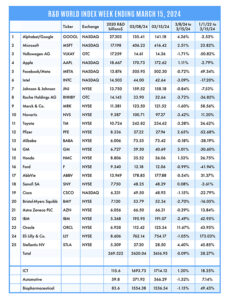

The R&D World Index (RDWI) for the week ending March 15, 2024, closed at 3,616.95 for the 25 companies in the RDWI. The Index was down -0.09% (or 7.09 basis points).

Nine RDWI members gained value last week from 0.08% (Sanofi SA) to 11.67% (Oracle). Sixteen RDWI members lost value last week from -0.18% (Alibaba) to -3.72% (Roche Holdings AG).

The biennial State of U.S. Science and Engineering 2024 report was released last week and revealed that the U.S. spent $806 billion, or 3.5% of its gross domestic product (GDP) on R&D in 2021. The report also noted that China, which had been gaining on the U.S. in overall R&D spending, was listed as spending $668 billion on R&D in 2021. The U.S. National Science Board (NSB) had expected China to surpass the U.S. in R&D spending in 2018. China has been beset by a faltering economy and plummeting birthrates, while there has been a surge in corporate R&D spending by U.S. IT and pharmaceutical companies. Also, U.S. private sector R&D is now so crucial that it funds almost as much of a proportion of basic research (36%) as the U.S. federal government (40%). The report also notes that while the U.S. and China continue to spend similarly large amounts of money on R&D, the gap between the EU — the number three R&D spender — also grows. Also, as part of the announcement, the U.S. Office of Science and Technology Policy (OSTP) noted that artificial intelligence (AI) R&D funds going forward will be spread across federal agencies to further the development of responsible AI. The National Science Foundation (NSF) had an FY2025 AI budget request of $729 million, a 10% increase over its FY2024 request, including $30 million for a second year for the National AI Research Resource pilot.

Last week, the European Parliament in Strasbourg, France, approved a law restricting how AI can be used. The rules are set to take effect gradually over several years, ban some uses, introduce transparency rules, and require risk assessment for systems that are deemed high-risk. The legislation applies to AI products in the European market regardless of where they were developed. It is backed by fines of up to 7% of a company’s worldwide revenue. According to analysts, other global jurisdictions are likely to use the European law as a model for their own AI regulations, according to analysts.

RDW Index member Meta Platforms (formerly Facebook), Menlo Park, California, announced last week that it plans to shut down its CrowdTangle data tool in five months and replace it with a tool called Meta Content Library, which will be available only to academic and nonprofit researchers, not to most news outlets. CrowdTangle has been used by journalists, researchers, and regulators seeking to understand social media platforms and studying the viral spread of content, including false information and conspiracy theories. Meta has already started taking applications for the new tool that it is continuing to develop. According to the company, the new tool is an upgrade over CrowdTangle with features that the old tool lacked. Early beta users of the new tool gave mixed reviews. The timing of the old tool’s shutdown could dramatically effect reporting of this year’s national elections in the U.S.

Vodafone Group, Berkshire, U.K., announced last week that it agreed to sell its Italian business to Swisscom, Bern, Switzerland, for $8.7 billion. The deal looks to reshape Europe’s largest telecom markets, bringing together Vodafone’s Italia mobile customer base with the fixed operations of the Swiss group’s Fastweb Italian subsidiary. Vodafone’s recent transactions leave the company with a slimmed-down portfolio, organized into five divisions — Germany, Europe, Africa, business, and investments. Vodafone’s R&D investments were about $52 billion in 2023.

RDW Index member Apple, Cupertino, California, announced last week that it is increasing its R&D facilities in China, expanding an applied research lab in Shanghai and a new lab in Shenzhen. The Shanghai lab is used to improve the materials and construction of Apple’s products and components. Opening in late 2024, the Shenzhen applied research lab will support regional employees and increase collaboration with local suppliers. This lab is also anticipated to help improve Apple’s testing capabilities for products, including the iPhone, iPad, and Apple Vision Pro.

The U.K. and Germany announced last week they are collaborating on a new series of science, research, and innovation. The joint plans include establishing a dedicated task force to translate their ambitions into concrete projects across critical domains like AI, quantum technology, clean energy, and research security. This collaboration will target the development and deployment of low-carbon hydrogen technologies. These research efforts will include researchers at London’s Imperial College and the Technical University Munich.

The U.S. Air Force’s proposed budget for FY2025 looks to cut procurement of two major fighter programs — the F-35A and F-15EX Eagle II — and boost R&D funding for future capabilities. Its proposed procurement budget would be down $1.6 billion from its FY2024 budget, while its proposed RDT&E budget would increase from $36.2 billion to $37.7 billion. The R&D increase would be partially put into the agency’s collaborative combat aircraft project, including drones outfitted with autonomous software that could fly alongside crewed next-generation air defense fighters and carry out other missions.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies), and ICT (9 companies) that invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spending in the world by government, industries, and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!