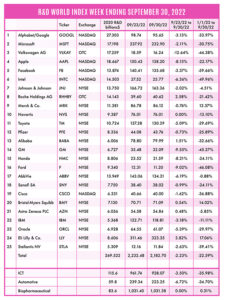

The R&D World Index (RDWI) for the week ending September 30, 2022, closed at 2,182.70 for the 25 companies in the RDWI. The Index was down -2.23% (or -49.78 basis points) from the week ending September 23, 2022. Five of the 25 RDWI members gained value during the past week from 0.48% (Astra Zeneca PLC) to 3.82% (Eli Lilly & Co.). Nineteen of the 25 RDWI members lost value last week from -0.73% (Pfizer) to -12.64% (Volkswagen AG). One of the 25 RDWI members had no change (Novartis at 76.01).

RDW Index member General Motors, Detroit, Michigan, and OneD Battery Sciences, Palo Alto, California, announced last week that they’ve formed a joint R&D agreement based on the use of OneD’s silicon nanotechnology in GM’s Ultium battery cells to increase the energy density in battery cells for electric vehicles (EVs) thereby increasing the range of EVs and reducing cost. OneD’s SINANODE technology adds more silicon onto the battery cell anodes by fusing silicon nanowires into EV-grade graphite. Silicon can store ten times more energy than graphite. GM Ventures and Volta Energy Technologies, Warrenville, Illinois, participated in funding R&D at OneD.

The U.S. Department of Commerce (DOC) created a new Industrial Advisory Committee last week that will make recommendations on a national microelectronics R&D strategy and new public-private partnerships. The committee was created by the National Defense Authorization Act of 2021 and is supported by the CHIPS and Science Act created in August 2022. Members selected for the committee come from a variety of industry, academia and federal laboratories, including Intel and Microsoft.

Mitre Corp., McLean, Virginia, announced last week that it will open a new R&D facility in Honolulu to bolster security and national defense in the Indo-Pacific region. Mitre works across six federal R&D centers and more than 200 individual laboratories. The new facility will work with the University of Hawaii and will focus on advancing marine technology, enhancing cyber defense, strengthening climate resilience, addressing natural resource management and testing energy technologies. Mitre has worked in Hawaii for nearly 50 years, and with this action, it will double its local workforce, advance STEM education and bolster security in the region.

Zhejiang Geely Holding Group Co., Hong Kong, last week announced that it has acquired an 8% stake in Aston Martin Lagonda Global Holdings PLC, Gaydon, U.K. Geely also owns Lotus Advance Technologies and Volvo Car Corp. In the same offering, the Public Investment Fund of the Kingdom of Saudi Arabia raised its stake in Aston Martin to 18.7% and the Yew Tree Consortium, Montreal, (owned by Lawrence Stoll) raised its share to 19%.

RDW Index member Toyota, Toyota City, Japan, announced last week that pursuing all-electric vehicles would be too narrow an approach for an automaker that sells in disparate global markets. Toyota’s strategy is to invest in EVs for the long term, while simultaneously promoting hybrid and plug-in hybrid vehicles. The company wants to offer its customers a diverse vehicle lineup, despite its investors’ requests to move more quickly and fully to EVs. The company has previously stated that it intends to invest up to $35 billion in EVs through 2030.

RDW Index member Johnson & Johnson, New Brunswick, New Jersey, announced last week that “Kenvue” will be the new name for its planned stand-alone company offering consumer healthcare products, including Tylenol, Listerine, Neutrogena and Band-Aid. J&J will continue to be the name of the company’s drug and device businesses. Kenvue products generated nearly $15 billion in revenue in 2021, about 16% of total J&J sales.

Car rental company, Hertz Global Holdings Inc., Estero, Florida, and energy firm BP PLC, London, announced last week that they signed a deal to develop and manage a network of EV charging stations across North America. The charging infrastructure will be available to taxi, ride-sharing customers and the general public. BP’s EV charging business, BP Pulse, will power and manage Hertz’s charging infrastructure under a memorandum of understanding (MOU). Hertz has signed contracts to purchase EVs from Tesla, Polestar and General Motors and currently has tens of thousands of EVs available at 500 locations across 38 states.

EV manufacturer BYD Company, Shenzhen, China, announced last week details of its full-scale European product launch for the Fall of 2022. Its products will be priced to compete with Volkswagen’s ID4 and Tesla’s Model Y. BYD also plans to introduce luxury EV models into the European marketplace, but automotive analysts don’t give them much chance of success, since existing luxury EV models from Nissan, Hyundai, Toyota, Mercedes-Benz, BMW and Audi have not fared well in the marketplace.

The Organization for Economic Cooperation and Development (OECD), Paris, reported last week that Russia’s invasion of Ukraine will cost the global economy about $2.8 trillion in lost output by the end of 2023 and even more if a severe winter leads to energy rationing in Europe. Western governments fear that Russia’s partial mobilization and its preparations to annex swaths of Ukraine could prolong the war for months, perhaps even years, further weighing on the global economy. European growth could be 1.3% lower in 2023 and in a recession.

Tata Group, Mumbai, India, a 154-year-old conglomerate, announced last week that it is merging seven small metal units of its business with itself to reduce costs, simplify its corporate structure and strengthen its balance sheet. Tata has been consolidating its businesses for several years and recently received approval to merge two of its airlines — AirAsia India and Air India.

RDW Index member Volkswagen AG, Wolfsburg, Germany, priced its Porsche AG initial public offering (IPO) at the top end of the targeted range last week. The offering of preferred stock values was placed at about $73 billion, but fell short of its forecast, ending flat when markets closed. Still, the IPO put VW among the top five biggest car makers measured by market value. VW retains a 75% stake in Porsche AG.

Memory-chip maker Micron Technology Inc., Boise, Idaho, announced last week that its sales fell 20% for its latest quarter, and profit also dropped 45% to $1.5 billion. The company is predicting sales of $4.2 billion for the current quarter, well below analysts’ projections of $5.7 billion. The company expects the market for its products will continue to contract in 2023 before growth resumes in 2024.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!