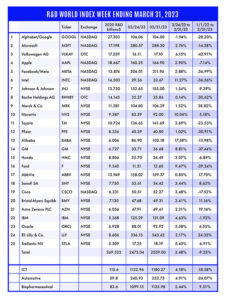

The R&D World Index (RDWI) for the week ending March 31, 2023, closed at 2,559.00 for the 25 companies in the RDWI. The Index was up 3.48% (or 85.96 basis points). Twenty-four of the 25 RDWI members gained value last week from 0.14% (Roche Holdings) to 17.58% (Alibaba). Only one of the 25 RDWI members lost value last week with -1.94% (Alphabet/Google).

The R&D World Index (RDWI) for the week ending March 31, 2023, closed at 2,559.00 for the 25 companies in the RDWI. The Index was up 3.48% (or 85.96 basis points). Twenty-four of the 25 RDWI members gained value last week from 0.14% (Roche Holdings) to 17.58% (Alibaba). Only one of the 25 RDWI members lost value last week with -1.94% (Alphabet/Google).

RDW Index member Intel, Santa Clara, California, last week listed the sale of its 25-acre San Jose office and research campus as part of a $3 billion cost-cutting campaign that includes layoffs (61 employees). The “innovation campus” is a four-building complex with 500,000 ft2 of office space, 57,000 ft2 of research labs, and parking for 800 cars. Any purchase arrangement would include a leaseback by Intel on all four buildings for one or two years according to the marketing brochure issued by Intel. The company plans to consolidate the San Jose innovation campus with its Santa Clara Mission Campus. Intel also has listed its 61-acre campus in Austin, Texas, and has canceled plans to build a $700 million lab in Hillsboro, Oregon. The company is continuing with plans for a $20 billion semiconductor plant in Licking County, Ohio, and a $20 billion expansion of its chip-making plant in Arizona.

RDW Index member Alibaba Group Holding Ltd., Hangzhou, China, announced last week that it plans to split itself into six independently run companies, each of which could seek separate initial public offerings (IPOs). The once $800 billion-valued company (now only $200 billion) would be split into companies focusing on Chinese e-commerce, global e-commerce, digital mapping and food delivery, logistics, media, and entertainment. The purpose of the reorganization was stated to improve efficiency and better compete with rivals. It mirrors other large tech moves, such as that at Google. For now, Alibaba’s stock listing status won’t be affected.

A study released last week by researchers at the University of Pennsylvania, Philadelphia, and OpenAI, San Francisco, (the company that created the artificial intelligence (AI) tool ChatGPT) noted that at least half of the tasks performed by accountants could be performed by ChatGPT tools. The study found the same to be true for mathematicians, interpreters, writers, and about 20% of the U.S. workforce. Most jobs can be changed in some form by GPTs (generative pre-trained transformers), according to the researchers. Other recent studies have also found that GPT tools can save significant time and produce better results than can be done by humans.

RDW Index member Google/Alphabet, Mountain View, California, announced to its employees last week to expect more spending cuts as the company tries to meet savings targets in 2023. Just as they did in 2008, the company will be looking at data to identify areas of spending that are not as effective as they should be, according to the company’s finance chief, Ruth Porat. The company said in January that it would cut about 12,000 jobs or 6% of its staff. The company also said it will hire at a slower pace.

The U.S. Department of the Treasury and the Internal Revenue Service (IRS) announced new rules last week for its electric vehicle (EV) tax credits. Starting on April 18, half of the current $7,500 credit will depend on an EV having a mostly North American battery and the other half on the provenance of the battery minerals, which need to come from free-trade partners. Chinese-manufactured batteries will automatically disqualify an EV starting next year. Some car makers, like Ford Motor, are working with other countries, such as Indonesia, to create their batteries and electrical components.

A poll conducted last week by the University of Chicago revealed that 56% of Americans think that earning a four-year college degree is a bad investment. It’s not worth the cost, say respondents, because people often graduate without specific job skills and with a large amount of debt to pay off. These results reverse the long-standing opinion that a degree would lead to good jobs and higher earnings.

ICT (information and communications technology) giant Huawei, Shenzhen, China, announced last week that it had increased its R&D investment by 13.2% year-on-year to $23.2 billion in 2022, which represented 25.1% of its total revenue. They also said that they increased their R&D staff by 6.2% in 2022 to 114,000. The company’s portfolio now includes ICT infrastructure, smart devices, cloud services, digital power, and intelligent automotive services.

U.S. Steel Corporation, Pittsburgh, announced last week that production of its new electrical steel will begin this summer at its Big River (Osceola), Arkansas, facility, with the commissioning of its non-grain-oriented electrical steel line. The company is introducing this new product for the rapidly growing EV market. This thin electrical steel has all the magnetic properties needed for EV motors and transformers. The Big River plant is expected to manufacture up to 200,000 tons of electrical steel per year. More than 80% of this grade of steel currently is produced by China, Japan, and South Korea, which are all subject to U.S. tariffs or quotas on steel imports. Electrical steel has a limited supply with very long lead times — often more than a year.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies), and ICT (9 companies) which invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spending in the world by government, industries, and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!