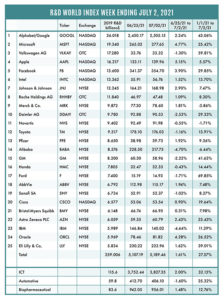

The R&D World Index (RDWI) for the week ending July 2, 2021 closed at 5,189.46 for the 25 companies in the R&D World Index. The Index was up 1.61% (or 82.27 basis points) from the week ending June 25, 2021. The stock of 15 R&D World Index members gained value from 0.90% (Cisco) to 5.15% (Apple). The stock of ten R&D World Index members lost value from -0.43% (Honda) to -4.70% (Alibaba).

The R&D World Index (RDWI) for the week ending July 2, 2021 closed at 5,189.46 for the 25 companies in the R&D World Index. The Index was up 1.61% (or 82.27 basis points) from the week ending June 25, 2021. The stock of 15 R&D World Index members gained value from 0.90% (Cisco) to 5.15% (Apple). The stock of ten R&D World Index members lost value from -0.43% (Honda) to -4.70% (Alibaba).

RDW Index member Sanofi SA last week announced that it was increasing its investment in mRNA development from $425 million in 2020 to $475 million/year in an effort to have six clinical stage candidates by 2025. The R&D investment will be split between Sanofi’s mRNA centers in Cambridge, Mass., and Marcy l’Etoile in Lyon, France. The investment will also be used to increase Sanofi’s mRNA research team to about 400 workers focusing on basic R&D, digital technologies and chemistry, manufacturing and controls (CMC). Sanofi has an alliance with Translate Bio, which specializes in mRNA products, including COVID-19 vaccines. Sanofi looks to improve upon the weaknesses of current approved COVID-19 vaccines including their need to be stored at cryogenic temperatures and their potential for cardio inflammations.

The top economic South Korean policymaker, Hong Nam-ki, last week announced that his country will invest more than $1.8 billion for large-scale R&D in next-generation rechargeable battery development. The government plans to support local companies to ensure a stable supply of rechargeable battery materials and the development of more than 1,100 skilled battery researchers/year. South Korea, China and Japan currently supply about 95% of the batteries for the electric vehicle market. South Korea is the leading global supplier of small rechargeable batteries.

RDW Index member Intel last week announced the production delay of one of its newest central microprocessors (CPUs) from late-2021 to early-2022. The additional time Intel is taking will allow researchers to improve the chip’s performance in data handling and artificial intelligence (AI) processing (two leading high-profile applications), which had been requested by customers. Intel stated that satisfying customer demand was more important to the company than losing short-term production ground to the competition (Advance Micro Devices (AMD) and Nvidia)—they would rather ship the best CPU possible.

Nvidia’s planned takeover of the UK’s semiconductor developer Arm Holdings (currently in regulatory approval mode) has been noted last week as being supported by Broadcom, MediaTek and Marvell Technology. Qualcomm, Google and Microsoft all use Arm-based chips in their products and are opposed to the regulatory approval of the Nvidia-Arm takeover. Support for the takeover stems from the additional R&D and financial investment that Nvidia could make in Arm Holdings. The acquisition still faces tough approvals from China and the U.S.

The UK government last week stated that it plans to deliver booster COVID-19 vaccines in September should the need arise for waning initial doses and protection against new virus variants. Rollout of the booster shots will depend upon review by the UK’s Joint Committee on Vaccination and Immunization. A UK study by the University of Oxford last week revealed that combining the approved vaccine by Pfizer with one from AstraZeneca PLC provides a strong immune response against the COVID-19 virus. A larger study is underway involving seven vaccines, the results of which will be available by September. A separate University of Oxford study also revealed that the AstraZeneca vaccine provides a strong increase to immunity when given as a booster shot more than six months after two doses of the same shot.

The recent approval of Biogen’s treatment, Aduhelm, in June for Alzheimer’s disease is facing tough scrutiny for its large $56,000 annual cost. The Biden administration has stated that Medicare cannot treat this high cost “as business as usual.” With additional costs for brain imaging tests, drug infusion costs and numerous doctor visits, the total Medicare cost becomes even larger. According to analysts, Medicare administrators may limit access to Aduhelm to only certain patients in earlier stages of the disease. Eli Lilly also plans to file for regulatory approval for its own Alzheimer’s treatment which could be available by late-2022.

London-based GlaxoSmithKline (GSK) announced last week that it is paying South San Francisco-based Alector $700 million to share in Alector’s two lead drugs, AL001 and AL101, for treating neurological disorders. Alector’s R&D approach addresses the role immune cell dysfunction plays in neurological disorders such as Alzheimer’s and Parkinson’s diseases. Milestone payments tied to the progress of Alector’s two lead drugs could bring the company up to $1.5 billion in additional funds. GSK said it will lead U.S. commercialization of AL101 in Alzheimer’s and Parkinson’s while Alector will lead in the commercialization of AL001 in orphan diseases. Outside of the U.S. GSK will commercialize both drugs and Alector will be eligible for royalties from sales.

The highly transmissible Delta variant (B.1.617.2) of the coronavirus is now the most common strain of the COVID-19 virus circulating in the U.S., according to Helix, a population genomics company collecting data from several U.S. states. Delta, first identified in India in December 2020, has since spread to 85 countries, with first cases in the U.S. showing up in March 2021. The Centers for Disease Control and Prevention (CDC) continues to state that its guidance issued in May 2021 continues to be valid and that fully vaccinated Americans are still protected, including the variants currently circulating in the country, such as the Delta variant. Nearly 154.9 million people, or 46.7% of the U.S. population are fully vaccinated, according to the CDC.

R&D World’s R&D Index is a weekly stock market summary of the top international companies involved in R&D. The top 25 industrial R&D spenders in 2019 were selected based on the latest listings from Schonfeld & Associates’ June 2020 R&D Ratios & Budgets. These 25 companies include pharmaceutical (10 companies), automotive (6 companies) and ICT (9 companies) who invested a cumulative total of nearly 260 billion dollars in R&D in 2019, or approximately 10% of all the R&D spent in the world by government, industries and academia combined, according to R&D World’s 2021 Global R&D Funding Forecast. The stock prices used in the R&D World Index are tabulated from NASDAQ. NYSE and OTC common stock prices for the companies selected at the close of stock trading business on the Friday preceding the online publication of the R&D World Index.

Tell Us What You Think!