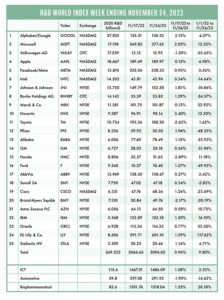

The R&D World Index (RDWI) for the week ending November 24, 2023, closed at 3,096.05 for the 25 companies in the RDWI. The Index was up 0.96% (or 29.40 basis points). Twenty-one RDWI members gained value last week from 0.12% (Merck & Co.) to 3.40% (Novartis). Four RDWI members lost value last week from -1.30% (Volkswagen AG) to -2.89% (Honda).

The R&D World Index (RDWI) for the week ending November 24, 2023, closed at 3,096.05 for the 25 companies in the RDWI. The Index was up 0.96% (or 29.40 basis points). Twenty-one RDWI members gained value last week from 0.12% (Merck & Co.) to 3.40% (Novartis). Four RDWI members lost value last week from -1.30% (Volkswagen AG) to -2.89% (Honda).

Moderna, Cambridge, Massachusetts, announced last week that it had completed the installation of its clinical laboratories at its new Moderna Innovation and Technology Centre (MITC) in Oxfordshire, U.K. MITC is scheduled to become operational in 2024 with an accompanying manufacturing facility due to be completed in 2025. MITC is located near the U.K. Health Security Agency facility which is working with Moderna on an early vaccine development program for future pandemic threats. When operational, MITC will employ more than 150 highly skilled researchers and have the capacity to produce up to 250 million vaccines per year for a future pandemic. Its operating target is to develop vaccines within 100 days and will provide the U.K. with access to mRNA vaccines for a wide range of respiratory diseases.

Semiconductor chip developer Resonac, Tokyo, announced last week that it will set up an R&D center for advanced packaging and materials in the Silicon Valley area of California. Resonac, formerly organized as Showa Denko, is a leading manufacturer of materials for packaging, including films, and plans to begin operations at the U.S. site in 2025. The packaging stage of production is increasingly seen as a critical area for driving advances in chip technology, with the U.S. announcing last week a $3 billion program to boost its packaging capabilities. Japan’s chip manufacturer Rapidus, Tokyo, was established in August 2022, with the support of Denso, NEC, NTT, Sony, Toyota, and others to have a 2-nm process capacity by 2027. Rapidus plans to open an office in California by the end of its current financial year.

Amazon, Seattle, announced last week it is creating a program to train millions of workers in AI skills as the company works to gain an edge in a pitched battle with Microsoft, Google, and other AI-based companies. Named AI Ready Amazon’s new program plans to train at least two million people by 2025 on basic to advanced AI skills, including how to make use of generative AI technologies which have generated language-powered models such as ChatGPT. The training is centered on eight generative online courses that target tech and tech-adjacent roles. The courses are free to access online through an Amazon learning website and are available for non-Amazon employees. Amazon said there is currently a shortage of AI specialists, stating that nearly three-fourths of employers surveyed said they cannot find the AI talent they need, despite most saying they plan to deploy AI in the next five years.

Nissan Motor, Yokohama, Japan, announced last week that it is expanding its electric vehicle (EV) manufacturing capacity in the U.K. with investments of $2.3 billion as the company pushes to have an all-electric lineup in Europe. The company plans to add a third gigafactory and produce two additional models at its EV hub in Sunderland, U.K. Both vehicle and battery manufacturing facilities in the U.K. will use renewable electricity from wind and solar farms, according to Nissan. The company confirmed that it will have a fully electric passenger car lineup in Europe by 2030.

RDW Index member General Motors, Detroit, announced last week that its Cruise driverless-car unit plans to eventually reintroduce its robotaxi service following safety mishaps, but will narrow the focus to one city and shelve plans for the Origin, a GM-built driverless taxi. This is a scale-back from the more than a dozen test cities originally planned by GM. The Origin vehicle will become a part of the company’s longer-term plans. Its near-term development plans will continue to use retrofitted Chevrolet Bolts, which the company has been using for years.

RDW Index member Ford Motor, Dearborn, Michigan, announced last week that it is moving forward with its construction of an EV battery plant in Michigan, but at a 40% reduced size from original plans, citing a pullback in the outlook for future EV demand. Ford paused work at the plant in September, while reassessing its ability to competitively operate the plant which will make batteries using lithium-iron-phosphate technology from China’s Contemporary Amperex Technology. The plant will now employ about 1,700 workers, down from the original planned 2,500. Ford and other automakers have cited the need to offer more affordable EVs to entice buyers.

Nvidia, Santa Clara, California, announced last week that its fiscal third quarter sales tripled to more than $18 billion, well above analyst FactSet, Norwalk, Connecticut, forecasts. Large AI investments by Microsoft, Amazon, and others have helped propel Nvidia’s sales to record levels. A surge in generative AI systems, such as OpenAI’s ChatGPT reveals that language and imaging can be created with minimal programming and prompting. Nvidia chips are still the most adept at creating complex AI systems. Nvidia has significantly increased supply of its chips each quarter and is expected to continue to do so in 2024.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies), and ICT (9 companies) which invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spending in the world by government, industries, and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!