[Note: this report was finalized before the current COVID-19 crisis began.]

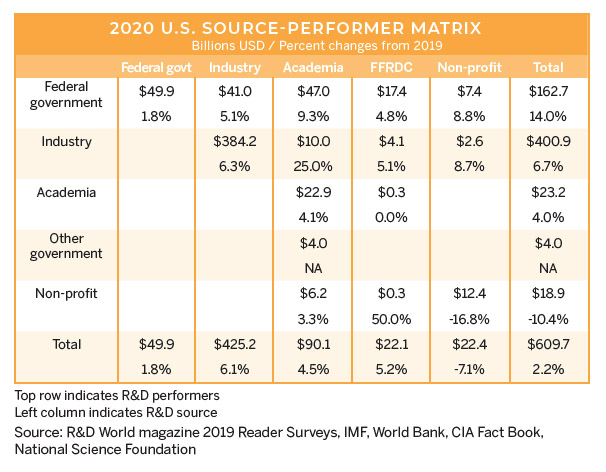

We forecast the U.S. will invest $609.7 billion in R&D in 2020, an increase of 2.2% over the $596.6 billion invested in 2019. U.S. industrial organizations will invest approximately $401.8 billion, a 65.9% share of the total investment. The U.S. government will invest about $162.8 billion in R&D (a 26.7% share of the total) and we expect academic organizations to invest $23.2 billion.

We forecast the U.S. will invest $609.7 billion in R&D in 2020, an increase of 2.2% over the $596.6 billion invested in 2019. U.S. industrial organizations will invest approximately $401.8 billion, a 65.9% share of the total investment. The U.S. government will invest about $162.8 billion in R&D (a 26.7% share of the total) and we expect academic organizations to invest $23.2 billion.

The U.S. economy and its ability to support R&D investments continued to grow in 2019, despite a global economic slowdown and the continuing imposition of tariffs between China and the U.S. The U.S. Federal Reserve forecasts this growth (GDP) rate to continue into 2020 at about 2.0% which is only slightly less than the 2.2% growth rate seen in 2019. The Fed’s latest economic projections (December 2019) also see unemployment remaining at the current 3.5% to 3.6% rate throughout 2020 and the federal funds rate remaining at the current 1.5% to 1.75% range for the foreseeable future.

The Fed considers the current monetary policy appropriate to support sustained growth. Strong labor market conditions (unemployment) and inflation near the Fed’s 2.0% target are also likely to continue throughout 2020 and into 2021 and 2022. All of this implies that the current low-cost economic environment for supporting and financing R&D efforts is likely to continue without any significant changes for the next several years.

We expect the strong general economy to support continued strong R&D investments buoyed by continuing technological improvements in industries such as automotive, ICT, aerospace, life science and advanced materials. As noted in previous years’ Global R&D Funding Forecasts, many R&D advances seen in 2019 and predicted for 2020 are driven by the inter-relationships of various industries and technologies. ICT R&D-based improvements, for example, such as in artificial intelligence, sensing, computing and telecommunications, will drive many of the R&D-based improvements in autonomous automotive vehicles and aerospace systems, along with ancillary improvements in the development of advanced materials and pharmaceutical compounds. Automation and robotics, essential ICT components, are also expected to influence dramatic system changes in other industries as well in 2020.

Again, as in 2019, the top five technology companies in the world (by stock-valuation) are U.S.-based (Amazon, Alphabet-Google, Microsoft, Apple and Intel). We expect these five to collectively invest more than $117 billion in R&D, an 11.5% increase from their R&D investments in 2019 and 25.5% over what they invested in 2018. This trend reflects on the global technology drivers which continue to be led by U.S.-based companies.

R&D staffing concerns

With the continuing low unemployment rate, it is becoming more difficult for R&D managers to find skilled personnel in the U.S. More than two thirds of the researchers surveyed by R&D World magazine in 2019 mentioned difficulties in recruiting new researchers for open lab positions. Less than 30% had no difficulties in finding skilled scientists and/or engineers. About a quarter of those surveyed had a current small R&D staffing shortage of up to 25 positions. About 8% of those surveyed were seeing a large R&D staffing shortage of more than 25 positions.

With the continuing low unemployment rate, it is becoming more difficult for R&D managers to find skilled personnel in the U.S. More than two thirds of the researchers surveyed by R&D World magazine in 2019 mentioned difficulties in recruiting new researchers for open lab positions. Less than 30% had no difficulties in finding skilled scientists and/or engineers. About a quarter of those surveyed had a current small R&D staffing shortage of up to 25 positions. About 8% of those surveyed were seeing a large R&D staffing shortage of more than 25 positions.

R&D managers in our 2019 survey said that attracting, developing, and retaining research talent were among their primary concerns. Nearly two thirds of the survey respondents indicated these personnel issues had high importance.

To offset these R&D staffing shortages, R&D managers utilize collaborations (40% of the survey respondents) and hire qualified consultants or consulting firms (42% of the survey respondents) to complete their R&D project requirements. About 35% of the R&D managers will outsource their R&D work where necessary when their own staff is incapable. Another 20% use computer-based resources, such as modeling and prototyping, to offset their R&D staffing shortages. Changes in the immigration laws, slowdowns in processing visa applications, and a general decline in foreign professionals looking to relocate to the U.S., have seriously reduced the number of immigrant researchers utilized by U.S. R&D-based firms more than five years ago.

Changes in R&D organizations

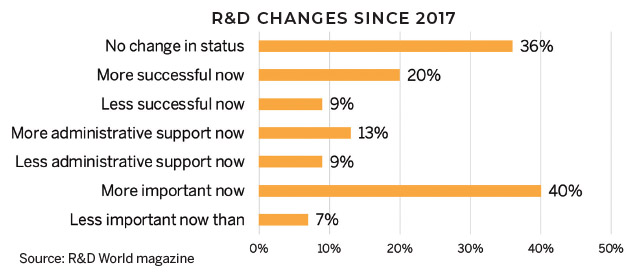

According to our survey, organizations still overwhelmingly see R&D as more important now than it was even three years ago in 2017. About 40% of our survey respondents say it has a higher importance today, compared to only 7% who say it has become less important than it was three years ago.

According to our survey, organizations still overwhelmingly see R&D as more important now than it was even three years ago in 2017. About 40% of our survey respondents say it has a higher importance today, compared to only 7% who say it has become less important than it was three years ago.

However, a majority of survey respondents don’t see much change in administrative support of R&D operations. About 13% of the respondents say they now have more administrative support for R&D than in 2017. Another 9% say they now have less administrative support for their R&D operations. About 20% of U.S. organization managers consider their R&D operations and projects to be more successful now than they were three years ago in 2017. This compared to about 6% of the respondents who say their R&D operations were now less successful than they were three years ago.

Perhaps surprisingly, external macroeconomic issues appear to influence organizational support and operation of R&D in only minor ways. About one-quarter of survey respondents said the continuing rise in stock market values (the Dow Jones Industrial Average hit a record high in December 2019, having risen nearly 23% in the previous year) helped boost R&D investments while about 16% of the survey respondents said the stock market impacted R&D investments negatively. About half of survey respondents also stated that the current Brexit (withdrawal of the U.K. from the European Union) discussions haven’t affected their global R&D investments, and 37% were unsure. Only 14% said Brexit discussions have negatively affected their global R&D investments.

Foreign competition

The biggest threats to the future of U.S. R&D operations appear to be from competitors — and increasingly from foreign competitors, not just domestic U.S. firms. The U.S. harbors the largest set of R&D operations in the world, so it is only logical that about half of U.S. firms see domestic competitors as their largest threat.

However, 44% of respondents see Chinese competitors as their largest threats. And 16% say non-Chinese Asian competitors are real threats. About 24% of those same respondents view European competitors as threats. This view is especially valid for European automotive firms that are valued more highly than their U.S. counterparts (i.e., Volkswagen, BMW, Mercedes) and European pharmaceutical firms with global operations in the U.S. and China.

A recent report by the Task Force on American Innovation, “Second Place America? Increasing Challenges to U.S. Scientific Leadership,” advances this view as China and other countries boost investments in research and grow their STEM (science, technology, engineering and manufacturing) workforces. The report states that emerging economies, particularly China, are playing a greater role in scientific discovery and innovation and challenging established U.S. leadership in critical research fields. It states that China has overtaken the U.S. in total research publication output as of 2016 and is now the dominant producer in engineering, physics, chemistry, geosciences and mathematics.

The report goes on to note that other countries continue to invest heavily in higher education, turning out more science and technology graduates. The U.S. also is noted as trailing the top eight countries in the EU as measured by the total number of bachelor’s degrees in science and engineering awarded since 2000.

R&D funding sources

Funding for U.S. R&D operations appears to be healthy, especially in 2020 where the U.S. government FY2020 budget increases S/E spending to record levels (see the next section in this report for details on the federal investments). Overall, R&D funding sources are organized as follows, according to our survey results:

Funding for U.S. R&D operations appears to be healthy, especially in 2020 where the U.S. government FY2020 budget increases S/E spending to record levels (see the next section in this report for details on the federal investments). Overall, R&D funding sources are organized as follows, according to our survey results:

Large R&D organizations increasingly share R&D funding, especially in areas like automotive development where there is a significant amount of fundamental research in electrically driven vehicle technology and autonomously/AI-driven control systems. The challenges in these areas are huge, making collaboration among multinational automotive firms worthwhile.

For example, General Motors has established a joint venture with LG Chem for production of automotive battery cells. Hyundai and auto parts maker Aptiv (the former Delphi operation) are working together in a joint autonomous vehicle venture. Volkswagen and Ford are also working together in a joint autonomous vehicle startup, Argo AI. Ford and others are investing hundreds of millions in startup EV manufacturer Rivian. Daimler and BMW are jointly investing in mobility services. Other collaborations include Toyota-Suzuki, Ford-Mahindra & Mahindra, Honda-Hitachi, Fiat Chrysler-Peugeot and Toyota-Subaru. Those firms attempting to go it alone in this new automotive world will be at a huge disadvantage in short order.

U.S. losses and gains

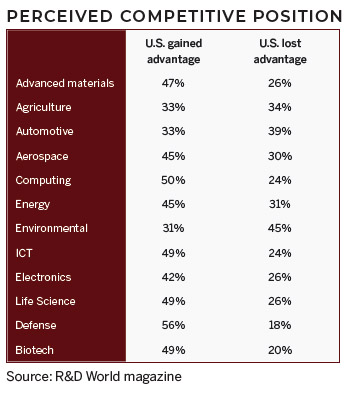

U.S. R&D has seen both gains and losses to foreign competitors over the past several years. Responders see changes in U.S. technologies this way:

U.S. R&D has seen both gains and losses to foreign competitors over the past several years. Responders see changes in U.S. technologies this way:

As shown, the biggest losses are in automotive and environmental technologies. This response is consistent with previous years’ results and consistent with technology leadership. Germany and Japan are big in automotive technologies. Germany, France and Japan are big in environmental technologies (see the International section of this report for individual country leaders for each technology).

In overall R&D, China has gained the most in R&D capabilities (71%) over the past several years. However, U.S. organizations have also gained significant R&D capabilities (63%), just slightly less than China. For the U.S. to gain R&D capabilities when starting from a large advantage to begin with says a lot for the continuing quality of R&D being developed in the U.S. The next closest competitor country is Germany (40%).

As also noted in the previous section, the extensive multinational collaborations in several industries (especially automotive and ICT) belies the specific national R&D advantages or leadership noted here since the technologies are being shared through corporate collaborations.

This article is part of R&D World’s annual Global Funding Forecast (Executive Edition). This report has be published annually for more than six decades. To purchase the full, comprehensive report, which is 58 pages in length, please visit the 2020 Global Funding Forecast homepage.

Tell Us What You Think!