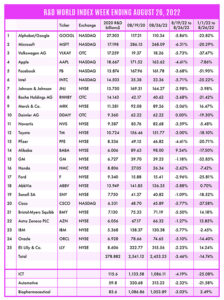

The R&D World Index (RDWI) for the week ending August 26, 2022, closed at 2,453.23 for the 25 companies in the RDWI. The Index was down -3.46% (or 87.89 basis points) from the week ending August 19, 2022. Only one of the 25 RDWI members gained value: 9.34% (Alibaba). Twenty-three of the 25 RDWI members lost value last week from -1.09% (Sanofi SA) to -6.31% (Microsoft). Daimler AG was unchanged for the week at 62.22 for the second consecutive week.

The R&D World Index (RDWI) for the week ending August 26, 2022, closed at 2,453.23 for the 25 companies in the RDWI. The Index was down -3.46% (or 87.89 basis points) from the week ending August 19, 2022. Only one of the 25 RDWI members gained value: 9.34% (Alibaba). Twenty-three of the 25 RDWI members lost value last week from -1.09% (Sanofi SA) to -6.31% (Microsoft). Daimler AG was unchanged for the week at 62.22 for the second consecutive week.

The U.S. Environmental Protection Agency (EPA) last week proposed designating PFOA and PFOS as hazardous substances. These chemicals are known as “forever substances” because they infiltrate people and the environment without breaking down. They’ve been in use for more than 50 years under the commercial names as Teflon and Scotchgard and are no longer manufactured in the U.S., where companies have turned to other chemicals with similar qualities. The chemicals have been found in the groundwater and soil of hundreds of U.S. communities, near military bases, chemical plants and landfills. The American Chemistry Council stated that regulating the chemicals under the Superfund law would be expensive, ineffective and cause delays in remediating sites since there are no standards on how to clean up the chemicals.

Panasonic, Osaka, Japan, a battery supplier to electric vehicle (EV) maker Tesla, announced last week that it is looking to build a $4 billion EV battery plant in Oklahoma. The company already jointly operates a similar plant with Tesla in Nevada and announced earlier this year it planned to build another battery plant in Kansas. Oklahoma and Kansas are noted as being convenient sites for supplying Tesla’s EV manufacturing plant in Austin, Texas. General Motors with South Korea’s LG Energy Solutions and China’s Amperex Technology Inc. have also announced they plan to build battery factories in the U.S.

The California Air Resources Board, Sacramento, last week approved regulations banning the sale of new gasoline-powered vehicles in the state by 2035. The announcement was supported by General Motors, however other industry lobbying groups cautioned that the target will be difficult to achieve, noting that EV charging stations and the availability of EV battery materials will affect how quickly new car sales can realistically go fully electric.

T-Mobile, Bellevue, Washington, and SpaceX, Hawthorne, California, announced last week that they plan to work together to use the rocket company’s Starlink satellites to provide connections to T-Mobile cellphones across the U.S. The companies plan to start with a test of text-messaging services in select markets by the end of 2023. The partners’ goal is to provide voice and data services anywhere regardless of cell towers, including in national parks or in large bodies of water. The Federal Communications Commission (FCC) needs to sign off on SpaceX’s use of the T-Mobile spectrum. Second-generation Starlink satellites for this partnership would be used with large antennae that cover large swaths of land that currently have no cellular service.

RDW Index member Novartis AG, Basel, Switzerland, announced last week that it plans to spin off its generics-and-biosimilars division, Sandoz, and list it as a stand-alone business based in Switzerland and listed on the SIX Swiss Exchange, with an American depository receipt program in the U.S. The action is being made so that the core company Novartis can more fully focus on innovative medicines. To achieve this focus, the company has, over the past ten years, shed units that sold animal medicines, vaccines, pharmacy staples, contact lenses and surgical tools.

RDW Index member Intel, Santa Clara, California, announced last week that it had formed a $30 billion funding partnership with Brookfield Asset Management Inc., Toronto, Canada, to help finance its factory-expansion plans. Under the deal, Intel would fund 51% of the cost of building new chip manufacturing facilities in Chandler, Arizona and will have a controlling stake in the financing vehicle that would own the new factories. Brookfield will own the remaining equity and the two companies will split the revenues created by the factories. Brookfield said that such deals are common in energy and telecommunications industries and are now being seen here because of its growing capital needs. Brookfield currently has more than $750 billion in assets under management.

RDW Index member Apple Inc., Cupertino, California, announced last week that the company is planning to manufacture its new iPhone in India months earlier than it did in previous models. Analysts noted that the company is looking to expand its production capabilities outside of its traditional base in China, where COVID-related issues and geopolitical tensions have increased risks for foreign companies. The upcoming Apple iPhone 14 model could be made in India as early as November 2022, two months after Apple’s traditional September product launch date. Apple currently manufactures its iPhone 13 models in India. More than 90% of all of Apple’s products are still made by Chinese contractors.

Amazon.com Inc., Seattle, announced last week that it is closing a telehealth service it built in-house (Amazon Care) for employees and businesses as the company looks to retool its healthcare offerings following the purchase in July of a line of primary-care clinics. The company looks to close the business by the end of 2022 stating it didn’t meet the needs of potential business customers that Amazon is targeting. The unit has operated as a telehealth service used by Amazon workers which could dispatch medical providers to patient homes. The company announced in July that it had purchased 1Life Healthcare Inc. for $3.9 billion. The company is also noted as among bidders for healthcare company Signify Health Inc., Dallas, Texas.

American Rare Earths Limited, New South Wales, Australia, announced last week that its wholly owned U.S. subsidiary, Western Rare Earths, Phoenix, has joined as the industrial partner in a research consortium that includes the technology company, Phinix LLC, St. Louis, Missouri, and Virginia Tech University, Blacksburg, Virginia. The research team has been awarded R&D funding by the U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy in an Advanced Manufacturing Office (AMO) program for Critical Materials: Next Generation Technologies and Field Evaluation. The consortium will receive up to $500,000 to fund the research. Western Rare Earths will provide rare earth bearing ores as feedstock for extraction and separation.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!