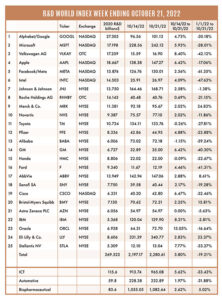

The R&D World Index (RDWI) for the week ending October 12, 2022, closed at 2,280.61 for the 25 companies in the RDWI. The Index was up 3.80% (or 83.44 basis points) from the week ending October 14, 2022. Twenty-one of the 25 RDWI members gained value during the past week from 2.02% (Merck & Co. and Novartis were both up the same amount) to 13.05% (Oracle). Three of the 25 RDWI members lost value last week from -0.09% (Honda) to -1.15% (Alibaba). Astra Zeneca PLC was unchanged for the week (54.97).

The R&D World Index (RDWI) for the week ending October 12, 2022, closed at 2,280.61 for the 25 companies in the RDWI. The Index was up 3.80% (or 83.44 basis points) from the week ending October 14, 2022. Twenty-one of the 25 RDWI members gained value during the past week from 2.02% (Merck & Co. and Novartis were both up the same amount) to 13.05% (Oracle). Three of the 25 RDWI members lost value last week from -0.09% (Honda) to -1.15% (Alibaba). Astra Zeneca PLC was unchanged for the week (54.97).

General Electric Corp., Boston, announced last week that it would keep its sprawling GE Research operations in Niskayuna, New York (near Schenectady), intact as the company works to split into three separately traded public companies over the next two years. GE announced in November 2021 that it was splitting itself into GE Healthcare, GE Aerospace, and GE Verona (energy, power, and digital). For now, the researchers at GE Research will keep their jobs, but moving forward they will be split among the three new independent companies to provide a steady flow of innovative products and services for their respective companies. From an organizational standpoint, GE Research will be split into three businesses on two campuses — Niskayuna and Bangalore, India.

Semiconductor device tool-maker Lam Research, Fremont, California, last week joined several of its industrial partners and competitors in forecasting a potential steep drop in sales as the U.S. imposes new restrictions on exports to China. Lam expects it could lose as much as $2.5 billion in 2023 sales from the China restrictions. Its outlook for its December quarter (which included the restrictions) was posted at $5.1 billion. Lam noted that the restrictions and deteriorating demand will push spending on chip-making equipment down by more than 20% in 2023. Similarly, AMD cut its 3Q sales forecast by $1.1 billion, while Nvidia said it will reduce quarterly sales by up to $400 million.

Nokia, Espoo, Finland, announced plans last week to transform its Ottawa, Ontario, facility into a world-leading, sustainable R&D hub. The new $250 million tech center will significantly expand Nokia’s capacity in next-generation ICT (information and communications technology) and cyber security innovation. Site construction will begin in 2023 and open in 2026. The 26-acre campus is expected to have nearly 2,160 employees working on cyber security, artificial intelligence (AI) and machine learning, cloud software, digital identity management, and security for critical digital networks.

The European Marine Energy Centre (EMEC), Stromness, Scotland, announced last week that it has finalized the design for its 100 MW floating wind laboratory. The lab will have six berthing sites and stationed 20 km offshore for 20 MW capacity units in water depths up to 95 meters. Prototypes anchored at the site will be run on windspeeds of 10m/sec. They will also have to weather North Sea conditions, including Nordic rains and very large waves. The experimental site is purpose-designed for developers to de-risk a range of floating wind technologies in an energetic offshore environment.

Taiwan Semiconductor Manufacturing Company, Hsinchu, Taiwan, announced last week that it is considering expanding its production capacity in Japan. TSMC currently is building its first chip-manufacturing plant on the island of Kyushu, Japan, and was subsidized with $3.2 billion in funding from the Japanese government. It is scheduled to be completed in late 2024.

BP PLC, London, announced last week that it has agreed to purchase U.S. biogas producer Archaea Energy Inc., Houston, for $3.3 billion. The two companies said they would be able to tap into rising demand for renewable natural gas. Biogas is captured from decomposing landfill and farm waste and made into alternative fuel for heavy trucks and power plants. BP expects to grow its biofuel business to $2 billion/year by 2030.

The United Kingdom’s (U.K.’s) Office for National Statistics announced last week that U.K. consumer prices in September were 10.1% higher than they were in September 2021. This data basically ensures that the Bank of England (BOE) will raise key interest rates in early November for the eighth consecutive time from their current level of 2.25%.

RDW Index member Microsoft, Redmond, Washington, announced last week that it is in advanced talks for a new round of funding in OpenAI (Open Artificial Intelligence), San Francisco. Elon Musk and others founded OpenAI. Microsoft invested $1 billion in the company in 2019. The new funding would help support the tremendous computing power Open AI needs to run its various AI products on Azure, Microsoft’s cloud-computing service.

Drug makers are scrambling to offset Medicare’s new power to negotiate medicine prices. Under the Inflation Reduction Act passed this summer, Congress gave Medicare the authority to negotiate how much it pays for certain high-priced therapies and to get rebates on treatments whose prices rise more than the rate of inflation. Medicare is the nation’s largest purchaser of prescription drugs.

RDW Index member Google (Alphabet), Mountain View, California, is in talks to invest at least $200 million into AI startup Cohere Inc., Toronto. Chip maker Nvidia, Santa Clara, California, has also been mentioned as being interested in investing in Cohere. The overall valuation of Cohere was not mentioned in any press releases. Google has been involved in investments in various AI-oriented companies, including Stability AI and DeepMind.

The Federal Reserve System last week reported that its index of industrial production (the combined output of U.S. factories, utilities, and mines) rose a seasonally adjusted 0.4% in September from August. This record high was 0.1% stronger than analysts expected. Driving these gains was a 0.4% rise in manufacturing production. Manufacturing output has been at its highest level since 2008. Much of this increase is attributed to automotive output, even considering the materials shortages experienced by many automakers.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies), and ICT (9 companies) which invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries, and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!