Aerospace and defense R&D

The commercial airline industry — both suppliers and operators — has been one of the hardest hit industries by the COVID-19 pandemic and is likely to be one of the longest affected industries as well. Boeing, Airbus and General Electric have seen their business models go from years-long production backlogs to basically zero required deliveries. Thousands of multi-million-dollar aircraft are parked on airport taxiways, parking lots and improvised storage areas around the world.

The owners of some aircraft — specifically Boeing 737 NG vehicles, which have been parked for the past six months — have recently received an advisory from the Federal Aviation Administration to inspect their engines for valve corrosion that may have occurred while stored, which could cause in-flight failures. While the airlines have detailed steps to maintain aircraft while in storage, the corrosion issue noted was new and had not been seen before. All of these stored aircraft will need extensive air worthiness inspections once they are taken out of storage. Any aircraft that has not been flown for seven or more days always needs to be inspected.

Boeing has the additional issue with its 737 MAX aircraft, which were all grounded in early 2019 following fatal crashes due to software issues. These aircraft have all been stored for more than a year and some were still in production prior to the COVID-19 pandemic. Tires, brakes, fuel, hydraulic systems and electronics will all need to be heavily (and expensively) inspected, recalibrated or replaced to assure their safety and airworthiness. Its doubtful that the researchers ever anticipated these aircraft for being out of service for such an extended period of time. And while the 737 MAX and NG aircraft are relatively new, there are likely much older Boeing and Airbus aircraft stored around the world that will also need to be inspected and recertified by their countries’ regulatory organizations.

Airline and aircraft researchers and engineers have been working for the past six months to develop systems and procedures for ensuring sanitized environments within the aircraft, lavatories, and airport boarding areas for their customers once the aircraft are put back into service. Research is underway employing computer modeling of the air flow in aircraft cabins and investigation into new anti-viral materials, UV lighting and long-lasting disinfectants. The research is being performed by the airframe manufacturers and academic researchers.

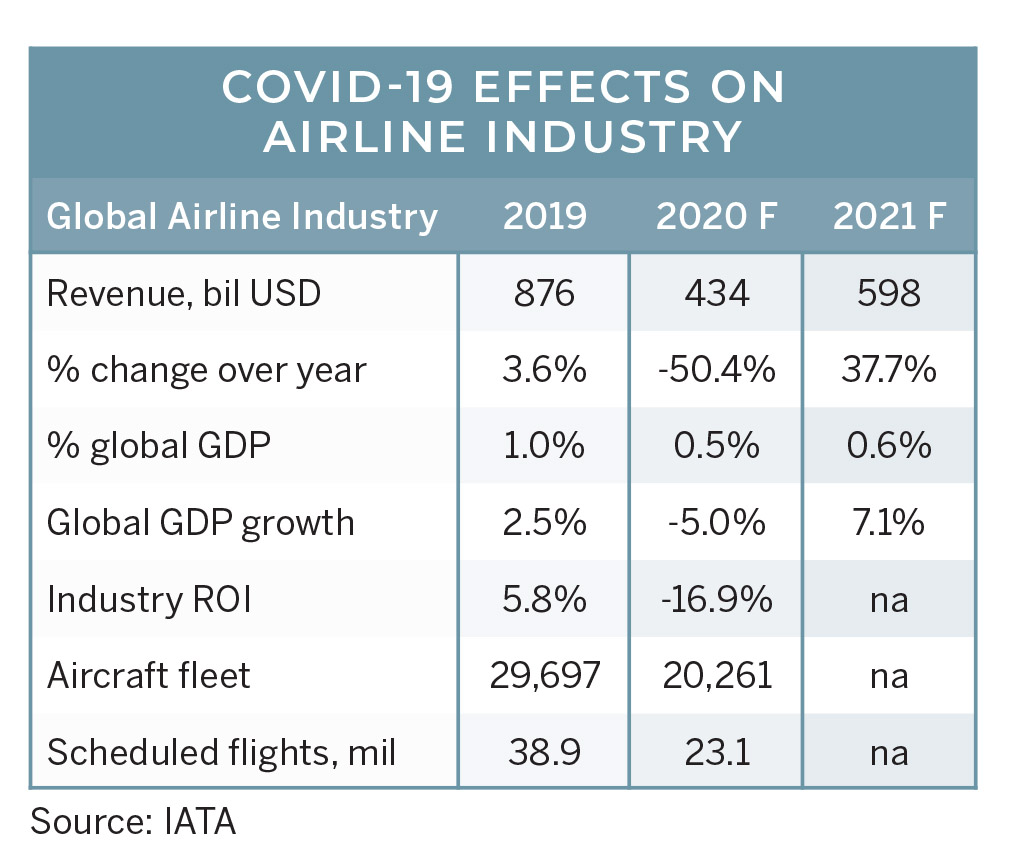

Global airlines are expected to post a net loss of at least $84 billion in 2020 due to lost bookings. Losses are expected to continue into 2021 according to the International Air Transport Association (IATA). Global air traffic has plunged as governments continue to close borders and would-be fliers are now hesitant to fly.

U.S. airlines were initially supported by the federal government under the $2 trillion stimulus packages passed in the spring. They also were required to fly limited schedules. These air packages expire on October 1 and most airlines have stated that they will then cut or furlough as much as half their staffs due to the severely reduced flight demands. United Airlines, for example, has stated that its current revenue is $100 million less per day than it was a year ago. The airlines have already cut many of their administrative staff positions

Aircraft maker Airbus doesn’t expect a recovery in air traffic to pre-pandemic levels before 2023 and thinks it could come as late as 2025. During this lull in business, the airlines will focus on changing their operating models through innovative processes including artificial intelligence-based interfaces, contactless technologies and ancillary revenue streams. “Hyperpersonalization” has become the new buzzword relating to how future flyers will be treated by the airlines.

Due to the lower revenues expected over the next several years, aircraft manufacturers have no new airframe models in their plans and only cost-saving innovations are expected.

The COVID-19 pandemic has also affected the defense side of the aerospace industry as supply chain and manufacturing operations were slammed by the stay-at-home orders, social distancing and actual employee infections and fatalities. Many aerospace firms are a blend of commercial and military businesses. With the commercial side hit with massive disruptions, the companies’ abilities to stay open and keep their workforce has become challenging.

Lockheed Martin’s production of the F-35 fighter aircraft from its plant in Fort Worth, for example, is expected to miss its 2020 production target by about 10% (about 17 fewer fighters than planned). The global recession is also expected to impact sales of these and other export military export systems. Governments will reset their defense budgets in line with their diminished resources. And with lower revenues will also come lower expectations for available R&D funding over the next several years.

This article is part of R&D World’s annual Global Funding Forecast (Executive Edition). This report has be published annually for more than six decades. To purchase the full, comprehensive report, which is 67 pages in length, please visit the 2020 Global Funding Forecast homepage.

Tell Us What You Think!