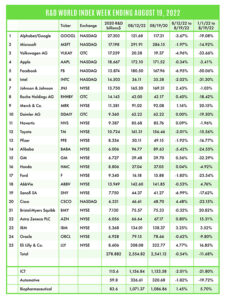

The R&D World Index (RDWI) for the week ending August 19, 2022, closed at 2,541.12 for the 25 companies in the RDWI. The Index was down -0.54% (or 13.70 basis points) from the week ending August 12, 2022. Eleven of the 25 RDWI members gained value from 0.04% (Honda Motor Company) to 4.48% (Cisco). Fourteen of the 25 RDWI members lost value last week from -0.32% (Bristol-Myers Squibb) to -6.99% (Sanofi SA). Daimler AG was unchanged for the week at 62.22.

The R&D World Index (RDWI) for the week ending August 19, 2022, closed at 2,541.12 for the 25 companies in the RDWI. The Index was down -0.54% (or 13.70 basis points) from the week ending August 12, 2022. Eleven of the 25 RDWI members gained value from 0.04% (Honda Motor Company) to 4.48% (Cisco). Fourteen of the 25 RDWI members lost value last week from -0.32% (Bristol-Myers Squibb) to -6.99% (Sanofi SA). Daimler AG was unchanged for the week at 62.22.

Conglomerate Samsung, Seoul, South Korea, announced last week that it is constructing a new R&D facility dedicated to semiconductor chips at its Giheung Campus in Gyeonggi Province, South Korea. The facility will be spread across 109,000 square meters with an investment of about $15 billion. The complete facility is scheduled to be completed by 2028 with one R&D semiconductor line operational by mid-2025. The facility will make use of the latest technologies including development of fabless system semiconductors, memory devices and state-of-the-art foundries. Samsung looks to overcome the limits of semiconductor scaling and solidify its competitive edge in semiconductor technologies. The company had previously announced its plans to build a $17 billion production facility in Texas to boost production of advanced logic semiconductor solutions.

The U.S. Centers for Disease Control and Prevention (CDC), Washington, D.C., last week announced that it will restructure itself to strengthen its response to public health threats. This response to its shortcomings in its fight against the COVID-19 pandemic will include improvements in the agency’s communications, timelines and accountability. It will include the elevation of the laboratory division to report directly to the agency director and restructure the communications office in an overall shift from that of a highly academic structure to focus more on preparedness and response. The changes follow an internal review performed by the Health Resources and Services Administration which found that the agency needs to better translate science into practical and reliable policy.

The recently approved and signed U.S. Inflation Reduction Act last week has been found to benefit many small business startups with a provision that can potentially double the amount that these businesses can claim on the R&D tax credit per year from $250,000 to $500,000 per year against payroll taxes. To be eligible, the businesses need to have less than $5 million in gross receipts and be less than 5 years old.

Semiconductor chip maker Analog Devices, Wilmington, Massachusetts, became the latest chip company to note that there is an economic uncertainty in future sales which is beginning to impact its bookings. Company orders moderated in 2Q 2022 with a modest increase in cancellations. Its 3Q forecast is only projected to be 1% above analysts forecast, a significant drop from the 5% per quarter increase seen in the past four quarters.

Deputy U.S. Department of Defense Secretary Kathleen Hicks last week confirmed that the national and military R&D laboratories have an aging infrastructure which has deteriorated. Hicks noted that the administration has aggressively added new test and lab capabilities, but that the infrastructure has been under-invested-in for a very long time, so “no one budget year will get us out of that hole.” Hicks added that there are industry and allies opportunities that they are working on to tackle the infrastructure shortfalls.

RDW Index member Toyota Motor Company noted last week that car buyers might not shift to fully electric vehicles (EVs) as quickly as many car makers expect and that hybrid EVs are likely to serve as a better near-term solution for many customers. The company noted that the EV marketplace isn’t mature enough yet with high sticker prices and a poor public-charging infrastructure likely keeping customers from widely embracing battery-powered vehicles. Toyota intends to continue its focus on plug-in hybrids. RDW Index members General Motors, Volkswagen AG and Ford have been more aggressive in going fully electric saying they see no future for hybrids in their product line ups.

China’s economy slowed significantly in July 2022. Factory output dropped in July, along with investment, consumer spending, youth hiring and real estate sales. To spur the economy, China dropped two key interest rates by 0.1% and pumped the equivalent of $59.3 billion into its financial system. Economists stated that further cuts in interest rates are likely in the months ahead. Economists at Standard Chartered Bank, London, cut their 2022 growth forecast for China to 3.3%, from its previous rating of 4.1%

The U.K.’s Office for National Statistics reported last week that consumer prices were 10.1% higher in July from 2021, up from 9.4% in June. By contrast, the U.S. inflation rate eased to 8.5% in July from 9.1% in June. The Bank of England, however, expects the inflation rate in the U.K. to continue to rise to 13% by the end of 2022 due to higher energy costs. Other countries in Europe, including Germany, Spain and Greece could also see double-digit inflation rates by the end of the year due to the rise in the Russia-Ukraine war-effected energy costs.

A gene therapy drug, Zynteglo, from Bluebird Bio Inc., Cambridge, Massachusetts, was approved last week by the U.S. Food and Drug Administration (FDA), for treatments against rare blood disorders. The drug costs $2.8 million per patient, making it the most expensive drug in the U.S. As part of the approval, Bluebird received a Priority Review Voucher, which can be used in future applications to have the FDA speed up its drug review process. The vouchers can be sold between drug companies.

The initial shipments of grain from the Ukraine which were begun within the past three weeks are being partially funded by the U.S. Agency for International Development which is spending $68 million to purchase and ship the grain which will then be provided to the United Nation’s World Food Program. The U.S. has provided $4.8 billion in food to the WFP in 2022, the most of any year.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!