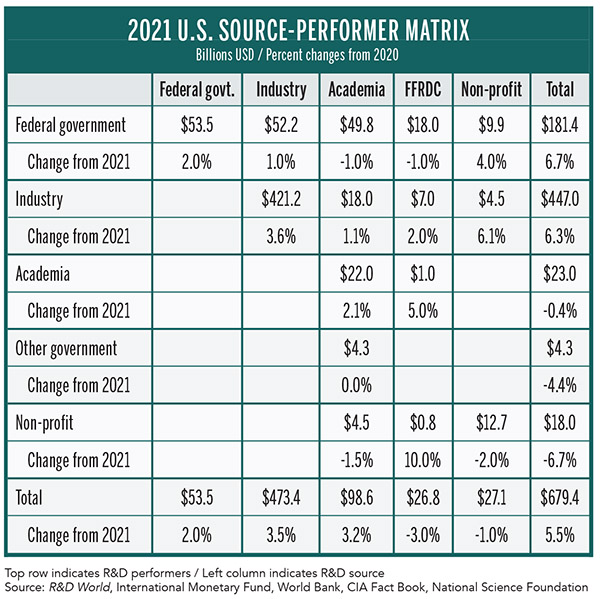

For 2022, U.S. industrial organizations are expected to collectively invest $447 billion in R&D efforts, or about 65.8% of the total R&D monies invested by the U.S. ($679.4 billion). That industrial investment is more than all other global countries except for China. The U.S. federal government is expected to invest $181.4 billion in R&D in 2022, which is more than all other countries except China and Japan. And U.S. academia will invest $23 billion, which is more than all other countries, except the top 16 spending countries shown in this report.

For 2022, U.S. industrial organizations are expected to collectively invest $447 billion in R&D efforts, or about 65.8% of the total R&D monies invested by the U.S. ($679.4 billion). That industrial investment is more than all other global countries except for China. The U.S. federal government is expected to invest $181.4 billion in R&D in 2022, which is more than all other countries except China and Japan. And U.S. academia will invest $23 billion, which is more than all other countries, except the top 16 spending countries shown in this report.

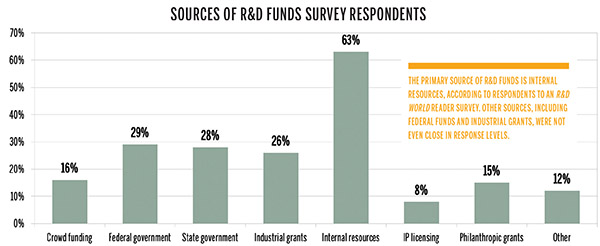

U.S. R&D investments as a share of its gross domestic product (GDP) have been steadily increasing over the past several years, according to reports by the National Science Foundation (NSF). Most of the increase in R&D as a share of GDP over the past decade has been due to an increase of non-federal spending on R&D and particularly in the industrial sector. According to the NSF, this comes mostly from the increasing role of business R&D in the U.S. national R&D system. This in turn reflects on the increase of R&D-based goods and services in the U.S. and global economies. By contrast, the share of federally funded R&D expenditures declined in the late-20th century, mostly from cuts in defense-related R&D investments following the fall of the Soviet Union.

According to NSF data and adjusted for inflation, growth in U.S. R&D investments averaged 3.3% in the 2010 to 2018 period (following the 2009 great global recession). The ratio of R&D to GDP increased to more than 3% in 2018 and is forecast at 3.07% for 2022. According to NSF data, U.S. basic research accounts for approximately 17% of the U.S. total R&D expenditure, or $115.5 billion in 2022. Applied research accounts for about 19% or $129 billion in 2022. The remaining 64% is invested in experimental development areas, or $435 billion in 2022.

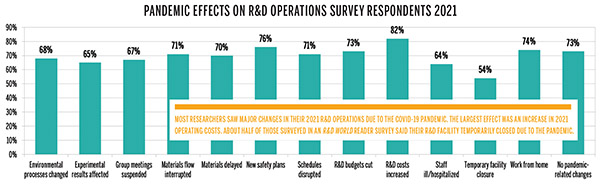

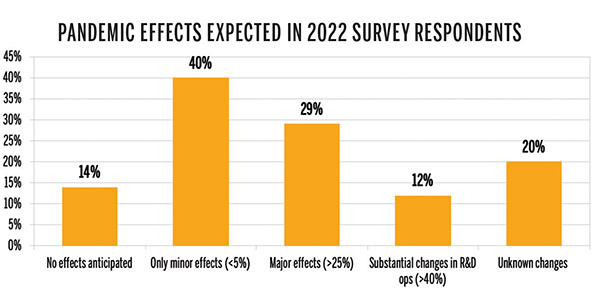

In the early days of the COVID-19 pandemic (late-2019 and early 2020), R&D analysts were concerned that the pandemic would slow R&D activity, especially in the biopharmaceutical industry sector. And while confusion and chaos dominated those early times, drug and vaccine research saw a resurgence, especially in the U.S.-dominated biopharm arena. According to a recent report by healthcare data company IQVIA, the pandemic actually accelerated biopharm innovations. This resulted in two U.S. companies, Pfizer and Moderna, introducing COVID-19 vaccines in late-2020, which received emergency use authorization from the U.S. Food and Drug Administration (FDA). Subsequent research growth in the mRNA-developed vaccines for other diseases has been driven by the COVID-19 vaccine products. The U.S. accounts for about 45% of the total global research pipeline. The U.S. share has been relatively stable for the past 15 years. China’s share of this market has increased from 6% to 12 % over the past five years.

The Global Innovation Index 2021 (GII 2021), published by the World Intellectual Property Organization (WIPO) based in Switzerland ranks the U.S. third, behind Switzerland and Sweden, in its annual ranking of innovation leaders in 132 countries. In 2021, the U.S. was considered the absolute leader in these rankings, holding first place in 13 indicators out of the 81 indicators used by the WIPO. These indicators include metrics such as global corporate R&D investors, venture capital deals received, the quality of universities, the quality and impact of the country’s scientific publications, the number of patents by origin, and E-participation. The U.S. also dominates in science and technology clusters in the GII report with 24 U.S. clusters noted out of 100 global areas. The top areas here were San Jose/San Francisco, Boston/Cambridge and New York City. The ranking of science and technology intensity similarly was dominated by 23 U.S. areas out of 100 global areas. The top U.S. S&T intensity areas were Ann Arbor, Michigan, San Jose/San Francisco, and Boston/Cambridge.

The electrification of everything is more apparent in the automotive industry than in most other technology areas. And all the global automakers are mostly playing catch-up with Tesla, headquartered in Palo Alto, California. Tesla now has a global presence in cars, trucks, solar cells, batteries, and other areas where its CEO, Elon Musk, is investing.

Events are happening at such a rapid pace in the electric vehicle (EV) arena, that its difficult to keep track of them. Everyone is investing billions of dollars in new sophisticated EV manufacturing plants, battery plants, and supplier collaborations, all across the U.S. and internationally as well.

GM and Ford are both reviving old closed plants or building brand new ones. There is an absolute race to see who can transition faster from the old “dirty” internal combustion systems to the new “clean” EVs and all within the next five years, or less. The R&D lights here are burning very deep into the night, every night.

And while those other automakers work hard to catch up to Tesla’s production levels, Tesla continues to invest in the technologies for autonomous driving systems for its EVs. However, Tesla is finding this technology is significantly more complex than its engineers initially envisioned. Accidents still occur in some cases with stopped or parked emergency vehicles that software updates don’t seem to fix completely. Tesla says there are 60,000 of its cars on the road that use its “full self-driving” beta software. Patching one issue in the software can create new complications for a nearly infinite array of real-life scenarios.

In the ICT (information and communications technology) area, U.S.-based firms with very deep R&D pockets continue to push the envelope for 5G and 6G applications. U.S.-based Apple, Microsoft, Google, Intel, and Amazon drive the new technologies and the pace at which they’re developed. These companies continue to evolve and the chip shortages for automakers only incentivizes these U.S. technology leaders to invest more in R&D and more production facilities. They also continue to upgrade their plans (almost monthly now) to build more, faster and more powerful chips. Intel recently announced that it’s going to build a brand new semiconductor manufacturing complex in mid-Ohio, far from Silicon Valley, the Pacific Northwest, the southwestern desert, and the Texas heartland where similar facilities currently reside.

In the ICT (information and communications technology) area, U.S.-based firms with very deep R&D pockets continue to push the envelope for 5G and 6G applications. U.S.-based Apple, Microsoft, Google, Intel, and Amazon drive the new technologies and the pace at which they’re developed. These companies continue to evolve and the chip shortages for automakers only incentivizes these U.S. technology leaders to invest more in R&D and more production facilities. They also continue to upgrade their plans (almost monthly now) to build more, faster and more powerful chips. Intel recently announced that it’s going to build a brand new semiconductor manufacturing complex in mid-Ohio, far from Silicon Valley, the Pacific Northwest, the southwestern desert, and the Texas heartland where similar facilities currently reside.

Apple is the current production leader in 5G-capable smart phones. Nearly 70% of Apple’s entire cell phone shipments are 5G capable, while its nearest competitor, Samsung has only 26% of its products that are 5G and China’s lower volume supplier Xiaomi has about 30% of its shipments that are 5G. When more lower cost 5G cell phones are introduced into the marketplace, Apple will lose some of its marketshare. Apple predicts that 5G networks will be available in 2022 from more than 200 carriers in 60 countries. Cell phone manufacturers are still waiting on the 5G “killer app” which will boost their overall sales. 5G use is expected to more than triple over the next four years, according to market researcher ABI. The huge volumes of 5G capable systems, with large global government support and incentives for all things 5G has laid the groundwork for the adoption of 5G applications. These next-generation technologies are designed to reap the benefits of superfast 5G connections.

The U.S. economy in 2021 and in several years earlier, effused strength and perseverance across a wide range of technologies, even in the face of a global pandemic. Toward the end of 2021 and into early 2022 that strength, low unemployment and production shortages resulted in strong inflationary pressures which hadn’t been seen in nearly 40 years. The Federal Reserve system had not been exposed to anything like these scenarios over that period of time. Throughout the second half of 2021, and as we enter 2022, the Fed has considered raising short-term interest rates from near zero to offset the inflationary threats and cool down an overheated economy.

How would higher interest rates affect the U.S. R&D community? First, it would make investment capital more expensive to obtain and would slow the overall economy and associated investments. Second, it would send a psychological message to U.S. industrialists that continued growth is no longer assured. The risks in new ventures might not be considered worth the costs of long-term investments (and higher financing concerns) they involve. Financial planning in this new environment would take longer and certainly be more restrictive. The problem, of course, is that U.S. financial analysts don’t currently have any experience in planning during these inflationary and high costs times, especially since its been more than 40 years since a similar financial environment occurred, and today’s analysts weren’t in charge then. The net effect, then, is that it’s a relatively safe bet that U.S. R&D growth will be less aggressive until the U.S. economy stabilizes.

As strange as it may seem, climate- change factors may also start to become involved in the short-term R&D planning process. Record droughts and fires in the western U.S., rapidly rising sea levels in the eastern U.S. coastal areas, record weather systems transiting the U.S. and dramatic temperature swings will certainly affect the water, energy, and social resources available to the R&D community. R&D managers have become (probably overly) secure in operating within a stable environment over the past 50 years.

This article is the second part of R&D World’s annual Global Funding Forecast (Executive Edition). See the first part here. This report has been published annually for more than six decades. The Executive Edition will be published in the Spring 2022 digital issue of R&D World. To purchase the full, comprehensive report, which is 50 pages in length, please visit the 2022 Global Funding Forecast homepage. Previous years editions can also be purchased there.

Tell Us What You Think!