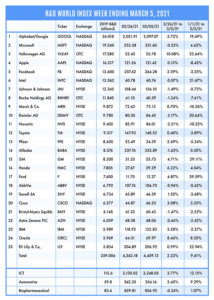

The R&D World Index (RDWI) for the week ending March 5, 2021 closed at 4,459.13 for the 25 companies in the R&D World Index. The Index was up 2.22% (or 96.95 basis points) from the week ending February 26, 2021. The stock of sixteen R&D World Index members gained value from 0.13% (Apple) to 10.08% (Volkswagen). The stock of nine R&D World Index members lost value from -0.07% (Intel) to -1.63% (Alibaba).

China announced its 14th Five-Year Plan for 2021-2025 last week with targeted annual increases to its R&D spending of 7% or more for the next five years — possibly increasing to double-digit annual increases. The R&D increase is 1% higher that China’s expected GDP increase for 2021. Analysts say that this R&D rate increase is targeted at raising its R&D as a share of its GDP to rival that of the U.S. by 2025. The draft Five-Year Plan was presented at the annual session of the National People’s Congress by Premier Li Keqiang. The Plan calls for the central government to increase China’s spending on Basic Research by more than 10% starting in 2021. It will also increase tax incentives for Chinese manufacturers to increase their research investments. R&D in the Five-Year Plan will focus on seven sectors, according to Premier Li: 1) artificial intelligence (AI), 2) quantum and cloud-based information, 3) advanced integrated circuits (ICs), 4) brain sciences, 5) genetics and biotechnology, 6) clinical medicine and health care and 7) deep Earth, sea, space and polar explorations. Li said that innovation and technological self-sufficiency are at the core of China’s strategy to develop new advantages in the face of increased hostility and decoupling pressures from major Western countries. Analysts decried the Plan’s contradictions between short-term and long-term climate goals. China has committed to reducing carbon dioxide emissions by more than 65% by 2030 and become carbon neutral as a country by 2060. China already is transitioning away from high-polluting coal energy to lower-polluting natural gas increasing its LNG consumption by 11% in 2020.

RDWI-member General Motors announced last week that it was looking to build a second automotive battery production facility, following construction of its first facility in Lordstown, Ohio, which it will operate with partner LG Chem. The second site would likely also be with LG Chem and could be located in Tennessee, according to analysts. GM invested $2.3 billion in the Ohio battery facility and will likely invest a similar amount in the second site. LG Chem is also planning production expansions of its own to support other automakers. LG Chem and SK Innovation (both based in South Korea) continue their legal wranglings following the International Trade Commission’s (ITC’s) decision to impose long-term restrictions on SK for theft of trade secrets from LG Chem. SK supplies automotive batteries to Ford and Volkswagen in the U.S.

A road map outline of fusion energy was released by the U.S. National Academies of Sciences, Engineering and Medicine (NASEM) last week stating that the U.S. should strive to start construction of a fusion energy pilot plant by 2035 and have it running by 2040. According to William Madia, vice president emeritus of Stanford University, the timeline is credible and doable. “But if fusion hasn’t shown itself to be feasible by 2035, its going to be left out of the carbon-free energy mix.”

Exxon stated last week at its annual analysts meeting that it plans to invest $3 billion in carbon capture technologies stating that it will be a $2 trillion/year market by 2040. Exxon has captured 120 metric tons of carbon over the past 30 years, primarily at its Shute Creek Treating Facility in Wyoming. This facility processes natural gas, separating carbon dioxide and other gases from methane. It sells most of this product to nearby drillers to enhance their oil recovery in which carbon is pumped into older oil and gas reservoirs to increase pressure and produce more fossil fuels.

It was announced last week that the U.S. Senate is considering including $30 billion in a new funding bill to boost competitiveness in the U.S.’s chipmaking industry. Lawmakers aim to bring the package to a full vote in April. The bill will also have provisions curbing China’s access to U.S. capital markets. The bill could be used as a vehicle to provide emergency funding for the bipartisan semiconductor programs included in the 2020 National Defense Authorization Act, which is still awaiting funding.

The World Health Organization (WHO) stated last week that it is scrapping an interim report on its recent mission to China to evaluate the source of the COVID-19 virus in or around Wuhan, China. The delay is due to mounting tensions between Washington, D.C. and Beijing over the investigation and an appeal from an international group of scientists for a new probe. The appeal for a new probe comes as the U.S. (which recently reversed its decision to leave the WHO) lobbies for greater transparency in the investigation.

The U.S. and Canada agreed last week to upgrade and modernize a network of defense satellites and radar in the Arctic in a bid to counter a growing military presence in the north from Russia and China. The NORAD (North American Aerospace Defense Command)-based system

developed during the Cold War has become outdated and new weapons systems developed recently would overwhelm the existing surveillance network. The new defense network is listed as a priority for the renewed U.S.-Canadian bilateral relationship.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2019 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ, NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!