Cooperative R&D Agreement) model used by the U.S. Department of Defense, this USSF partnership looks to build on the financial opportunities of venture capital firms.

In a report issued last week by media company Visual Capitalist, Vancouver, British Columbia, the company stated that Tesla spends nearly $3,000 on R&D per car it sells, while Ford Motor spends about $1,200, Toyota $1,060 and GM about $900. Comparatively, the report also states that Tesla does not spend on advertising its products while the other automakers spend $400 to $500 per car sold on advertising. Due to the larger overall number of vehicles manufactured by the traditional automakers (compared to the number produced by Tesla), their overall R&D investment is each still substantially larger than that posted by Tesla (approximately $1.5 billion in 2020).

National Resilience, San Diego, and Harvard University, Cambridge, Mass., last week announced they have established a five-year R&D alliance aimed at developing biologics, vaccines, nucleic acids and cell and genome therapies. Resilience committed to investing $30 million to the alliance. Under the agreement, Resilience will fund faculty-initiated research focused on novel therapeutic and biomanufacturing technologies developed in the university labs. One technology initially identified for incubation involves skeletal muscle disorders.

U.S.-Ireland medical device manufacturer Medtronic (Minneapolis and Dublin, Ireland) announced last week that the company is rebranding itself to include advances in artificial intelligence (AI), data analytics, robotics and other healthcare technologies. The company also pledged to increase its R&D spending by 10% from its current $2.7 billion.

San Francisco-based Orbit Fab, a startup offering a refueling service in space, announced last week that it has entered into a CRADA with the Space Vehicle Directorate of the U.S. Air Force Research Laboratory to advance on-orbit refueling technologies for the lab’s Spacecraft Technology Division. In the collaboration, the company will share its hardware products, including its Rapidly Attachable Fluid Transfer Interface and its cooperative docking guidance strategy with the USAF, which will provide its facilities for use in the company’s performance and qualification goals.

Azimuth Capital Management, Calgary, Alberta, announced last week that it is seeking $1 billion for a new R&D fund to support businesses including renewable-fuel manufacturers, battery recyclers and power storage providers. Azimuth is initially looking at businesses involved in hydrogen production, low-carbon transportation fuels and waste-oil and plastics recyclers. Azimuth looks to provide 20% returns from the new fund — its fifth such venture.

RDW Index member Microsoft, Redmond, Wash., announced last week that it will shut down its LinkedIn professional networking site in China. The decision was made after “facing a significantly more challenging operating environment and greater compliance requirements in China” than in other countries. The move is not surprising as the Chinese government has recently increased its control over its own tech companies, private enterprises and online commentary.

Natural gas prices have roughly tripled in Europe in 2021, according to the UBS. But their effect on inflation in the Euro area has been minimized to less than 1% due to high regulatory influences and price controls. According to the UBS last week that may change in 2022 as natural gas becomes a larger part of Europe’s energy mix as the region decarbonizes. Natural gas accounts for about a third of the UK’s power sources, a quarter of Germany’s and about 15% for France.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2019 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!