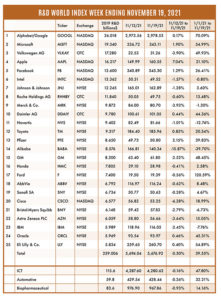

The R&D World Index (RDWI) for the week ending November 19, 2021, closed at 5,676.92 for the 25 companies in the RDWI. The Index was down -0.30% (or -17.12 basis points) from the week ending November 12, 2021. The stock of nine RDWI members gained value from 0.17% (Alphabet/Google) to 7.04% (Apple). The stock of 16 RDWI members lost value from -0.28% (Sanofi SA) to -15.87% (Alibaba).

Two RDW Index members, General Motors and Ford Motor Company announced last week that they both had created strong relationships with semiconductor device manufacturers. General Motors is working with Qualcomm, NXP Semiconductors, Taiwan Semiconductor Manufacturing Co., Infineon Technologies, STMicroelectronics and others to co-develop and manufacture chips to secure a consistent supply of chips. Ford has a strategic collaborative agreement with GlobalFoundries, Malta, N.Y., to co-develop chips in a pact that could eventually lead to joint U.S. production. Ford said that developing its own chips could improve some vehicle features. The joint development work with GlobalFoundries is focused on higher performance devices that could go into vehicles several years from now. Like noted above with GM, Ford also currently has a strong supplier relationship with NXP Semiconductors.

The Congressional Budget Office (CBO) released a report last week that identifies the real costs of the Biden administration’s Build Back Better (BBB) legislation. The report states that the $1.5 trillion BBB bill, which passed the House of Representatives vote last week, would result in a net deficit increase of $367 billion from 2022 to 2031. The bill, which features new tax credits for electric vehicles and immigration reform faces a tough fight to get through the U.S. Senate, especially in terms of its increasing inflationary effects on the overall economy in a period of already rising inflation rates.

Harvard University’s T.H. Chan School of Public Health, Cambridge, Mass., and Zhejiang University School of Medicine (SAHZU) in Hangzhou, China, announced the launch of a bilateral exchange program in clinical research last week. The program aims to enhance the capabilities of both universities and to develop a multi-year program of clinical research education. The program also aims to foster the exchange of primarily young physicians to conduct clinical research studies.

The U.S. Centers for Disease Control and Prevention (CDC) announced last week that COVID-19-based booster shots from Pfizer and partner BioNTech SE and Moderna will be available to all adults who have received their primary shots at least six months after their second shot. Supplies of these booster shots should be readily available. The U.S. purchased 600 million doses of the Pfizer vaccine and 500 million Moderna doses. The booster expansion comes after the Delta-driven COVID-19 variant increases seen over the summer have receded in most states. More than 32 million people have already received the booster shots.

RDW Index member Pfizer also said last week that it has agreed to $5.3 billion deal with the U.S. to provide enough supplies of its COVID-19 pill to treat 10 million people once health regulators approve the drug. Pfizer’s anti-viral drug Paxlovid is currently being reviewed by the U.S. Food and Drug Administration (FDA) with a decision expected before the end of 2021. Pfizer also stated last week that it was licensing Paxlovid to the United Nation’s Medicine Patent Pool to work with generic drug manufacturers to produce and distribute the drug to nearly 100 low and middle-income countries. The pill treatment consists of the patient taking 30 pills over five days.

Sweden’s telecom developer Ericsson, Stockholm and Saudi Arabia’s King Abdullah University of Science and Technology (KAUST) last week announced a three-year R&D partnership focused on three research projects aimed at advancing telecommunications networks with advanced technologies. Ericsson and KAUST plan to use machine learning for frequency-selective wireless channels to solve channel estimation and resource allocation problems. The partnership expects to focus on 6G capabilities moving to higher frequencies and backup systems to guarantee the high-rate data networks.

Royal Dutch Shell announced last week that it was moving its headquarters from The Hague, the Netherlands, to London to create a simpler structure. The move will entail changing the company’s name to simply Shell. No changes in R&D locations or organizational structure were announced. Royal Dutch Shell spent about $800 million on R&D in 2020.

A report last week in the Wall Street Journal noted that the continuing chip shortage has resulted in numerous products being redesigned to offset the shortages. Simpler product designs are being implemented which do not require electronics according to the study. Older mechanically driven systems, often used before electronic upgrades, are now being re-implemented in many applications. In some situations, products are also being shipped without some electronic components, such as displays, where the electronics can be simply installed later when those parts become available.

An analysis of last week’s announcement of the split-up of General Electric (GE) has resulted in glowing reviews and a bright future for GE’s Healthcare unit. This unit, which is dominated by the MRI (magnetic resonance imaging) systems manufactured in GE’s Waukesha, Wis., facility is noted as being able to respond faster and more competitively without the complexities of the previous GE corporate infrastructure. GE’s MRI’s compete with Siemens Healthineers, and Koninklijke Philips NV, along with artificial intelligence (AI) focused startups and fast-growing players in China.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2019 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!