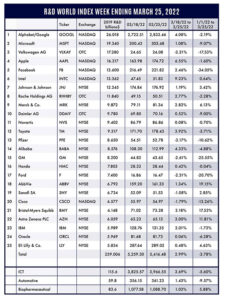

The R&D World Index (RDWI) for the week ending March 25, 2022, closed at 5,416.48 for the 25 companies in the RDWI. The Index was up 2.99% (or 157.18 basis points) from the week ending March 18, 2022. Nineteen of the 25 RDWI members gained value from 0.06% (Oracle) to 9.23% (Intel). Six of the 25 RDWI members lost value from -1.08% (Sanofi SA) to -3.17% (Pfizer).

Tesla, Austin, Texas, opened its Gigafactory Europe last week in Grunheide, Germany, just outside Berlin in the state of Brandenburg. The plant eventually will employ up to 12,000 people and make up to 500,000 electric vehicles (EVs) a year. The company plans to make 100,000 EVs in 2022 and ramp up substantially in 2023. Tesla CEO Elon Musk and German Chancellor Olaf Scholz officiated at the factory opening following a two-year construction phase which was accelerated with the help of the German government. The Berlin-Brandenburg plant is Tesla’s second overseas plant after Giga Shanghai in China.

Federal Reserve Chairman Jerome Powell stated last week that the central bank was prepared to raise interest rates in half-percentage-point steps and high enough to slow the U.S. economy if it concluded that such steps were warranted to bring down inflation. His remarks were made in a speech Powell made to the National Association for Business Economics in Washington, D.C. Powell stressed there is considerable uncertainty facing Fed officials following the pandemic and the Russia-Ukraine war. Most Fed officials believe that the Fed’s “neutral” interest rate is near 2.5%, assuming annual inflation is at its target point of 2%. Annual inflation rose to 6.1% in January using the Feds’ preferred gauge. Powell warned that the Ukraine war and the West’s heavy sanctions on Russia could aggravate supply-chain disruptions and increase prices of key commodities. Continued high inflation rates throughout 2022 will have a negative effect on R&D managers’ 2023 R&D budgeting plans.

Elon Musk’s other company, SpaceX,. Hawthorne, California, announced inflationary-resulting cost increases in its launch systems last week. Baseline Falcon 9 launches increase from $62 million to $67 million and Falcon Heavy costs increase from $90 million to $97 million.

Moderna, Cambridge, Massachusetts, developer of an approved COVID-19 vaccine, announced last week that its vaccine safely induced robust immune responses in children ages 6 months to 5 years in a new study, although the shot had only modest efficacy (37.5% to 43.7%) against the Omicron variant. This effectiveness was comparable to that seen in adults having two doses of the COVID-19 vaccine against the Omicron variant. Moderna said it would seek U.S. Food and Drug Administration (FDA) authorization in the U.S. and Europe and other places in the coming weeks. The vaccine from RDW Index member Pfizer, New York City, is authorized for anyone 5 and older, while Moderna’s vaccine is currently available only to those 18 and older in the U.S.

Researchers at the University of Hong Kong announced last week that three doses of their available COVID-19 vaccines had a clear benefit (98% efficacy) over two doses (72.2% efficacy) in preventing severe illness or death in people over the age of 60 years. The World Health Organization (WHO) has recommended three vaccine doses to those over the age of 60. Hong Kong offers two vaccines to its residents, one developed by RDW Index member Pfizer/BioNTech SE, New York City, and another by Sinovac Biotech, Beijing. Chinese researchers are still evaluating the effect of waning immunity over time of these vaccines. The current increase in Omicron-variant coronavirus infections in China is mostly limited to those who have not been vaccinated.

The U.S. FDA last week rejected an application by RDW Index member Eli Lilly & Co., Indianapolis, and its Chinese partner, Innovent Biologics, Suzhou, Jiangsu, to sell a new lung cancer drug in the U.S. The FDA raised concerns about the drug’s (Tyvyt) testing in China. The FDA recommended that an additional clinical trial of the drug be conducted in multiple regions. Analysts do not expect Lilly to continue developing the drug for the U.S. market due to the long timeline of the development and its associated costs. The FDA said it will continue to scrutinize Chinese-developed drugs for the U.S. market.

In a follow-up to Russia’s invasion of Ukraine and trade sanctions imposed by Western countries against Russia, the U.S. last week announced it will provide at least 15 billion cubic meters (bcm) of liquefied natural gas (LNG) to Europe in 2022. This is approximately a 70% increase in U.S. exports to the EU. The U.S. also committed to providing at least 50 bcm to Europe annually through 2030. U.S. LNG producers had about 115 bcm of LNG capacity in 2021, which will increase to 130 bcm in 2022. A re-ordering of LNG supplies will result with the U.S. supplying the EU with much of their needs and Australia and Qatar supplying Asia with their LNG requirements.

European lawmakers and regulators last week proposed the Digital Markets Act (DMA) which is the largest global tech regulatory law expansion in several decades. The law seeks to impose new obligations and prohibitions on digital giants that the EU defines as gatekeepers (gatekeepers are defined as companies with European revenues of at least $7.2 billion and those serving more than 10,000 active business consumers). Fines on these gatekeepers for non-compliance could rise into billions of dollars (up to 10% of annual revenues). The proposed law affects several RDW Index members, including Meta Platforms (Facebook), Apple, Google, Microsoft, and Amazon. These companies have opposed elements of the law, which could lead to court challenges.

Financial analysts last week warned of potential problems with the Federal Reserve increasing interest rates at too fast of a pace to offset inflationary effects. The more these rates increase, the more the economy slows, which, of course, is the Fed’s purpose. Not at all lost on Fed officials is the potential for an economic recession if the economy slows too much. The analysts note that correlations between short-dated and long-dated Treasury bonds are already in place which have been shown to presage previous U.S. recessions. Europe is also noted to be at risk for a recession from the bond-yield curve data noted by the economists.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2019 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of. Multri all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!