[Adobe Stock]

How will Section G affect documentation?

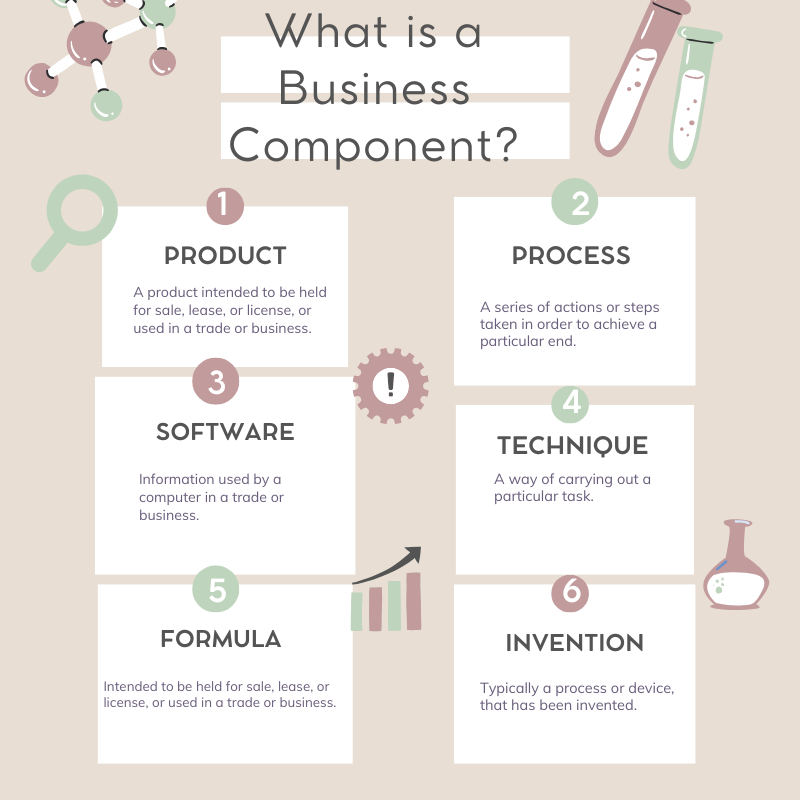

The central change to the requirements is that R&D work must be segmented by Business Component. A Business Component refers to any product, process, computer software, technique, formula, or invention that is intended to be held for sale, lease, or license, or used in a trade or business of the taxpayer. In previous years, the IRS did not require organizations to maintain documentation in a specific format to claim the R&D Credit. All that was needed in the past was regular, old books and records consisting of timesheets, job titles, and activity listings. Starting in 2026, the IRS will require R&D Organizations to maintain documentation of their alignment with the 4-part test on a business-component basis. This documentation must be kept contemporaneously, per a recent Tax Court ruling. The 4-part test is the standard that the IRS uses to evaluate the qualification of R&D for the Tax Credit. It consists of requirements such as the work must be technological in nature, must address an uncertainty, must use a process of experimentation, and must be to develop or improve a business component.

The new R&D requirement, known as Section G, requires organizations to list their significant business components, along with the wages associated with each scientist. In addition, organizations must designate the salaries for direct research, direct supervision, and direct support activities for each business component when filing for the tax credit. Previously, taxpayers often waited until they received an audit notice before gathering the required business component information and distributing surveys. Of course, if they have not already organized documentation in the proper format by the end of the tax year, they will not be able to file for the tax credit with contemporaneous documentation, one of the Tax Credit’s requirements.

How to prepare for the coming changes

These new requirements to file for the R&D credit will require research organizations to increase scrutiny of the methods engineers use to document their work. Due to a recent Tax Court Case, there is greater emphasis on contemporaneous Substantiation. The difference lies in the definition of documentation vs. substantiation. Oxford Dictionary defines documentation as “material that provides official information or evidence, or that serves as a record”. Substantiation is defined in Oxford as “the act or process of proving something is true, real, or valid by providing supporting evidence, facts, or proof, often used formally to mean providing concrete proof for a claim or accusation”. While both words, when used in the context of R&D, describe information that serves as a record, only one, substantiation, zeroes in on proving a specific valuable fact to the IRS R&D Tax Auditor. While valid R&D substantiation is generally culled from general documentation by an R&D consultant with enough creativity and luck, relying on such a haphazard method is risky in a tax dispute with a non-forgiving federal agency such as the IRS.

Waiting until the end of the tax year to gather contemporaneous substantiation is an oxymoron. In the same way that you would not wait until the end of the year for your bookkeeper to visit to update your books and records, waiting for the end of the tax year to create substantiation to validate your R&D effort for the IRS makes no sense. A better approach is to have an R&D Substantiation expert compile your R&D Substantiation Dossier monthly. This file includes everything needed to prove the qualification of your R&D to meet the IRS’s particular rules. Since this file is built contemporaneously while the R&D is being performed, you will reduce the risk of being cited by the IRS for creating retrospective substantiation, as was cited against Kyocera in a recent tax court case. The Kyocera case ultimately cost the company $13M, roughly 10 times the amount of the original R&D Tax Credit filing. The economic risk when dealing with the IRS and R&D Documentation is greater than meets the eye.

Summary

The IRS has delayed the implementation of the Section G requirements for filing for an R&D Tax Credit until the 2026 tax year. This is good news because it will allow firms that perform R&D to prepare in advance for the changes to their documentation. Enacted by Congress to encourage technical work performed in the US, the R&D Tax Credit is a valuable credit with benefits ranging from tens of thousands of dollars for small firms to hundreds of millions of dollars for large public companies.

Richard Bernstein is a retired 17-year veteran of the IRS, where he was an R&D Engineer. Before that, he was a software engineer in the industry. At the IRS, he specialized in auditing extensive software R&D Credits claims nationwide. He now writes and speaks about changes to the IRS’s R&D Tax Credit audit process. He is a graduate of Brooklyn Polytech and Rutgers Business School and has written for both TaxNotes and Accounting Today. He can be reached at www.linkedin.com/in/richb201.

Tell Us What You Think!

You must be logged in to post a comment.