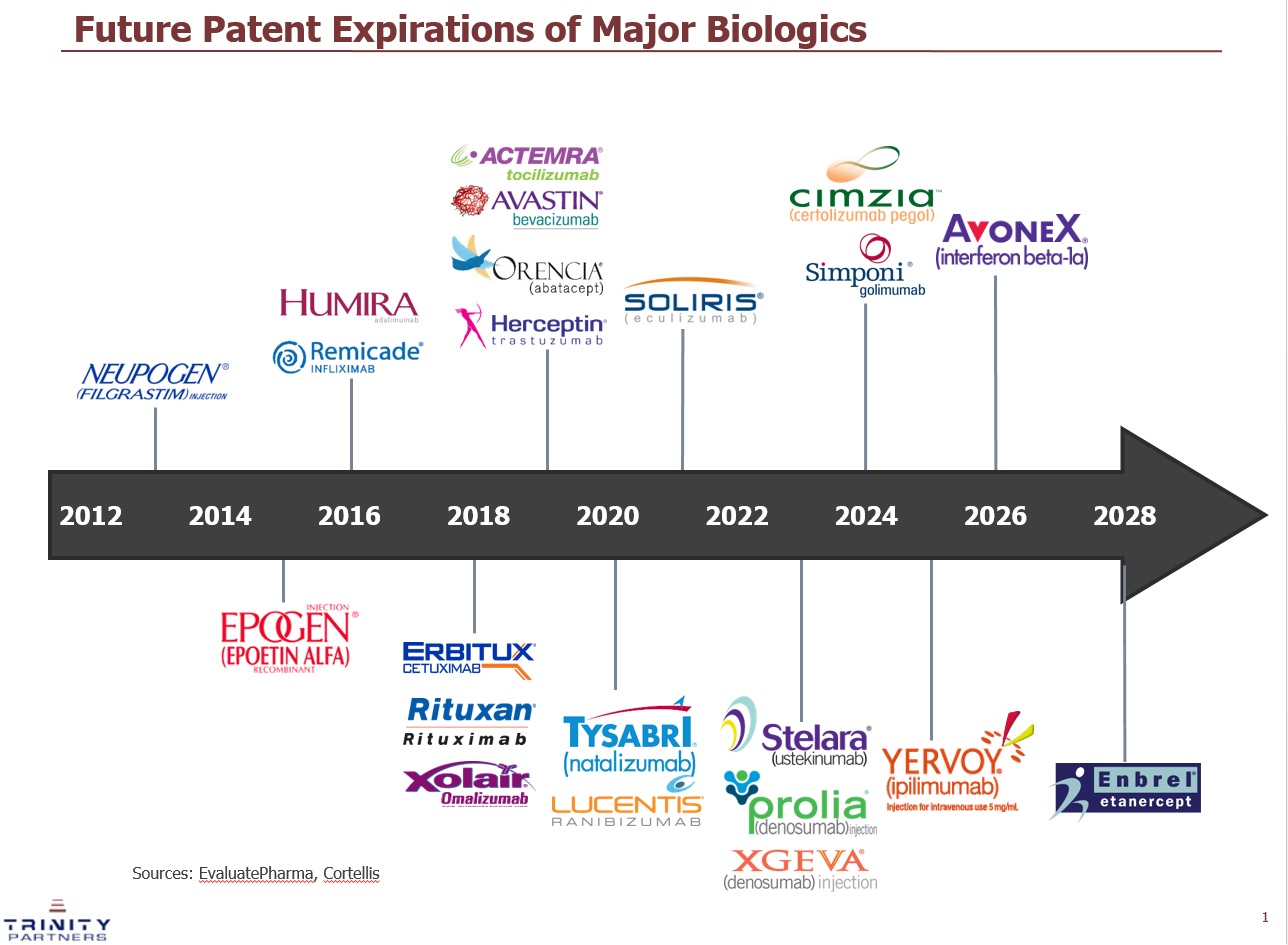

The US biologic market landscape is undergoing dramatic change. When the Patient Protection and Affordable Care Act (Affordable Care Act) was passed in 2013, it amended the Public Health Service Act (PHS Act), creating an abbreviated approval pathway for biological products that are “biosimilar” or “interchangeable” with an FDA-approved biological product. This opened the door to great opportunity since many of the top selling biologic products’ patents were expiring over the next 15 years, representing a $40B+ opportunity (Figure 1).

Figure 1: Patent Expiration Timeline of Major Biologics through 2028. This figure shows the expected patent expiration of top selling biologic products in the US over the next 10+ years. Source: EvaluatePharma, Cortellis

The biosimilar market generated a lot of interest, but there were also many unanswered questions.

- What does it mean to be “biosimilar” versus “interchangeable”?

- Will pharmacists be able to automatically substitute a biosimilar product?

- Will biosimilars have the same name as the reference product? Or will it be differentiated?

- What type of information will be included in the label? Will the label indicate whether the product is biosimilar or interchangeable to the reference product?

The FDA has issued guidance on these questions over the last three years helping clear up some of the uncertainty. However, navigating this new biosimilar frontier is no easy task. This article highlights three unique commercialization challenges biosimilar manufacturers face.

1) Education of Key Stakeholders

Biosimilar products are not generic versions of biological products. Generics are exact replicas of branded small molecule drugs – they have the same active ingredient, dosage form, safety profile, strength, route of administration, quality, and indications. Biosimilar products are highly similar to the reference biologic product, but there are some allowable differences due to the fact they are complex molecules made from a living organism. Biosimilar product labels may differ from the reference products as they may not seek approval for all the same indications for which the reference product is approved. It will be critical for manufacturers to educate key stakeholders (physicians, pharmacists, patients, and payers) on biosimilars. Physicians need to feel comfortable the biosimilar product has no clinically meaningful difference in terms of efficacy and safety compared to the reference product. Pharmacists will also play a key role since they will have the ability to automatically substitute the biosimilar product for the reference product if the biosimilar is deemed “interchangeable1.” Many states are creating their own state laws that will require notifying the provider and potentially the patient of the substitution. Therefore, it will be critical to educate all key stakeholders on biosimilars and instill confidence that the biosimilar will produce similar clinical outcomes for the patient.

2) Developing a Pricing Strategy that Protects Price

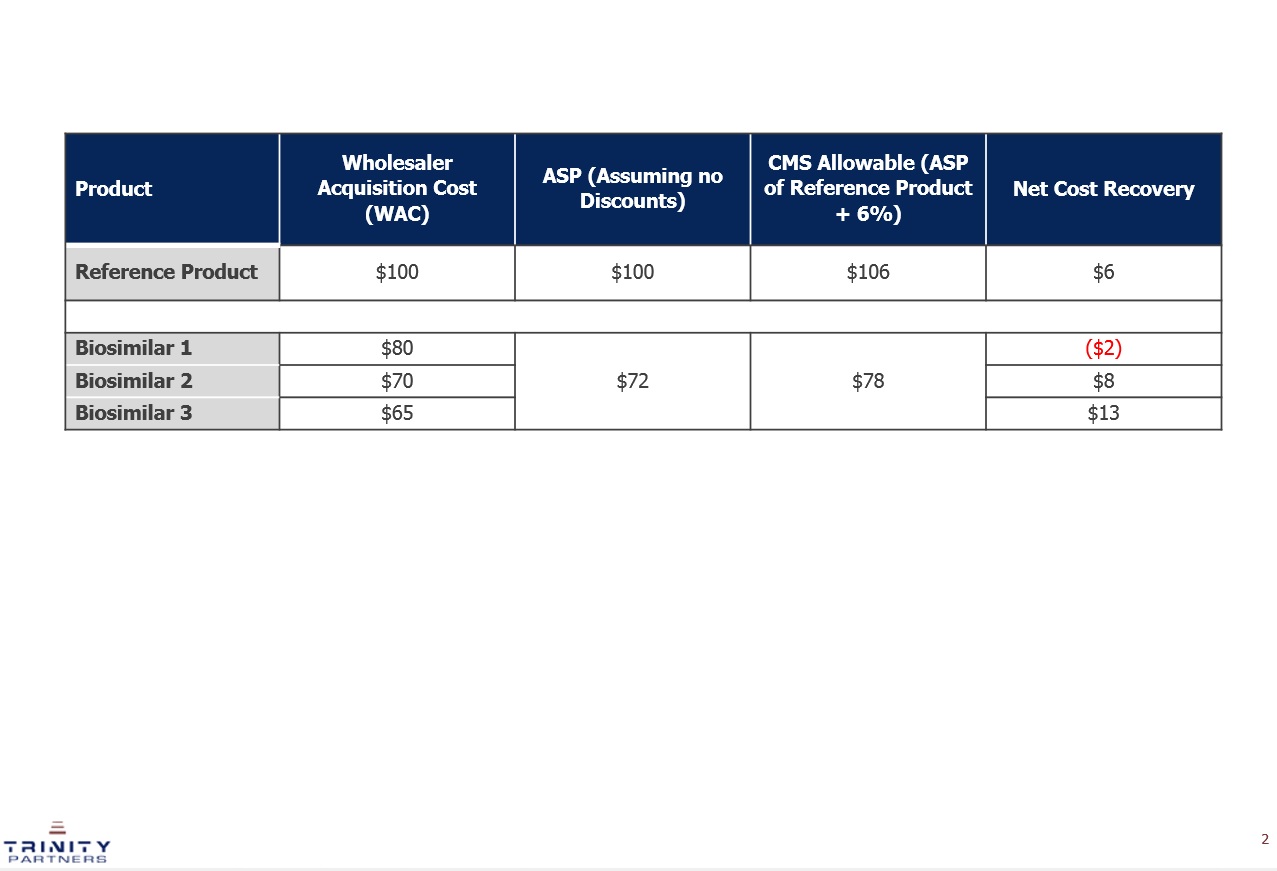

In 2015, the Centers for Medicare and Medicaid Services (CMS) released payment policies for biosimilar products dispensed to individuals covered under Medicare. For biosimilars administered under Medicare Part B, which typically includes administration by physicians in offices and clinics (including hospital outpatient), the biosimilar products for a single reference product will share the same HCPCS code3-4. The payment will be based on the average selling price (ASP) of the shared biosimilar HCPCS code.An additional 6 percent of the ASP of the reference product will be added to the payment.In the future, CMS is considering changing the payment to ASP plus 2.5 percent of the reference product plus a flat fee of $16.80 or a value-based payment. The fact that biosimilars for the same reference product will share a HCPCS code adds a level of complexity. The biosimilar manufacturers do not have complete control over their product’s ASP. The providers’ net cost recovery will be highest by using the lowest priced biosimilar (Figure 2). Since biosimilar products are clinically the same, this financial advantage could be a significant driver of use. A pricing war could ensue if manufacturers decrease their price via discounting in order to get a competitive advantage over the competitor biosimilar products resulting in a ‘race to the bottom’ if manufacturers do not develop a clear pricing strategy that protects their price.

Figure 2: Illustrative Example of the Net Cost Recovery for Biosimilars and the Reference Product. This figure provides a hypothetical example of the expected net cost recovery of a reference biologic product and three biosimilar products. The reimbursed amount (CMS allowable) is the same for all three biosimilar products as it is based on the blended ASP of the three biosimilar products. The biosimilar product with the lowest price (Biosimilar 3) results in a higher net cost recovery for the provider.

3). Alternative Promotional Tactics

The traditional selling model for branded products involves promoting the clinical benefits of the product to prescribers. By definition biosimilars have no clinically meaningful differences from the reference product. Biosimilar products’ value proposition is the lower price point – the biosimilar is similar to the reference product in terms of efficacy and safety, but it is significantly cheaper. Most biosimilar products are expected to be priced 20-30 percent lower than the reference product. The selling model for biosimilars needs to adapt.Biosimilar manufacturers need to educate prescribers using a ‘bottom-up’ selling approach to ensure they understand the clinical benefits of the biosimilar product upon launch. However, a ‘top-down’ selling approach is also needed to truly drive adoption.Manufacturers should focus promotional tactics on payers and hospital budget holders to ensure they understand the potential cost-savings associated with biosimilars so they are placed on preferred tiers and hospital formularies.This will ensure ease of access to biosimilars and drive adoption.

Four biosimilar products (Zarxio, Inflectra, Erelzi, and Amjevita) have been approved by the FDA to date. Many more biosimilars are expected in the future. In order to successfully launch a biosimilar product, manufacturers will have to develop a disciplined pricing strategy and adapt their promotional model in order to break down potential barriers and drive adoption.

Acknowledgments

John Greenaway, Christina Danosi, and Kristina Cotter from Trinity Partners helped support the research for this article.