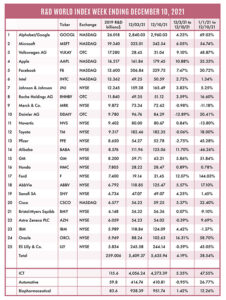

The R&D World Index (RDWI) for the week ending December 10, 2021, closed at 5,635.94 for the 25 companies in the RDWI. The Index was up 4.19% (or 226.57 basis points) from the week ending December 3, 2021. The stock of 19 RDWI members gained value from 0.07% (Bristol-Myers Squibb) to 16.31% (Oracle). The stock of six RDWI members lost value from -0.06% (Toyota) to -12.89% (Daimler AG).

Volvo Car Group, Gothenburg, Sweden, and battery developer Northvolt, Stockholm, announced last week that they had signed a $3.3 billion binding agreement to establish a joint R&D center in Gothenburg, to become operational in 2022. The goal of the R&D will be to develop new battery cells, tailor-made for the next-generation pure electric Volvo and Polestar cars. The new R&D center will be near Volvo Cars’ own R&D operations and Northvolt’s existing innovation campus, Northvolt Labs, in Vasteras, Sweden, to support synergies and efficiencies as they develop new battery technologies. The partnership also consists of the development of a battery gigafactory in a to-be-announced European location. The gigafactory will start in 2023 with large-scale production in 2026. The gigafactory is expected to have the annual potential for 50 Gwh of batteries, enough for about half a million cars per year with an employment base of 3,000 people. Until the gigafactory is completed, Volvo will rely on battery cells from external suppliers, including South Korean LG Chem.

Volvo also announced last week that they had launched an investigation into a cyber security breach and theft of some R&D data from an unnamed third party, which could impact Volvo’s operations. While not announcing the exact nature or details of the theft, the company did not see an impact on the security of its customers’ cars or their personal data.

The Biden administration last week released a supplement to their FY2022 budget that looks to increase funding for R&D projects conducted under the Networking and Information Technology R&D (NITRD) program. The supplement includes a total budget request of $7.8 billion for federal agencies NITRD-related FY2022 R&D. This is an increase of 19.6% compared to the $6.5 billion requested for FY2021. The NITRD program consists of 25 member agencies and more than 60 participating agencies to coordinate federal R&D investments in advanced digital technologies. The White House is required to release a budget supplement for NITRD programs. This supplement, however, for the first time includes budgetary and programmatic information on the National Artificial Intelligence Initiative Act of 2020.

Samsung Electronics Co., Suwon-si, South Korea, last week merged its mobile and consumer electronics units into a single and in the process replacing all three of its co-CEOs. The change allows the company to create a cohesive ecosystem much like that of its rival Apple. Samsung’s leader Lee Jae-yong, is expected to appoint new market CEOs to reverse the company’s flat market growth, stale agendas on its future and an over-dependence on semiconductor memory devices.

Apple, Cupertino, California, last week won a U.S. appeals court decision allowing it to delay implementation — perhaps for years — of a federal judge’s order to force Apple to allow developers to communicate with users inside their apps about alternative payment methods outside of the App Store. According to the court decision, Epic Games had failed to show Apple violated any antitrust laws but did show that their conduct violated California’s Unfair Competition Law. The new changes would have new privacy and security risks, according to Apple.

General Motors, Detroit, last week announced it plans to spend more than $3 billion to make electric vehicles (EVs) in two Michigan plants. One would be a converted Orion Assembly plant in suburban Detroit which would serve as a hub for its electric pickup trucks. The other plant would be the creation of a battery cell factory near one of GM’s plants in Lansing, Michigan. The Lansing plant would split more than $2 billion between GM and its battery partner, South Korea’s LG Energy Solutions, and create about 1,200 new jobs. The Lansing battery plant would be the third for GM’s joint venture with LG Energy Solutions; one in Ohio scheduled to open in 2022 and another in progress in Tennessee.

The U.S. Environmental Protection Agency (EPA) last week proposed reducing the amount of ethanol and other biofuels that must be blended into gasoline this year and retroactively lowered last year’s mandate. If the older mandates were kept, refiners would need to purchase credits to comply with the law. The high current cost of biofuels would raise the overall costs to refiners and consumers alike. The EPA sets blend rates under the Renewable Energy Standard passed by Congress in 2005. The EPA proposal is not final and the agency said they would review public input before implementation.

Stellantis NV, Amsterdam, The Netherlands, the former Fiat Chrysler Automobile firm, last week announced plans to hire thousands of software engineers and collaborate with Foxconn Technology Group, Taipei, Taiwan, to develop semiconductor devices for its vehicles. The company also stated it plans to leverage partnerships with BMW AG and Alphabet’s Waymo to create autonomous driving offerings for its vehicles. Stellantis said it would increase the number of software engineers it employs to about 4,500 by 2024, up from about 1,000 today.

RDW Index member Intel, Santa Clara, California, announced last week that it plans to publicly list shares of its Mobileye self-driving-car unit in mid-2022 through an IPO, estimated to be valued at more than $50 billion. Intel would be expected to maintain majority ownership. Intel acquired Mobileye from Israeli founders in 2017 for about $15 billion. Mobileye specializes in chip-based camera systems which power automated driving features in cars.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2019 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!