Global pharmaceutical R&D

The global biopharmaceutical R&D community has been tasked with finding a cure for the COVID-19 virus. The global health-care industry, up until this pandemic, had been one of the best performing sectors for the investment community. But since the rapid global expansion of the COVID-19 virus in April 2020, it has been among the worst performing investment sectors due to its inability to create an effective coronavirus vaccine or treatment. Investors over the past several weeks have pulled more money from global health-related equity funds than they have in nearly two decades.

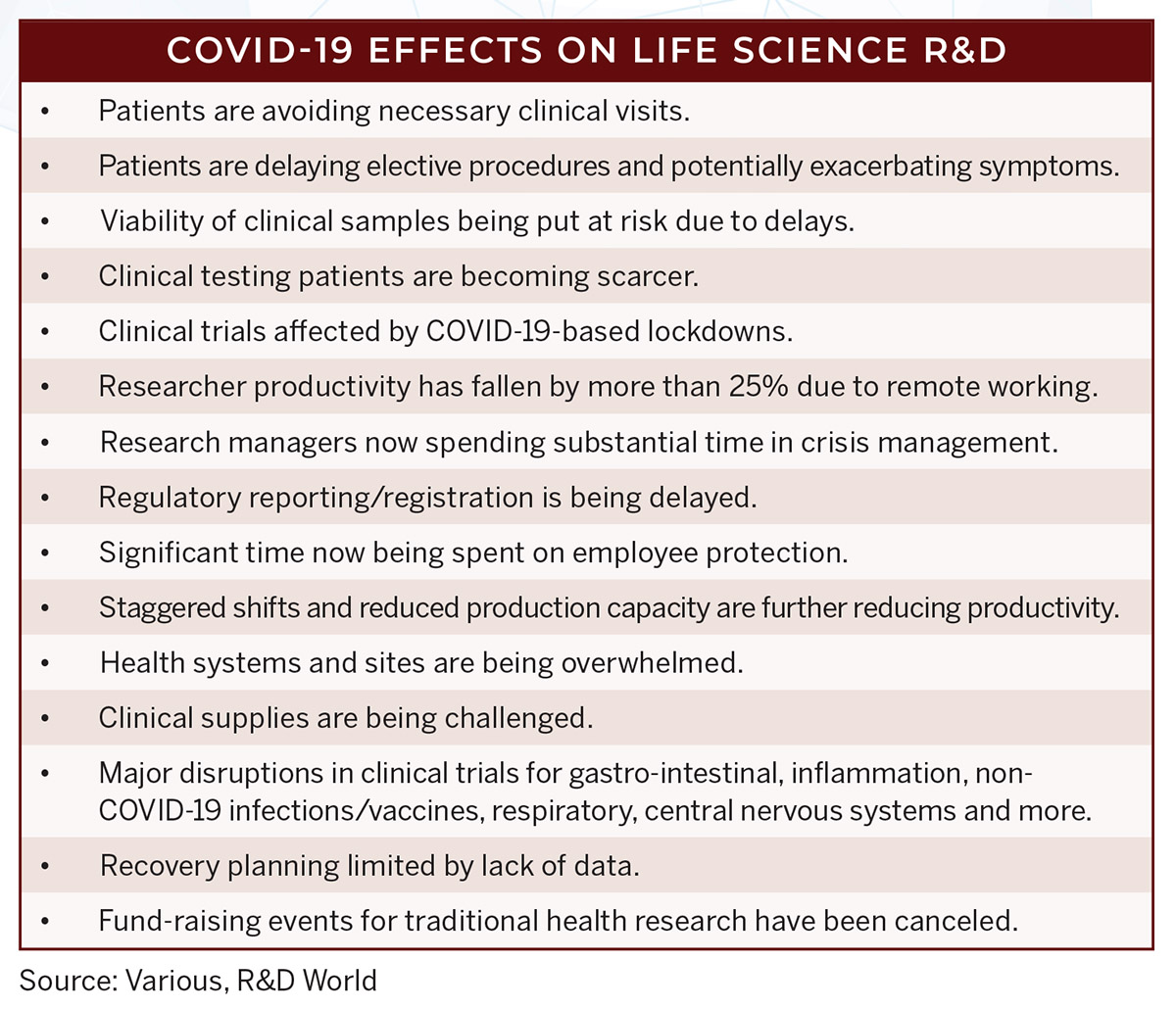

The problem for the biopharmaceutical R&D community is multi-pronged. On one hand, many researchers were quarantined and restricted from working on their traditional research projects; then their priorities were changed to focus on COVID-19 research, treatment and cures. But, COVID-19 is a unique virus and initial assumptions about susceptible individuals, its incubation period and symptomatic characteristics turned out to be inaccurate. Initial comments from leaders were also contradictory or false.

There were also issues in tracking infected individuals and recruiting an adequate number of clinical testing participants. Its actual profusion in the human body and the extent of organ susceptibility were also unknown.

Also, the last incidence of an influenza pandemic was a hundred years ago, with the Spanish Flu in 1918, when one-third of the world’s population became infected with the virus and about 675,000 Americans died from the disease. Politicians and researchers alike didn’t know how to respond until the virus had reached a pandemic scale. Emergency hospitals were set up in convention halls, refrigerated trucks were rented to act as temporary morgues and often conflicting directives were made to confine the populace and limit spreading of the disease.

Issues in developing a COVID-19 vaccine were not limited to the U.S. Two drug trials in China were suspended as they were planning to test Gilead’s experimental drug remdesivir, which showed promise when used in mice. The problem here was the inability to recruit enough patients before Chinese lockdown measures were employed to slow the spread of the virus. The Gilead drug has been considered by the NIH for potential use in the most severe COVID-19 cases. While not all studies have been successful, the successes revealed an accelerated time to recovery.

Lockdown measures also hindered the development of vaccines at Oxford University in the U.K. These studies were changed to use health-care workers as test subjects. London-based Informa Pharma Intelligence estimates that there are more than 1,000 clinical trials testing treatments or vaccines for COVID-19, many of those led by universities and government research agencies. The UK information company Informa also recently launched a free COVID-19 online content hub that will be updated daily with comprehensive data on clinical trials, pipeline status, market events and insights. Links to this hub can be accessed at https://pharmaintelligence.informa.com/contact/contact-us.

In June, the NIH confirmed that Moderna Inc.’s vaccine would be the first to enter large phase 3 clinical trials, starting in July. Studies of vaccines from AstraZeneca and Johnson & Johnson are slated to start Phase 3 trials in August and September. Pfizer Inc. and its German partner BioNTech SE are also planning to start a large Phase 3 trial in July. They say that they will be able to seek regulatory approval by the end of 2020. BioNTech also has a partnership with China’s Shanghai Fosun Phamaceutical Co., which could quickly produce vast amounts of vaccine doses for the global market.

Researchers at these (and other) companies have been working nonstop for the past six months (with government and private R&D funding) on these experimental vaccines. In early July, the federal government awarded $1.6 billion to Novovax to fund its Phase 3 clinical studies and to support large-scale manufacturing of doses. Novovax said it could deliver up to 100 million doses of its vaccine for use in the U.S., possibly by the end of 2020. The federal government also gave a $450 million contract to Regeneron Pharmaceuticals to manufacture thousands of its experimental COVID-19 treatment that the government will distribute at no cost to the public, if approved for use. The Regeneron drug is a combination of two antibodies and is intended for people already infected and as a temporary preventive treatment.

This article is part of R&D World’s annual Global Funding Forecast (Executive Edition). This report has be published annually for more than six decades. To purchase the full, comprehensive report, which is 67 pages in length, please visit the 2020 Global Funding Forecast homepage.

Tell Us What You Think!