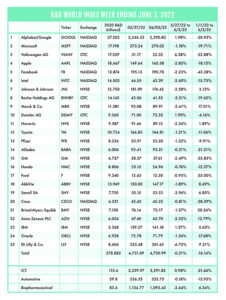

The R&D World Index (RDWI) for the week ending June 3, 2022, closed at 4,720.99 for the 25 companies in the RDWI. The Index was down -0.21% (or -10.10 basis points) from the week ending May 27, 2022. Four of the 25 RDWI members gained value from 1.37% (IBM) to 6.38% (Volkswagen AG). Twenty-one of the 25 RDWI members lost value from -0.21% (Alibaba) to -6.75% (Eli Lilly & Co.).

The R&D World Index (RDWI) for the week ending June 3, 2022, closed at 4,720.99 for the 25 companies in the RDWI. The Index was down -0.21% (or -10.10 basis points) from the week ending May 27, 2022. Four of the 25 RDWI members gained value from 1.37% (IBM) to 6.38% (Volkswagen AG). Twenty-one of the 25 RDWI members lost value from -0.21% (Alibaba) to -6.75% (Eli Lilly & Co.).

RDW Index member Bristol-Myers Squibb, New York City, announced last week that it would acquire biotech firm Turning Point Therapeutics Inc., San Diego, for $4.1 billion. The action is seen as an effort to deepen BMS’s position in lung cancer treatments. BMS invested about $7.1 billion in R&D in 2020, while Turning Point invested slightly less than $0.2 billion in the same period. BMS expects to complete the acquisition in Q3 2022. Turning Point’s lead drug is a tyrosine kinase inhibitor that targets non-small lung cancer cells. It’s expected to be approved by the U.S. Food and Drug Administration (FDA) in late 2023.

GSK (GlaxoSmithKline), Brentford, U.K., announced last week that it plans to acquire vaccine maker Affinivax Inc., Boston, for about $3.3 billion. Affinivax’s drugs target meningitis and pneumonia and were developed by doctors at Boston Children’s Hospital. The FDA granted Affinivax’s a vaccine breakthrough therapy designation for its strong pneumonia response based on early human human-trial results. The Affinivax vaccine targets 24 types of pneumococcal bacteria with a follow-up vaccine covering 30 types. Pneumococcal diseases are a major cause of death in children and senior citizens, especially in developing countries. BMS invested $11.1 billion in R&D in 2020.

A report issued last week by the Association for Advancing Automation, Ann Arbor, Michigan, noted that orders for workplace robotics in the U.S. increased by a record 40% in Q1 2022 from Q1 2021. Overall U.S. robot orders increased 22% in 2021 to $1.6 billion. Rising wages and worker shortages were listed as the main reasons for this dramatic increase in orders. Automotive-based robotic orders had been declining in the U.S. for several years but increasing in other industries, such as food and pharmaceutical production.

RDW Index member General Motors, Detroit, last week announced that all its Buick-labeled vehicles would be all-electric by 2030. The new models will all bear an old-Buick model tag, Electra, tying them into the EV framework. GM previously announced that all its Cadillac models will also be fully electric by 2030. Buick’s China portfolio will likely change over to all EV after 2030 due to the brand’s long-running heritage in the country.

Tata Motors, Mumbai, India, announced last week that it will strengthen its R&D with increased hiring in 2022 across all its various businesses, which include automotive, aerospace and defense, and industrial heavy equipment. One of the areas the company plans to focus its R&D on is in electric vehicle (EV) battery packs, motor design and software architectures. Tata invested about $2.1 billion in R&D in 2020.

RDW Index member Microsoft, Redmond, Washington, cut its fiscal 4Q revenue and earnings forecast last week by nearly 1% to $52.3 billion and $2.28/share. The company cited the impact of foreign exchange rates as the reasons for this reversal as the strong U.S. dollar effected this change. Other U.S.-based companies, including pharmaceuticals and farm equipment companies selling U.S.-manufactured products overseas have also noted that the strong U.S. dollar is having a negative effect on their financials.

RDW Index member Ford Motor, Dearborn, Michigan, announced last week that it will invest $3.7 billion in manufacturing facilities in Michigan, Ohio and Missouri, while creating 6,200 new unionized jobs, as part of a major Midwestern expansion. The company also stated that it was converting 3,000 temporary employees to permanent full-time status ahead of a pre-announced schedule. Ford also stated that the expansion will include facilities for a new electric commercial vehicle, although it did not provide specific details.

The U.S. Department of Labor last week announced that the U.S. economy added 390,000 jobs in May, down from 436,000 additions made in April. Over the past three months more than 1.2 million new jobs have been added, down from the 1.9 million jobs added in the rolling three-month period announced in December 2021. The economy is still 800,000 jobs short of where it was prior to where it was before the pandemic. Unemployment is still at 3.6% in May.

Self-driving company, Aurora, Pittsburgh, announced last week the construction of a 78,000 ft2 R&D facility in Bozeman, Montana. The facility was developed in partnership with the Montana State University Innovation Campus. Aurora acquired Blackmore in 2019, a Bozeman-based company specializing in light detection and ranging. The new facility will house R&D labs, manufacturing space, a garage and space for up to 200 researchers.

RDW Index member Pfizer, New York City, announced last week that its COVID-19 pill, Paxlovid, has become the leading pandemic drug prescribed in the U.S. The Pfizer pill outsells its Merck competitor by about four to one, according to Iqvia Holdings. Initial supplies of the Pfizer pill in December 2021 were limited but have since improved.

The Russia-Ukraine war and its associated sanctions are affecting inflation in the Eurozone countries with inflation in May increasing to an 8.1% annual rate from 7.4% seen in April. Consumer prices in the Eurozone are rising at the fastest pace seen since 1997. Energy prices in the Eurozone were nearly 40% higher than a year ago due to the war, sanctions and embargoes.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!