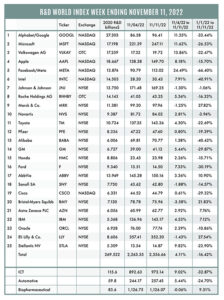

The Index was up 4.11% (or 93.11 basis points) from the week ending November 4, 2022. Twenty of the 25 RDWI members gained value during the past week from 0.61% (Cisco) to 24.49% (Facebook/Meta Platforms). Five of the 25 RDWI members lost value last week from -1.25% (Merck & Co.) to -3.58% (Bristol-Myers Squibb).

Boeing Co., Chicago, announced last week that it plans to expand its Boeing India Engineering & Technology Centre in Bengaluru (Bangalore) with a wholly owned $200 million, 43-acre technology campus. This will be Boeing’s largest facility of its kind outside of the U.S. The company currently has about 4,000 employees at the Centre, it plans to increase its strength by 25%. The Centre is focusing on achieving net zero emissions for aircraft by 2050, this will involve the extensive implementation of artificial intelligence (AI) and machine learning (ML) techniques.

The U.S. government announced last week that it plans to leave the COVID-19 pandemic status as a public health emergency in place past January 2023 and could last into the spring. The public health emergency status was imposed in January 2020 and renewed every 90 days since then. The emergency status enables states to receive enhanced federal payments for Medicaid and for pharmacists to give COVID-19 vaccine inoculations.

At last week’s UN Climate Conference, COP27, in Sharm El Sheikh, Egypt, President Biden announced that his administration, through the Environmental Protection Agency (EPA), is moving to tighten restrictions on methane emissions — a strong global warming promoter. The plans include monitoring oil and gas production facilities for methane leaks and their repair or replacement. Methane flaring would be reduced or eliminated at all well sites. In conjunction with these efforts, Biden also pledged nearly $200 million for climate data collection and weather forecasting across Africa.

The U.S. National Science Foundation (NSF) announced last week that it is shutting down travel to McMurdo Station in Antarctica after nearly 10% of the research station’s population tested positive for COVID-19. Air travel to the outpost will be paused for two weeks. There currently are 64 active cases of COVID-19 at the station, where 993 people are stationed. It wasn’t immediately clear which type of COVID-19 variant led to the outbreak. Most of those infected have mild symptoms and are isolating in their rooms. The NSF is assessing any impact the outbreak will have on ongoing research projects.

The Research Division of RDW Index member IBM, Armonk, New York, announced last week that it has created a more powerful quantum computing chip, its 433-qubit Osprey chip. The device has more than three times as many qubits as the 127-qubit Eagle chip it introduced in 2021. IBM plans to introduce a 4,000-qubit system by 2025, which will be able to solve some problems faster or more accurately than conventional computers.

Graphics-processing chip maker Nvidia Corp., Santa Clara, California, announced last week that it had developed an alternative to a high-end chip that had been restricted by the U.S. government from being shipped to customers in China. Their new chip, the A800, meets U.S. regulations and can be exported to China. It went into production in Q3 2022 and replaces the A100, a chip widely used by China’s tech giants, Alibaba (an RDW Index member), Tencent Holdings, and Baidu Inc. The A800 has the same computing performance, but a narrower interconnect bandwidth. The chip meets U.S. regs by not being able to be programmed to exceed its performance.

The U.S. Department of Labor last week reported that consumer prices rose at a slower pace in October than in recent months. Core prices rose 0.3% from September, the smallest gain in a year. The federal reserve approved a 0.75% rise in interest rates to stem inflation rates seen in previous months, the fourth consecutive increase of that level to a range between 3.75% and 4.00%. Fed officials, including Fed chairman, Jerome Powell, have indicated they’re looking for signs that could justify a relaxation in their interest rate increases and the CPI increase of 0.3% could be one of those signs. As a result, analysts are now expecting the Fed will back off to a 0.50% rate increase at their December 13, 2022, meeting. Fed officials have stated that they would like the interest rates to settle between 4.5% and 5.0% early next year but analysts fear that peak may still be exceeded.

Several high-tech firms have announced workforce cuts to offset slowing sales and rising inflation. RDW Index member Meta Platforms (Facebook), Menlo Park, California, was the latest to do this last week with its announcement to reduce its workforce by 13% (or about 11,000 people). The company also stated it’s reducing its office space, moving to desk sharing for some workers, and extending a hiring freeze through 1Q 2023. The company stated that its spending on infrastructure related to AI could become more efficient, implying a possible reduction in R&D.

RDW Index member Toyota, Toyota City, Japan, announced that it and Sony Group Corp., Tokyo, together with six other Japanese companies are creating a business to design and fabricate next-generation semiconductor chips by the late-2020s. Toyota, Sony, Kioxia Holdings, Tokyo Electron, and SoftBank Group have each contributed about $7 million to create this venture. A research center for the new business will be set up in 2022, at a site to be determined in Japan. Japanese companies recognize that Japan, which was once the leader in semiconductor device development has fallen behind efforts by Taiwan and the U.S. and this initiative will be to rebuild that lost standing. Earlier this year, Toyota trimmed its annual production target for cars by 500,000 vehicles, citing the risk of semiconductor shortages. The China-U.S. competition in this area has also increased Japanese companies’ future concerns about their ability for stable supplies

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) which invented a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries, and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World

Tell Us What You Think!