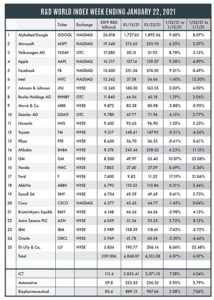

The R&D World Index (RDWI) for the week ending January 22, 2021 closed at 4,315.08 for the 25 companies in the R&D World Index. The Index was up 6.07% (or 247.01 basis points) from the week ending January 15, 2021. The stock of 17 R&D World Index members gained value from 0.31% (AbbVie) to 17.19% (Ford Motor). The stock of eight R&D World Index members lost value from -0.31% (Toyota) to -7.62% (IBM).

Dr. Anthony Fauci, now the chief medical advisor to President Biden, re-established U.S. participation in the World Health Organization (WHO, a specialized agency of the United Nations with 194 member states) last week and, at an annual WHO executive board meeting on January 21 (via video conference), committed to fulfill the U.S.’s financial obligations to the organization (which is about $500 million/year). Fauci has been the director of the NIH’s National Institute of Allergy and Infectious Diseases (NIAID) for the past 37 years and was R&D Magazine’s (the predecessor to R&D World) Scientist of the Year in 2005.

RDWI- member Intel announced last week that it would outsource more semiconductor chip production, according to new incoming CEO Pat Gelsinger. The bulk of its new 2023 chips would still be produced in-house and no mention was made as to where its next generation microprocessor devices would be produced. Gelsinger stated that its new 7-nm manufacturing process currently under development is proceeding. TSMC is a likely candidate for manufacturing more Intel chips. TSMC is the largest contract manufacturer of semiconductor chips and already has a facility in Camas, Washington, with another manufacturing site possibly planned for Arizona, and in production by 2024. TSMC purchased land in the Phoenix area for the potential $12 billion facility in December 2020.

South Korea’s Samsung Electronics Co. also was found last week by people familiar with the company’s plans that it is considering building a chip-making facility in either Arizona, Texas or New York. Samsung already has a chip manufacturing facility in Austin, Texas, where the company had indicated in 2020 it would invest up to $20 billion. Two new chip-making incentives were included in the U.S. National Defense Initiative passed in January 2021, although the measures have yet to receive funding.

While semiconductor chip manufacturing has become a global enterprise, with the majority focused in the Asian region due to their lower operating costs, the multibillion-dollar manufacturing equipment that goes into these fabs and much of the R&D involved in developing the next generation of devices is based in the U.S., the EU and Japan. These equipment manufacturing companies include Tokyo Electron, LAM Research, ASML, Applied Materials and KLA-Tencor.

Microsoft last week announced that it was investing in General Motors’ driverless-car startup, Cruise, as part of a group of companies investing more than $2 billion in the San Francisco-based company. Cruise has been majority owned by GM since 2016. The current financing brings Cruise’s valuation to $30 billion, nearly double its valuation from two years ago. GM is adding to its investment, as is initial investor Honda Motor. Cruise is now expected to use Microsoft’s Azure cloud-computing service to roll out its autonomous-vehicle services.

GM also announced last week that it was forming a new GM business unit to sell electric vans and services to commercial delivery companies, including FedEx. Rivian, an electric truck start-up, stated on Thursday that it had raised $2.65 billion for a total valuation of nearly $28 billion. Ford Motor invested in Rivian in 2019. Rivian plans to build electric pickup trucks and off-road SUVs which it will make available in 2021. Ford’s current valuation is only about $44 billion, but has aggressive plans to introduce electric trucks, vans and sports cars.

RDWI-member Lilly announced last week that its under-development antibody-based drug prevented COVID-19 in staff and residents in nursing homes and assisted living facilities. This points to its use as complementing currently available COVID-19 vaccines. The Lilly drug, bamlanivimab, reduced the risk of getting sick by 60% to 80%. These results were from Phase 3 clinical trials conducted in partnership with the NIH. The FDA authorized the use of bamlanivimab in November 2020 to treat people already sick with mild to moderate COVID-19 based on earlier test results.

About the R&D World Index

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2019 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly $260 billion in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ. NYSE, and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!