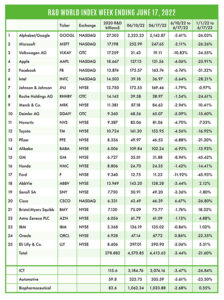

The R&D World Index (RDWI) for the week ending June 17, 2022, closed at 4,413.63 for the 25 companies in the RDWI. The Index was down -.3.44% (or -157.22 basis points) from the week ending June 10, 2022. Two of the 25 RDWI members gained value from 0.86% (Oracle) to 6.67% (Cisco). Twenty-three of the 25 RDWI members lost value last week from -0.86% (IBM) to -11.92% (Ford Motor Co.).

The R&D World Index (RDWI) for the week ending June 17, 2022, closed at 4,413.63 for the 25 companies in the RDWI. The Index was down -.3.44% (or -157.22 basis points) from the week ending June 10, 2022. Two of the 25 RDWI members gained value from 0.86% (Oracle) to 6.67% (Cisco). Twenty-three of the 25 RDWI members lost value last week from -0.86% (IBM) to -11.92% (Ford Motor Co.).

Foxconn Technology Group, Taipei, Taiwan, started building its first plant to produce electric vehicle (EV) batteries last week. The company said it plans to invest $200 million on battery production lines and an R&D center in Kaohsiung in southern Taiwan. The plant will produce lithium iron phosphate batteries, the type used by U.S. EV automaker Tesla. The first product will be tested in early 2024, according to the company. Foxconn also stated that it plans to build an EV battery supply chain in Taiwan, from upstream materials to midstream cells and the downstream battery packs. The company started delivering EV buses in March 2022 which were designed on a Foxcon-led open platform. Foxconn has EV plants in Ohio and Indonesia and said it wants to supply 3 million EVs annually by 2027, or 10% of the global market.

RDW Index member Merck & Co., Readington, New Jersey, was noted last week as considering the purchase of biotech Seagen Inc., Bothell, Washington, to increase the company’s cancer drug portfolio. Seagen’s current market value is about $30 billion with an estimated annual R&D investment of more than $1.3 billion. Merck and Seagen have collaborated in the past on the development of breast-cancer treatments. Merck also licenses one of Seagen’s drugs outside of the U.S.

Micron Technology, Boise, Idaho, last week announced that it will add 2,000 employees and set up a new R&D corridor in Taiwan. Known for manufacturing semiconductor memory chips, Micron has invested in Taiwan for more than 20 years and currently has more than 10,000 employees in Taiwan in two factories there. Micron invested more than $2.2 billion in R&D in 2020.

A report in Japan’s Nikkei Asia publication last week noted that Japanese semiconductor-based companies, including Canon and Tokyo Electron, are in talks with their U.S.-based counterparts, including RDW Index member IBM, to work together on R&D and production of 2-nm-based semiconductor devices. Joint research could begin this summer with the first Japanese plant to be built between 2025 and 2027. Japan’s Ministry of Economy, Trade and Industry (METI) will partially subsidize R&D and capital expenditures for this development according to the report. Rival Taiwan Semiconductor Manufacturing Co. (TSMC), Hsinchu, Taiwan, is expected to manufacture 3-nm devices in late-2022 with 2-nm devices due by the end of 2025.

The continuing rise in inflation rates and last week’s U.S. Federal Reserve response of increasing the short-term interest rate by 0.75% has caused 60% of the top 750 corporate executives to expect a recession in their geographic region within 12 to 18 months, according to a survey released by the Conference Board, New York City, last week. About 15% of the survey respondents also believe that the region where they operate is already in a recession. This is nearly triple the number of respondents expecting a recession risk in a similar survey conducted in late-2021.

Financial officers of RDW Index members General Motors, Detroit and Ford Motor Co, Dearborn, Michigan, stated last week that they are assessing the impact of inflation and rising gasoline prices on their product lines. These events are already taking a toll on their companies’ profitability in some areas and therefore on their ability to invest in R&D. Higher fuel costs and inflation are creating a more fluid environment, especially for long-term planning issues in these companies. The events are also causing increased scrutiny in hiring decisions.

Caterpillar Inc., Deerfield, Illinois, last week announced that it is moving its global headquarters to Irving, Texas. Cheaper real estate and larger potential workforces were listed as the primary reasons for the move. This move follows similar moves to Texas by Tesla, Oracle and Hewlett-Packard. The transition to EVs has also been a reason for moves to more technologically significant locations. Caterpillar invests about $2 billion in R&D annually. No mention concerning their R&D status was made in the announcement. Their computer operations and associates, currently located in Chicago, are not expected to move.

China last week formalized into a regulation their R&D tax relief policy. From this year forward companies can deduct their R&D expenses during the first nine months from their concurrent taxable income when they file for taxes in October. China now allows technology-intensive small and medium-sized firms and those in the manufacturing sector to deduct twice the sum of their R&D costs from taxable income, up from 175% previously.

Numerous labor market indicators cooled slightly over the past month, suggesting the U.S. job market is slowing. Job openings dropped in April from 11.9 million to 11.4 million. Layoffs also increased slightly in May as noted by softer payroll growth. Wage growth also dropped to 5.2% in May from 5.6% in April. The unemployment rate stayed at 3.6% for the third consecutive month in May, but analysts expect it to increase to 3.7% by the end of 2022.

The Bank of Japan (BOJ), Tokyo, maintained its ultralow interest rates last week, ignoring the large 0.75% increase made by the U.S. Federal Reserve system last week. BOJ believes that keeping its interest rates low (currently at -0.1%) will support its economy and prevent a sharp depreciation of the Japanese yen. The yen has fallen against the U.S. dollar to its lowest level (135 yen to the dollar) since 1998. Japan’s inflation rate, however, exceeded its 2.0% target in April by rising to 2.5%.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2020 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!