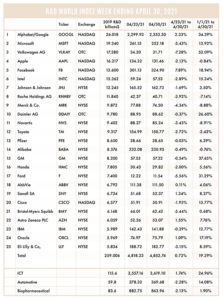

The R&D World Index (RDWI) for the week ending April 30, 2021 closed at 4,852.74 for the 25 companies in the R&D World Index. The Index was up 0.72% (or 34.51 basis points) from the week ending April 23, 2021. The stock of six R&D World Index members gained value from 0.11% (AbbVie) to 7.89% (Facebook). The stock of 19 R&D World Index members lost value from -0.03% (Pfizer) to -7.28% (Volkswagen).

RDW Index member Ford Motor Company announced plans last week for a Global Battery Center of Excellence to be built in Allen Park, Michigan, about seven miles south of its Global Headquarters in Dearborn, Mich. The $185 million R&D center will work with engineering teams at Ford’s Battery Benchmarking and Test Laboratory, also in Allen Park, which was completed in 2020. Located in Ford Ion Park, the new center with its 200,000-ft2 laboratory, is scheduled to open in late-2022. Ford eventually plans to manufacture its own battery cells, according to Hau Thai-Tang, Ford’s Chief Product Platform and Operations Officer, and is discussing details with the Biden administration on how best to build secure supply chains for batteries and the critical materials used to build them.

RDW Index member Sanofi announced last week that it plans to close its Great Valley R&D Facility in Pennsylvania by the end of September 2021. The closure will impact 75 employees. Sanofi previously laid off several hundred employees at the Great Valley site in July 2011, leaving only a small number of clinical trial supply employees and support staff. Sanofi will continue to operate at their vaccine R&D and manufacturing campus in Swiftwater, Pa.

Apple announced last week that it would build a campus and engineering center in North Carolina as part of its series of $430 billion in capital investments scheduled over the next five years. The company stated that their new $1 billion regional hub would create more than 3,000 new jobs in machine learning, artificial intelligence (AI) and software engineering in the Raleigh-Durham Research Triangle area.

The Biden Administration announced last Tuesday that it would support the U.S. electric power grid with $8 billion of financing for new high voltage power transmission lines. The Administration also issued guidelines on how states can remove obstacles to the construction of the new power lines along highways, railroads and other rights of way. These efforts are part of the infrastructures needed to get to the goal of 100% clean electricity by 2035 and net-zero carbon emissions by 2050. The Western Area Power Administration, a federally owned utility, is relaunching an infrastructure program with $3.25 billion for transmission.

RDW Index member Sanofi SA signed an agreement last week to help manufacture as many as 200 million doses of Moderna’s COVID-19 vaccine at its Ridgefield, N.J., plant starting in September 2021. The production would be for U.S. use with a production run through April 2022. Moderna plans to deliver 300 million doses of its vaccine by the end of July. Pfizer/BioNTech and Johnson & Johnson also are supplying vaccine doses to help meet the Moderna goal. The Sanofi doses manufactured for Moderna may be directed toward vaccinating children under 18 years of age (assuming it is authorized for them by the FDA/CDC). The Sanofi/Moderna capacity could also be used for booster shots for COVID-19 variants. In a separate announcement, Moderna said it would triple its yearly output of vaccines in 2022 to provide up to 3 billion doses for the global community.

RDW Index member Pfizer announced last week that it was developing an oral COVID-19 treatment that could be available for distribution by the end of 2021. Pfizer started clinical trials on the new oral treatment in March 2021. The only current oral antiviral drug authorized for use by the FDA is remdesivir from Gilead Sciences and it only provides a modest benefit in COVID-19 hospitalized patients. Pfizer’s protease inhibitor is based on antivirals developed when Pfizer was working on treatments for the SARS epidemic in 2003.,

China’s NIO electric vehicle (EV) manufacturer, headquartered in Shanghai, announced last week that it will build a massive smart EV industry park in Hefei, China. The nearly 17,000-acre site is 12 times that of Tesla’s Fremont, Calif., plant. The $7.7 billion plant will include smart manufacturing, R&D and a living area, with an attached eco-park for employees and visitors. NeoPark expects to employ 10,000 R&D personnel and 40,000 technical workers. NIO expects NeoPark will produce 1 million EVs and 100 GWh in battery packs annually. NeoPark should also put suppliers and others within close proximity. Production began in April 2021 with the first phase expected to be completed by April 2022.

Weather disruptions in Texas last winter and a fire at chip-supplier Renesas continue to have long-lasting effects on the supply of automotive and computer chips. The supply shortfalls are now being felt in home appliances, heavy equipment manufacturers, servers and toys. The scarcity is raising product prices for consumers, along with extending deliveries for electronic goods and devices. Analysts say that the expanding global economies will force the chip shortage to continue into 2022. Microsoft and Apple both are likely to see sales shortfalls this year.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2019 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!