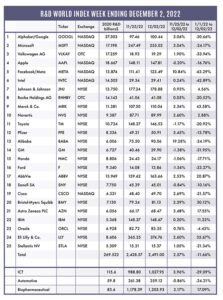

The R&D World Index (RDWI) for the week ending December 2, 2022, closed at 2,491.00 for the 25 companies in the RDWI. The Index was up 2.57% (or 62.43 basis points) from the week ending November 25, 2022. Nineteen of the 25 RDWI members gained value during the past week from 0.05% (Roche Holdings) to 19.28% (Alibaba). Six of the 25 RDWI members lost value last week from -0.20% (Apple) to -1.56% (Ford Motor Co.).

The R&D World Index (RDWI) for the week ending December 2, 2022, closed at 2,491.00 for the 25 companies in the RDWI. The Index was up 2.57% (or 62.43 basis points) from the week ending November 25, 2022. Nineteen of the 25 RDWI members gained value during the past week from 0.05% (Roche Holdings) to 19.28% (Alibaba). Six of the 25 RDWI members lost value last week from -0.20% (Apple) to -1.56% (Ford Motor Co.).

RDW Index member Microsoft, Redmond, Washington, and the National Oceanographic and Atmospheric Administration (NOAA), Washington, D.C., last week announced they will work together to improve climate and forecast models using machine learning. As part of a new cooperative R&D agreement (CRADA), NOAA will use Microsoft’s Azure cloud platform to pilot Earth Prediction Innovation Center (EPIC) earth system modeling projects. This latest CRADA is one of several Microsoft has entered with NOAA and other departments including the U.S. Navy and U.S. Army in the past two years to optimize satellite management, access educational resources, and improve natural disaster resilience. NOAA hopes to improve its models including those used to predict air quality, wildfire smoke, and particulate pollution.

Samsung, Seoul, South Korea, announced last week that it plans to hire nearly 1,000 engineers from the Indian Institute of Technologies (IITs) and top engineering institutes to work on cutting-edge technologies at its R&D institutes across India. The new hires will work on artificial intelligence (AI), machine learning, image processing, the internet of things, connectivity, cloud, big data, business intelligence, predictive analysis, system-on-a-chip, and storage solutions. The company will also hire from mathematics, computing, and software engineering disciplines. The company has made pre-placement offers to IIT students and other top institutions.

RDW Index member Apple, Cupertino, California, has publicly announced that it is looking to move many of its production capabilities outside of China, specifically into India and Vietnam. It’s also looking to reduce its dependence on Taiwanese assemblers led by Foxconn Technology Group. These actions come following violent worker protests due to COVID-19-based government-enforced lockdowns. Apple no longer feels comfortable in having such a large portion of its production (up to 85% at one point in time) based in one location. The company has informed its suppliers to plan more actively for assembling Apple products elsewhere in Asia. Overall changes will occur slowly with each new production site having its own specific issues. Foxconn and Apple have been very proactive in offering bonuses to Chinese workers to return.

RDW Index member Honda Motors, Tokyo, announced last week that it would focus for now on partial autonomous driving technologies to improve safety, stating that fully autonomous technologies are not yet mature enough. Honda has worked with the General Motors Cruise self-driving unit and plans to roll out a prototype system that allows a car to overtake slow-moving vehicles on a highway starting in 2024. The company says it has found more cost-effective ways than the current sensor and radar technologies to make autonomous vehicles more affordable for mass-market cars. However, the cars still cannot fully drive themselves. An alert human driver still needs to be in control. Honda plans to continue to invest up to $2 billion in GM’s Cruise technologies by 2030. GM has submitted applications to the California Department of Motor Vehicles for driverless vehicles to be tested in San Francisco and is awaiting approval.

Eurozone inflation dropped to 10.0% in November from 10.6% in October, according to data from the European Union’s statistics agency. This drop was associated with lower energy costs. The data will play into the European Central Bank’s decision on interest rate increases scheduled for December.

Several thousand shipping containers holding solar panels are being delayed at U.S. Customs near ports such as Los Angeles or even in factories in Vietnam and Malaysia due to U.S. crackdowns on labor abuses in China. Asian solar manufacturers account for more than 80% of all solar panels used and up to 23 GW of solar projects have been delayed in 2022, twice as much as was delayed in 2021.

U.S. federal reserve chairman Jerome Powell last week intimated that the next Fed meeting in mid-December will likely increase interest rates by only 0.5%, down from the 0.75% increases seen in each of the fed’s past four sessions. Powell stated that the overheated labor market still needs to cool down some more before any further interest rate reductions are made.

RDW Index members Volkswagen AG, Wolfsburg, Germany, and Honda Motors have halted production at some plants in China as authorities persist in using strict measures to control COVID-19 outbreaks. Toyota is also adjusting production at some of its factories in China because of the COVID-19 disruptions. The scales of the production disruptions are limited but underscore the effects of supply chain issues and China’s repeated lockdowns.

The U.S. Department of Labor reported last week that employers added 263,000 jobs in November, holding near the strong gains of the previous three months. The jobless rate held at 3.7% in November. The high job gains cast doubt on the federal reserve’s ability to hold down its interest rate increases. The U.S. Department of Commerce last week reported that the Consumer Price Index (CPI) rose by only 0.3% in October from September, the slimmest gain since December 2021. Also, core costs only rose 0.2%. Economists see inflation continuing to cool down in the coming months.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies), and ICT (9 companies) which invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries, and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index

Tell Us What You Think!