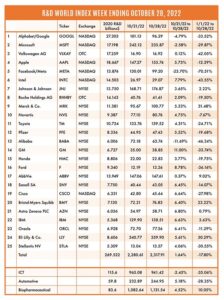

The R&D World Index (RDWI) for the week ending October 28, 2022, closed at 2,317.91 for the 25 companies in the RDWI. The Index was up 1.64% (or 37.30 basis points) from the week ending October 21, 2022. Twenty-one of the 25 RDWI members gained value during the past week from 0.12% (Volkswagen AG) to 11.00% (General Motors). Four of the 25 RDWI members lost value last week from -2.58% (Microsoft) to -23.70% (Facebook/Meta Platforms).

The R&D World Index (RDWI) for the week ending October 28, 2022, closed at 2,317.91 for the 25 companies in the RDWI. The Index was up 1.64% (or 37.30 basis points) from the week ending October 21, 2022. Twenty-one of the 25 RDWI members gained value during the past week from 0.12% (Volkswagen AG) to 11.00% (General Motors). Four of the 25 RDWI members lost value last week from -2.58% (Microsoft) to -23.70% (Facebook/Meta Platforms).

First Solar Inc., Tempe, Arizona, announced plans last week to invest about $270 million in a dedicated R&D innovation center near its existing thin-film photovoltaic (PV) production facility in Perrysburg, Ohio. The R&D plant will allow the production of full-sized prototypes of thin-film and tandem PV modules. The new R&D facility is expected to be completed in 2024. The facility will cover an area of 1.3 million ft2, feature a high-tech pilot manufacturing line for the prototype PV modules, and will allow researchers to create innovative products without taking mission-critical tools offline. First Solar is the only U.S.-headquartered solar company and the only manufacturer of thin-film PV modules. The company announced in August that it would invest up to $1.2 billion to ramp up production of U.S.-made solar panels, following the passing of the Inflation Reduction Act.

Marvell Technology Group, Santa Clara, California, announced last week that it was eliminating some roles in China as part of the realignment of its global R&D investments. Marvell is the developer of semiconductor chips for switches used in data centers owned by cloud-computing providers. The move comes after Washington enacted tough sanctions on the Chinese chip sector which effectively bars U.S.-based equipment makers from servicing Chinese manufacturers of advanced chips. Other semiconductor companies, including Micron Technology, have also shut down their R&D activities in China.

Mobileye Global Inc., the automated driving arm of RWD Index member Intel, Santa Clara, California, was offered as an IPO (initial public offering) last week for a valuation of roughly $23 billion. Intel sold fewer Mobileye shares than initially planned, representing only about 5% of those that will ultimately be outstanding. Intel also lined up cornerstone buyers for roughly 40% of the overall deal. Mobileye trades on Nasdaq under the symbol MBLY.

The Federal Reserve is expected to raise short-term interest rates at its regular November 1-2 meeting this week by another 0.75%, for the fourth consecutive 0.75% increase this year (June, July, September, and November) in their attempts to lower the inflation rate. Analysts are expecting the fed to state that their next meeting in December will see a slightly lower interest rate increase of 0.50%, matching the 0.50% increase the fed imposed in May 2022. Following this week’s expected actions, the fed-funds rate is likely to be set at a range of 3.75% to 4.00% after starting 2022 (and the previous decade) at near zero.

RWD Index member Intel announced last week a 20% drop in 3Q sales and issued a forecast for even weaker revenues in 4Q. It also lowered its full-year outlook. Intel is beginning targeted job cuts and other adjustments to cope with the economic downturn. The company did not state how many of its 120,000 employees would be affected nor how it might affect its R&D investments. The company wants $3 billion in overall cost reductions in 2023 and up to $10 billion in annualized cost reductions and efficiency gains by the end of 2025. The company currently invests more than $14 billion/year in R&D. Intel said it reduced capital spending plans from $27 billion to $25 billion for 2022.

The U.S. Department of Commerce (DOC) reported last week that the U.S. economy grew in 3Q by an annual rate of 2.6%, after declining in 1Q by -1.6% and in 2Q by -0.6%. Trade contributed the most to 3Q’s gains as the U.S. exported more oil and natural gas as the Ukraine war disrupted supplies in Europe. Consumer spending grew at a slower rate in 3Q than in 2Q, while business and residential investment in construction fell at more than a 26% annual rate. The fed’s actions to combat inflation with higher interest rates are likely to further weigh on the economy in the coming months, according to the DOC.

RDW Index member Merck & Co., Kenilworth, New Jersey, raised its revenue outlook last week after posting a 14% increase to $15 billion in 3Q sales on the growing demand for its oncology treatments and vaccines. Excluding the impact of a stronger dollar, sales of Merck’s top-selling cancer drug, Keytruda, grew by 26% in the U.S. The company expects to see an overall 21% growth in sales for 2022 to $59 billion.

The European Central Bank (ECB), Frankfurt, Germany, announced last week that it had raised interest rates by 0.75% for the second time in a row to 1.5%, its highest level in more than a decade. The ECB also stated that it would likely make further increases in the future but cautioned that they were looking at these effects on overall regional growth. Analysts were quick to note that the ECB would relax interest rates earlier than the U.S. federal reserve would. The Ukrainian war and weakness in Europe’s southern nations would affect the ECB’s overall strategies.

Airbus SE, Leiden, the Netherlands, announced last week that it plans to ramp up aircraft production in 2023, despite persistent supply-chain disruptions. The European plane-maker wants to extend its lead over rival Boeing Co., Chicago, in the crucial market for smaller jets. The company confirmed plans to increase production of its A320 aircraft to 65 units/month by early 2024 from about 50 units/month at the end of 2022. This is one of the fastest increases in the company’s history. The company has said it doesn’t have availability for new A320 orders until 2028 and plans a further increase to 75 units/month by 2025 to meet demand.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies), and ICT (9 companies) which invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries, and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!