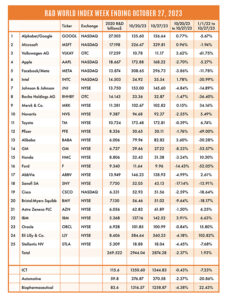

The R&D World Index (RDWI) for the week ending October 27, 2023, closed at 2,874.28 for the 25 companies in the RDWI. The Index was down -2.37% (or -69.76 basis points). Seven RDWI members gained value last week from 0.15% (Merck & Co. to 3.91% (IBM). Eighteen RDWI members lost value last week from -0.39% (Toyota) to -17.14% (Sanofi SA).

The R&D World Index (RDWI) for the week ending October 27, 2023, closed at 2,874.28 for the 25 companies in the RDWI. The Index was down -2.37% (or -69.76 basis points). Seven RDWI members gained value last week from 0.15% (Merck & Co. to 3.91% (IBM). Eighteen RDWI members lost value last week from -0.39% (Toyota) to -17.14% (Sanofi SA).

The Biden administration announced last week that it is proposing major changes to the H-1B visa program for highly skilled foreign professionals such as those required for assistants in R&D labs. The lottery system used for H-1B visas in the past allowed multiple entries — in 2022 there were 780,000 entries to the visa lottery program, up from 270,000 in 2019. The new program will only allow one application per person. Also, employers no longer need to acquire a visa on behalf of a foreign worker as they did in the past. Visa-enabled employees can also work from remote locations in the U.S. approved by their employers. The U.S. Department of Homeland Security has approved this change. Visa applicants can also choose their place of employment, potential employees do not need to go through the previously required lottery system. H-1B visas are good for a three-year term and can be extended for an additional three years for the same job.

Big university endowments such as the multi-billion-dollar programs used to fund research at places like Massachusetts Institute of Technology, Cambridge, Massachusetts; Duke University, Durham, North Carolina; and Stanford University, Palo Alto, California, have seen their financial returns drop — and in some cases show a loss — for the second straight year, according to an analysis released last week by Cambridge Associates, Boston. Rising interest rates have made fast-growing unprofitable tech companies far less appealing to investors which university endowments embraced for large venture capital gains in the past.

Most global automakers have announced within the past few weeks — and last week in particular — the scaling back of their plans to build new plants to produce electric vehicles (EVs) and electric batteries for them. RDW Index member General Motors, Detroit, was the latest to abandon its self-imposed target to build 400,000 EVs by mid-2024. This comes as Tesla, Austin, Texas, and Ford Motor, Dearborn, Michigan, have made similar announcements due to falling consumer demand for EVs and their unwillingness to pay a premium over traditional models. GM also said it would delay the opening of an EV truck factory in suburban Detroit by at least a year. U.S. EV sales are still growing at a faster rate than the broader auto market, but that rate has slowed.

Other news involving GM announced last week was the California Department of Motor Vehicles’ (DMV’s) suspension of GM’s Cruise autonomous driving permit which was used as a robot-taxi service experiment in San Francisco. The DMV stated that Cruise vehicles are not safe for public operation. These actions were based on failures in the Cruise vehicles which led to blocked intersections, and three crashes which included two injuries. Driverless cars in California are regulated by the DMV and the state’s Public Utilities Commission, both of which have now suspended GM’s authority to carry passengers in driverless vehicles.

RDW Index member Alphabet/Google, Mountain View, California, last week agreed to invest up to $2 billion in artificial intelligence (AI) company Anthropic, San Francisco. Amazon, Seattle, invested $4 billion in Anthropic in September 2023. Anthropic has been competing with OpenAI, San Francisco, to secure the training resources and wealthy investors needed to become the AI technology’s leaders. Anthropic also has deals with Amazon and Google to train and run its AI models.

RDW Index member Sanofi SA, Paris, announced last week that it plans to spin off its consumer health business which includes allergy medicine Allegra, and pain treatments IcyHot and Aspercreme. Sanofi follows Pfizer, Johnson & Johnson, and GlaxoSmithKline (GSK) to spin off their consumer health businesses to focus on more commercially lucrative but scientifically riskier prescription drugs. The Sanofi split is expected to be completed by 4Q 2024. At that time Bayer, Munich, Germany, will become the largest drugmaker with a consumer health business as well.

RDW Index member Stellantis, Hoofddorp, Netherlands, announced last week that it was investing $1.6 billion to buy a 30% stake in EV-maker Zhejiang Leapmotor Technology, Hangzhou, China. The deal involves Stellantis obtaining two board seats and Leapmotor’s exclusive export partner via a European joint venture. China can produce EVs 30% more cheaply than Western automakers, according to Stellantis.

RDW Index member Intel, Santa Clara, California, announced last week that its sales and profits fell in its latest quarter as weak personal computer sales damped the market for its semiconductor chips. The company said it is expected sales of $14.6 billion to $15.6 billion for the current fiscal quarter, which is ahead of Wall Street forecasts. Intel is expected to release new devices with improved AI features in the coming months, which the company says will be an inflection point for its future growth.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies), and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spending in the world by government, industries, and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

I believe the H1-B Visa — acquired /processed by a company on behalf of the candidate can facilitate the in-coming of a foreign candidate, for e.g. like me, in areas of Scientific, Engineering and Technology; and likewise, to implement a lucrative Advanced Technology Project in US.