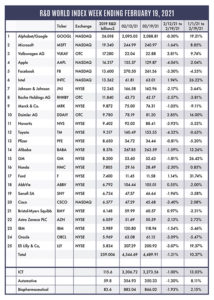

The R&D World Index (RDWI) for the week ending February 19, 2021 closed at 4,489.91 for the 25 companies in the R&D World Index. The Index was down 1.21% (or 54.78 basis points) from the week ending February 12, 2021. The stock of six R&D World Index members gained value from 0.97% (Bristol-Myers Squibb) to 3.85% (Daimler AG). The stock of 19 R&D World Index members lost value from -0.31% (Alphabet/Google) to -4.32% (Toyota).

The head of RDWI-member Honda’s R&D division, Toshihiro Mibe, was named as Honda CEO last week, effective April 1. Mibe replaces Takahiro Hachigo, who streamlined development and reduced costs in his six years as CEO, but fell behind competitors in the development of new electric vehicles (EVs). Mibe is expected to collaborate with General Motors and China’s battery maker, Contemporary Amperex Technology, to build new EV and autonomous vehicles for the Chinese market. Some Honda EVs could even be produced at GM factories. Mibe has worked on both fully EV and hybrid gas-electric vehicles. In 2018, Honda invested $2.8 billion in GM’s Cruise self-driving research unit.

RDWI-member Ford Motor also announced last week that it would invest $1 billion in a German factory as part of a plan to phase out gas-powered cars in Europe by 2030. Ford’s Cologne, Germany, plant will be converted to produce EVs, including the European-built all-electric passenger car in 2023. By 2030, EVs should account for all of Ford’s passenger-car sales in Europe, along with two-thirds of its commercial vans and trucks.

RDWI-member IBM is considering the potential sale of its IBM Watson Health business, according to people familiar with the company and IBM’s new CEO Arvind Krishna, who has stated that he intends to focus the company on artificial intelligence (AI) and hybrid cloud technologies. IBM’s current Watson Health business has approximately $1 billion in annual revenue and is not profitable. It has not met the company’s initial plans, despite acquiring a collection of health-related businesses over the past several years.

The World Health Organization (WHO) approved RDWI-member AstraZeneca’s COVID-19 vaccine last week for emergency use immediately. This clears the way for the company to ship the free vaccines to inoculate the world’s poorest nations. AstraZeneca supplies about a third of the Covax vaccines which are financed mostly by Western governments and charitable groups, such as the Bill and Melinda Gates Foundation. South Korea’s SK Bioscience was also approved by the WHO in this announcement. Covax vaccines are expected to supply about 2.27 billion vaccine doses in 2021 to 145 countries. In January, the WHO approved the emergency use of the Pfizer/BioNTech SE vaccines for emergency use.

According to a report last week in the Wall Street Journal, the spread of highly-contagious COVID-19 variants is accelerating in Europe and outpacing a slow vaccine rollout in the region. The three new variants — U.K. (B1.1.7), South Africa (B.1.351) and Brazil (P.1) — are gaining ground from the overall declining initial coronavirus. European countries are now considering tightening their restrictions on civil society and businesses.

The Taiwan Semiconductor Manufacturing Company (TSMC) announced last week that it plans to build a $189 million R&D center in the Ibaraki Prefecture, northeast of Tokyo, Japan. The center will focus on advanced semiconductor packaging and testing. TSMC could also install a local production facility to add capacity. The company is also aggressively hiring for more than 600 engineers and executives for its planned 5 nm production plant in Arizona. TSMC plans a capital investment in 2021 of up to $28 billion. Most automotive chip suppliers, who are currently suffering from a severe production shortage affecting automakers production capacity, outsource at least part of their production to TSMC.

A report issued by the National Science Foundation last week noted that U.S. academia increased its R&D growth by 5.7% in FY2019 to $83.7 billion from FY2018. This marks the fourth consecutive year of increased funding from federal and non-federal sources in both constant and current dollars. The most spending by academia was led by Johns Hopkins University with $2.917 billion. All of the top 19 academic institutions each had more than $1 billion in total R&D expenditures for FY2019. The top five included Johns Hopkins, the University of Michigan, the University of California at San Francisco, the University of Pennsylvania and the University of Washington at Seattle.

Data released by Israel’s Ministry of Health last week revealed that the coronavirus vaccine from Pfizer/BioNTech is 98.9% effective at preventing death caused by COVID-19. It is also 99.2% effective against serious illness and decreases the chance of hospitalization by 98.9%. More than 4 million Israelis have received at least one dose of the Pfizer vaccine, while nearly 3 million have received both shots.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2019 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ. NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!