Energy R&D

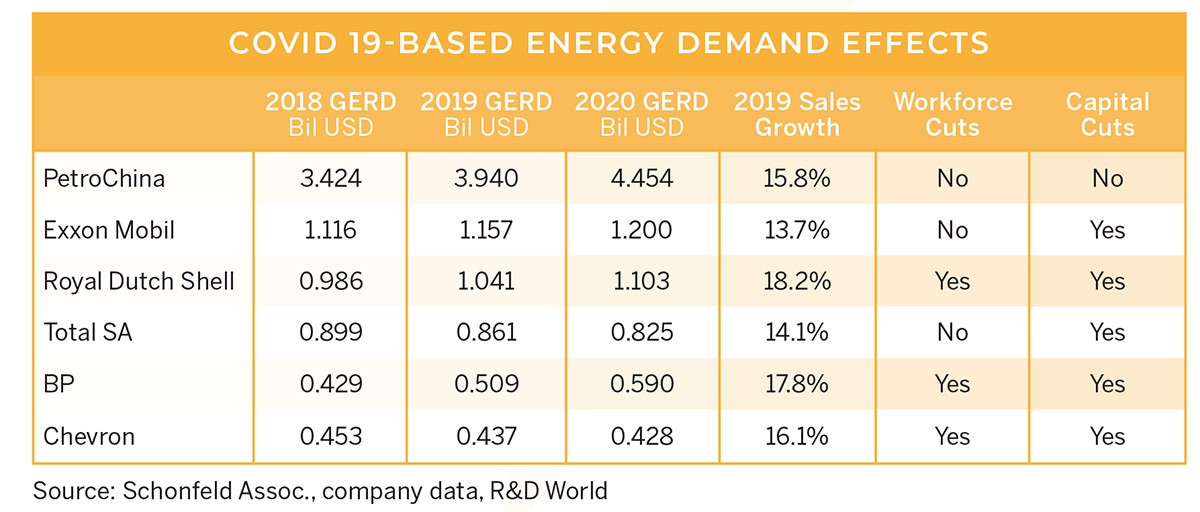

With the COVID-19 recession, restricted travel and dramatically reduced aerospace demand, demand and production of oil and gas declined more than 20% in the spring. Global oil prices crashed in April. The West Texas and Eastern New Mexico Permian Basin, with its fracking technologies, helped lead the U.S. into global oil leadership just a few years ago. But low prices quickly turned the area into a ghost town with barely more than 100 oil rigs drilling today compared to more than 400 at this time in 2019.

Oil demand has somewhat recovered since April and the vast Permian Basin reserves will be producing again once the economy recovers in 2021. However, the Organization of the Petroleum Exporting Countries (OPEC) states that 2021 demand, while greater than current demand, will still fail to completely offset the drop during the pandemic fall. The 4.7 million barrels produced per day in 2019 were forecast to grow to nearly 12 million barrels per day by 2030, even with the growing automotive electrification trends.

The International Energy Agency (IEA, Paris) notes that the COVID-19 pandemic is having a major impact on global energy systems and threatens to slow the expansion of clean energy technologies. Before the pandemic, technological progress on clean energy technologies had been promising, albeit slightly uneven. The IEA states 10 energy themes associated with the pandemic:

- Pandemic-induced reduction in CO2 emissions does not guarantee a sustained decline.

- Renewables have been resilient but still need government support.

- Government stimulus packages could provide the boost that energy efficiency needs.

- Low-carbon electricity has overtaken coal but still needs to expand.

- Electric cars are outpacing rivals but still need government leadership.

- Smart policies created during the pandemic can promote behavioral changes.

- Hard-to-abate sectors now risk becoming even harder to abate.

- Breakout moments are possible for emerging technologies.

- Clean energy investments still need a dramatic increase.

- Achieving net-zero emissions will require step changes in innovation.

The Center for Strategic and International Studies (CSIS, Washington, D.C.) has noted that the COVID-19 pandemic could also delay China’s clean energy agenda. China’s investments in clean energy systems will depend upon how the economic fallout from COVID-19 pandemic affects the enormous Chinese debt that has grown since its economic stimulus response to the last global downturn in 2009. China announced that its GDP had plunged 6.8%, year on year, in 1Q 2020 — the first time its economy has shrunk in more than 40 years. All of its key indicators, including unemployment, consumer spending, and fixed asset investments, forecast that China’s GDP will fall by 3% for all of 2020.

China now has the most indebted corporate sector in the world. Interest repayments on its existing credit exceed its nominal GDP growth each year. All of these issues leave little room for clean energy investments and climate mitigation.

However, despite these economic woes and the COVID-19 pandemic, China still managed to add nearly 4 GW of solar infrastructure in 1Q 2020. The National Energy Administration also noted that 1.74 TWh of Chinese solar electricity was curtailed, dropping its growth by 24% from the same period in 2019. The 2020 slowdown was prompted by a 6.5% reduction in electrical demand due to the COVID-19 pandemic induced recession. The reopening of industries in China since the 1Q has seen a rebound in power consumption.

The U.S. Dept. of Energy (DOE) recently announced the availability of new resources for innovators to combat COVID-19 through its Lab Partnering Service (LPS) and the COVID-19 Technical Assistance Program (CTAP). These initiatives will allow innovators to access resources and partner with experts at the DOE’s 17 National Laboratories in the fight against the virus. Information on these resources can be obtained by contacting [email protected].

This article is part of R&D World’s annual Global Funding Forecast (Executive Edition). This report has be published annually for more than six decades. To purchase the full, comprehensive report, which is 67 pages in length, please visit the 2020 Global Funding Forecast homepage.

Tell Us What You Think!